Stablecoin Conference LATAM 2025

Insights from Panel Discussion “Local and International Payments: The Role of Stablecoins in Empowering Communities” from Stablecoin Conference LATAM 2025 presented by Bitso Business

October 9, 2025

Stablecoins Are Changing the Basis of Money Movement in LatAm

One of the key conversations at the Stablecoin Conference LatAm focused on how stablecoin technology is transforming business-level transactions. The session “Local and International Payments: The Role of Stablecoins in Empowering Communities” weighed the pros and cons, and it leaned on a few examples of the obstacles experienced mostly by companies in moving money across borders in Latin America.

Moderated by Lisette Pérez (Computer Weekly), the panel gathered Maggie Wu (VelaFi), Teymour Farman-Farmaian (HiGlobe), Omid Scheybani (Conduit), and Jan Heinvirta (REAP). Together, they painted a picture of why stablecoins are slowly becoming the default rail for global money movement.

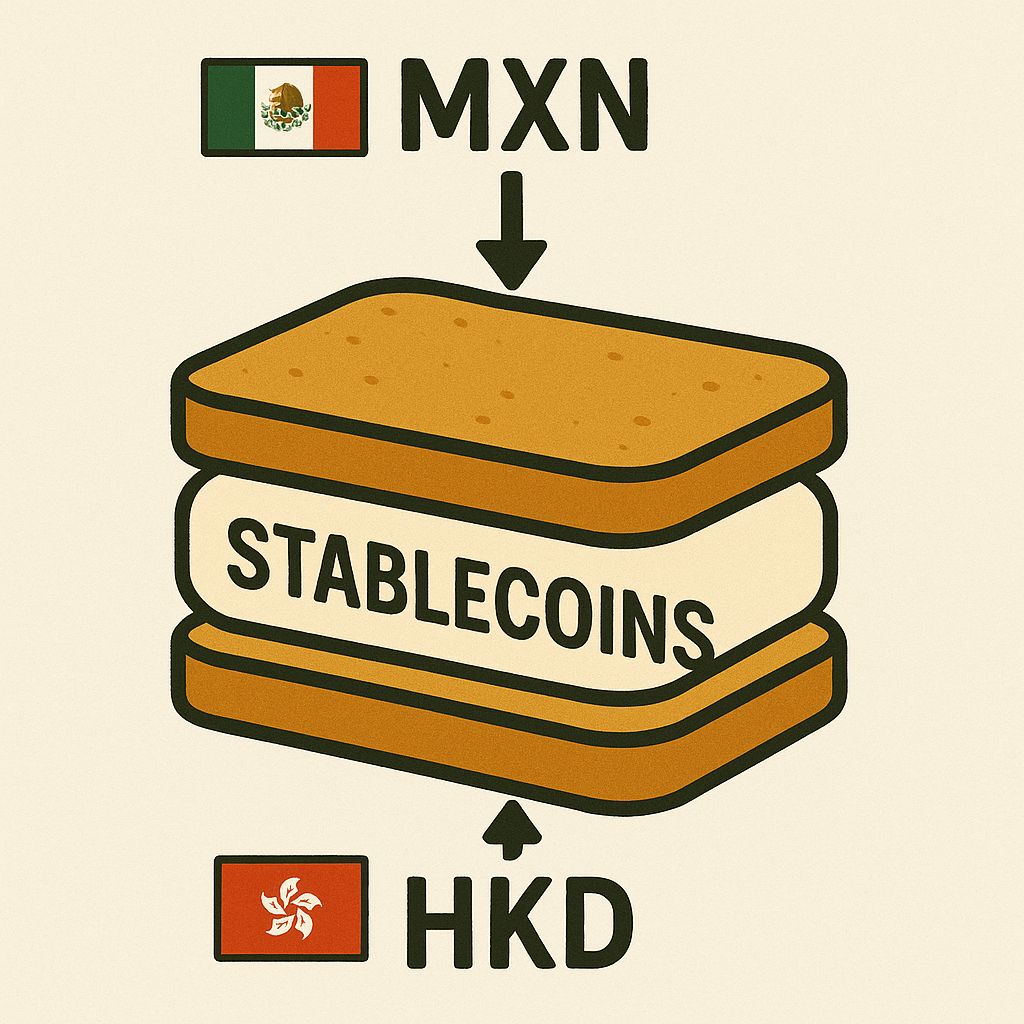

Before diving into statistics, the simplest way to understand stablecoin payments is through what Maggie Wu, CEO of VelaFi, called the “stablecoin sandwich.”

“We do the local (money) convert to stablecoin, send across the border, then convert again to local… we can settle within one day for a LatAm to Hong Kong transfer.” — Maggie Wu.

This process eliminates the correspondent banking chain, where each intermediary adds fees and delays. A peso in Mexico becomes USDC, swiftly through blockchain transactions in seconds, and lands in Hong Kong as Hong Kong dollars. A process that used to take a week under the current banking system is now completed within a couple of hours.

Omid Scheybani, founder at Conduit, reminded the audience just how creaky the old system is. SWIFT, the backbone of international transfers, was born in 1973. It links more than 11,000 banks. In “easy” corridors (U.S.–U.K., for instance), it performs reasonably well. But try sending money into Latin America and the picture changes:

“When we’re talking about moving money into Latin America… a payment can take two to five days and can cost 4-6% in fees. It’s like an ice cube that’s moving and with every stop it’s getting a little bit smaller.” — Omid Scheybani.

I saw this problem first-hand in Argentina. A simple USD transfer between two local bank accounts took days to clear.

It happened just last week. I needed to pay for my credit card for the flight to the Bitso conference, but I didn’t have enough USD in my account. A friend offered to send me dollars via a domestic transfer if I sent him USDT in return.

He sent the money first and showed me the “instant” transfer receipt from his bank app. Meanwhile, I bridged USDC from Base to Polygon, swapped it to USDT, and then pushed it through Binance using the pay link he had shared. The whole crypto side of the process cost me $0.004 and took about five minutes (slower only because Binance required 800 block confirmations on Polygon).

The notification hit his phone right away. But the dollars he had sent to my bank account didn’t show up. When I called the bank nervously, they told me the transfer could take 24–48 hours.

This wasn’t SWIFT. This was a local dollar transfer between two banks in the same country. And yet the delay was painfully long.

And beyond the fees talk, there’s the hidden cost of capital stuck in the system. Scheybani cited reports estimating $12 billion in working capital trapped in long settlement cycles, plus another $4 trillion in pre-funded accounts. That’s money parked in limbo, to sustain a system of manual checks, institutional trust and many unknowns. That money could easily be used to fund any sort of need for people and companies alike.

The panelists identified five key advantages:

Taken together, the incentives are clear. The moderator added this concluding question: Why would businesses keep paying for slow, expensive, inflexible wires when an alternative is faster, programmable, and increasingly regulated?

Who Really Benefits?

A natural question followed: Is this about helping everyday people or padding corporate margins? The panelists listed several segments where the impact is visible:

“The big takeaway in this is that moving Stablecoin costs nothing. So, Economics 101 from the University will teach you that when marginal cost goes to zero, guess what happens to the price? It tends to zero. So we're moving to a world where you have zero-cost movement, and it's present today here in Mexico.” - Teymour, CEO at HiGlobal.

Zero-fee foreign exchange could transform consumer payments, making international transactions effortless. And stablecoin technology clearly shows that this can be possible. Unless corporations, who still control major money movements, decide not to share that fee reduction and still charge the end user with deposit/withdrawal fees.

Travelling, booking hotels, or paying for international subscriptions could become effortless, with no fee calculations required for most people.

But it’s also where skepticism is warranted. As you noted, legacy FX giants like Western Union or PayPal might not easily surrender that revenue. True zero-fee may appear only on the most liquid routes in LatAm (USD–MXN, USD–BRL). In long-tail flows like Latin America to Southeast Asia, costs will remain, although lower, in the foreseeable future.

Argentina must be one of the most drastic FX scenarios you will ever see. Even after the 2025 reforms, things remain messy. By mid-2025, individuals could finally buy dollars directly from banks again, a big change after 14 years. Businesses, though, still face caps and long waits to access foreign currency.

Currently, there are at least 9 different exchange rates for USD/ARS.

Today, there are at least nine different exchange rates for USD/ARS. The government narrowed the gap in April 2025 by introducing a managed band (initially ARS 1,000–1,400 per USD). At times, the spread between official and parallel markets has fallen to single digits. But the system is still fluid, and authorities continue to intervene.

Argentina has even invented surreal rates like the “Dólar Qatar,” used for World Cup travellers and layered with special taxes. Since 2011, restrictions on buying foreign currency have shifted constantly. For years, the simplest and most reliable option was stablecoins. That’s why Argentina became one of the leading adopters in Latin America.

Stablecoins offered what no local policy could: one transparent, global price, available 24/7. Even when official and parallel markets converge for a moment, that appeal endures. It’s why Argentines embraced USDT so quickly. In a chaotic system like this, it feels stablecoins are poised to be the only source of truth. Where value is free to move and there’s little to no way a government or companies can manipulate it.

Teymour, CEO at Higlobe, painted an optimistic vision of a new global payments landscape, emphasizing that there is “another 95% of the world where innovation and proactive policy are transforming the movement of money”. In his words, “in this world, fees for moving money instantly are at zero, and really great government policies lead that in countries like Brazil.” This is vividly exemplified by Brazil’s PIX system, an instant payment network launched in late 2020 by the Central Bank of Brazil.

PIX has become deeply embedded in daily life: by early 2025, over 182 million individuals (around 87% of the adult population) and 19 million businesses. In 2024 alone, PIX processed 64 billion transactions, amounting to more than 26.4 trillion BRL (roughly $4.6 trillion USD). Notably, PIX’s volume in March 2025 exceeded that of credit cards by 2.5-fold.

Teymoure detailed his future vision for money: Very much what's happening on the frontier of Argentina and Brazil, where someone has their money, they get paid in the USA, the money's in dollars. They go to a merchant, they flash the QR code, the money is taken straight out of the dollar account, using a card or neobank app, and the money will get translated by a local foreign exchange, and it will turn up in the merchant’s bank account without Visa, without MasterCard, taking 5% for that transaction. — Teymour H. FARMAN-FARMAIAN

The panel’s approach to regulation was light and had a cautious optimism. The speakers treated regulation as both a gatekeeper and an enabler: something that must be secured for any business interested in operating in any of Latin America's markets, through licenses and compliance partnerships. Government bodies also act as a signal of legitimacy that reassures corporate partners. They emphasized the advantage of regions where frameworks are clearer and more supportive. There is still a lot to be done, so for all builders in the stablecoin space, there’s a bigger call for ongoing collaboration with regulators to maintain trust and foster adoption. Overall, regulation was framed less as a barrier and more as an essential piece of infrastructure that, when well designed, accelerates stablecoin usage.

Regulation is arriving, but LatAm is not an even group of countries, so every market will present its opportunities and challenges unevenly. And even where frameworks are improving, regulation alone doesn’t clear the road to adoption. From the discussion and from the state of the ecosystem, several practical blockages still stand out:

The enthusiasm around lower fees, faster settlement, and regulatory progress in the room was evident, but one theme was conspicuously absent: trust. The panelists spoke confidently about their licenses, their rails, and their ability to move money across borders in record time. They presented a picture of inevitability. “They are not a bet, but a reality,” was heard from the mainstage. Yet at no point did the conversation pause to ask the harder question: do people currently trust these instruments?

It is precisely in markets hit hardest by inflation, devaluation, and capital controls where stablecoins are finding their product–market fit. In Latin America, this scenario is far more common than many outsiders realize. For people whose savings erode daily, who face constant hurdles to access dollars, and who pay punishing spreads to move money, stablecoins represent the only sensible option. It’s a risk they’re willing to take because there is no better one available.

But for everyone outside that frontline of new-tech early adopters, those not yet forced into experimentation, or businesses still able to manage the chaos of traditional systems, trust remains the decisive hurdle.

Trust from businesses, who in most cases are too afraid to change, or are too slow to learn new technologies, especially in the finance departments, they've only heard from traditional media all the scars from crypto frauds. Trust from consumers continues to be low, and the learning curve continues to be steep, where information is still mainly in a foreign language and heavily technologically oriented.

It is what stops the cautious majority from even trying, in addition to the steep learning curve, and it is far stronger than any fee cut or promise of faster settlement. Until this is addressed head-on, adoption will remain uneven, and the conversation will keep sounding like builders cheering to builders.

The session revealed both the promise of stablecoin infrastructure and the industry's reluctance to address adoption barriers. Still, what struck me from the conversation also revealed what still goes unsaid. Fees, speed, and regulation on stage feel like we’re congratulating each other, but how much harder it is to pause and talk about the gaps we face as an industry. That gap doesn’t take away from the value of the session; it’s what makes covering it worthwhile. It’s in these conversations that you can see both the excitement of a new system and the very real work left to be done.

The Stabledash newsletter keeps you off the timeline and dialed into modern money.

Join leaders at Circle, Ripple, and Visa who trust us for their stablecoin insights.