Insights

Pioneering the Internet of Money with Bitcoin

David Marcus unveils a global payments network built on Bitcoin, integrating real-time fiat rails, stablecoins, and developer APIs to make money move like the internet.

October 22, 2025

Lightspark connected Bitcoin’s Spark and Lightning layers to real-time payment systems across 65 countries, linking over 1,500 U.S. banks and 3,000 European institutions via RTP, FedNow, and SEPA Instant.

Spark enables instant, low-cost transactions in native Bitcoin and new stablecoins like USDB (by Brale and Flashnet) with fixed fees and unilateral exits to Bitcoin Layer 1.

The new Grid platform opens Lightspark’s infrastructure to developers, allowing simple API calls to send fiat, Bitcoin, or stablecoins globally in seconds.

Lightspark Sync 2025: Pioneering the Internet of Money with Bitcoin

At Lightspark's Sync 2025 conference, CEO David Marcus opened with a provocative question:

"If the internet could move value natively, would you use anything else?"

Lightspark Sync 2025

This event showcased Lightspark's latest advancements in transforming global payments. As "Bitcoin plumbers," Lightspark is bridging Bitcoin's Lightning and Spark layers to traditional payment systems, enabling seamless, real-time transfers where users send fiat currencies like USD and receive them as BRL without ever touching Bitcoin directly—much like emailing without thinking about SMTP or TCP/IP.

This article expands on the keynote's key announcements, drawing from Lightspark's progress in network expansion, the Spark Layer 2 protocol, the new Grid API platform, partnerships, and broader implications for the digital economy.

By leveraging Bitcoin's decentralized foundation, Lightspark is positioning itself as a key enabler for instant, low-cost global value movement.

Global Network Expansion and Connectivity

Lightspark has significantly broadened its infrastructure since last year's Sync, focusing on connecting Bitcoin to real-time payment systems worldwide.

The network now spans 65+ countries, covering approximately 5.6–6 billion people, $93 trillion in GDP, and over 14,000 institutions including banks, e-money providers, and mobile wallets across North America, Latin America, Europe, Africa, and Asia. This expansion emphasizes real-time interoperability, abstracting Bitcoin's role to make transfers feel like "magic money."

In the US, Lightspark Payments, a regulated subsidiary, is now fully operational, integrating with RTP and FedNow to link over 1,500 banks for Bitcoin-interoperable payments.

A major highlight was the acquisition of Striga, a leading European digital assets and payments firm, announced on October 14, 2025. This move enables direct connectivity to SEPA Instant across 32 European countries and 3,000+ banking institutions, facilitating native USD and EUR movements on Bitcoin for the world's largest economies.

Looking ahead, Lightspark aims for full connectivity to all real-time fiat systems (excluding sanctioned countries) by Sync 2026, achieving end-to-end global interoperability.

This plumbing work addresses the limitations of legacy systems, which are slow, expensive, and unavailable outside business hours.

Spark: The Live Bitcoin Layer 2 Protocol

Spark, introduced as a protocol design at last year's event, is now live on Bitcoin's mainnet following a challenging implementation.

As a fast, cheap, and ultra-scalable Layer 2 solution, Spark supports Spark-to-Spark transactions while maintaining backward compatibility with Lightning and Bitcoin L1. It enables instant, self-custodial transfers of native Bitcoin (not wrapped), stablecoins via the open-source BTKN token protocol, and other tokens.

Key features include:

- Asset Support: Native Bitcoin, stablecoins (e.g., USDB launched by partners like Brale and Flashnet), and tokens for diverse applications.

- Builder Tools: A developer-friendly experience for creating stablecoin and Bitcoin wallets, bolstered by partners such as Brex, Privy, Flash, Tether (which launched its Wallet Development Kit shortly after the event), and Dynamite. Demos, including one from Privy's Henri Stern, highlighted novel apps built on Spark.

- Trust Model: Unilateral exits to Bitcoin L1 for all balances, ensuring users inherit L1's decentralization without relying on Spark operators.

Stablecoin innovations on Spark address mainstream payment challenges. For instance, USDB is the first of many stablecoins on the platform, offering fixed low fees (1 second, 1 cent) regardless of network volatility, unlike Ethereum's variable costs. Users can pay fees directly in the stablecoin (e.g., USDB fees in USDB), eliminating the need for foreign tokens.

Upcoming "Stable Change" will introduce an interchange system akin to Visa or Mastercard, allowing issuers to set fees, generate revenue, and incentivize adoption.

Developer momentum is high, with Spark enabling applications impossible on L1 due to high fees or on Lightning due to liquidity constraints.

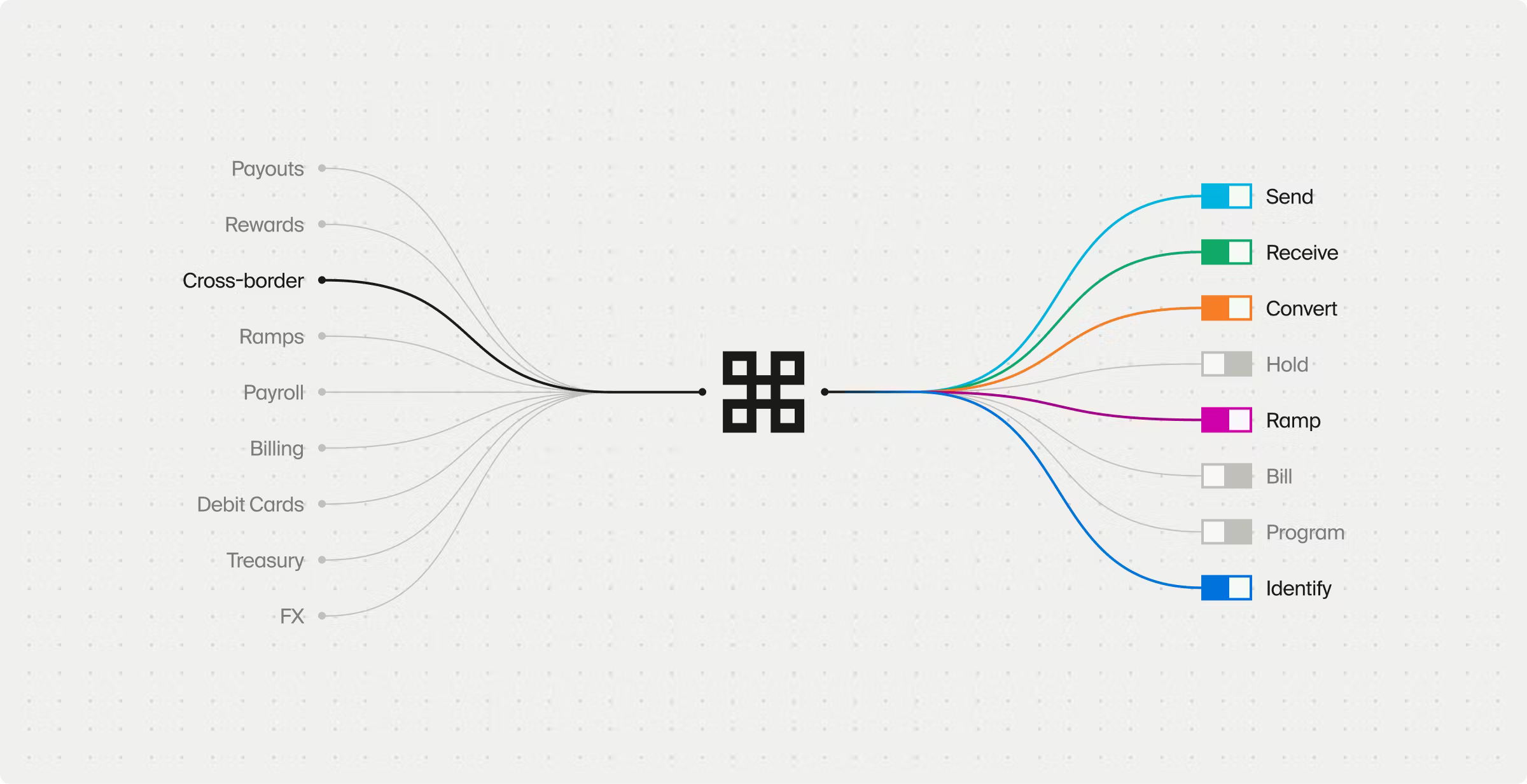

Grid: Unbundled APIs for Global Money Movement

The keynote's core contribution was the launch of Grid, a new API platform at that unbundles Lightspark's capabilities for developers to build real-time global apps.

Available in closed beta now, with a full launch by year-end, Grid provides "superpower-like" APIs for moving money across 65+ countries and 75+ currencies.

Connection options include:

- Lightspark Payments: Direct access in the US and 32 European markets.

- Network Partners: Fiat-only integration, where partners handle Bitcoin conversion.

- Native Bitcoin: Global access for entities handling BTC directly, like exchanges or wallets (e.g., integrations with partners like Nubank).

True to Lightspark's open-source ethos, all technology is available for homegrown implementations without involvement from the company.

Demoed use cases, powered by simple JSON APIs, include:

- Cross-Border P2P: Instant USD transfers from a US bank to a German IBAN via FedNow, Bitcoin/Lightning, and SEPA Instant, or to Brazil using Universal Money Address (UMA).

- Bitcoin Rewards: On-the-fly Spark wallets for micro-rewards (e.g., 10–50¢ in sats for card usage, gaming, or loyalty programs), solving L1 delays and Lightning liquidity issues.

- Stablecoin Payouts: Global sends of USDB or other stablecoins from a fiat balance, arriving in seconds.

Grid democratizes access to Lightspark's three-year build, making it easier for builders to create consumer and business apps on Bitcoin.

Partnerships and Real-World Integrations

Lightspark's ecosystem is growing through strategic partnerships.

The keynote demoed a real-time USD-to-MXN transfer via partner Bitso and Mexico's SPEI system, costing just $0.50 and completing in seconds even at 1 AM on a Sunday. Backend: USD converts to BTC, routes via Lightning, and settles as MXN.

Other integrations include Nubank for native BTC handling in Brazil and broader network partners for coverage.

These enable the fastest, cheapest cross-border options, abstracting Bitcoin for "magic money" experiences that benefit consumers and businesses alike.

Conclusion

Sync 2025 solidifies Lightspark's role in Bitcoin's evolution, with Spark and Grid unlocking unprecedented scalability and usability.

Builders are encouraged to explore Grid's beta, provide feedback, and attend sessions on integrations.

As Marcus noted, Bitcoin is the only network deserving the title of open internet for money—now more accessible than ever.

Read More:

https://www.Lightspark.com/news/lightspark/introducing-lightspark-grid

Don't Miss the Next Big Shift

The Stabledash newsletter keeps you off the timeline and dialed into modern money.

Join leaders at Circle, Ripple, and Visa who trust us for their stablecoin insights.