Stableminded

From NFT roots to fintech rails, Crossmint is pioneering modern money movement

November 13, 2025

Crossmint, a stablecoin infrastructure provider, powers everything from remittances to autonomous AI-driven transactions.

In a candid discussion with Drew Rogers, Rodri unpacked Crossmint's journey, the transformative power of stablecoins, and the emerging frontier of agentic commerce.

Crossmint's story is one of adaptation in a fast-changing industry. Founded four years ago by Rodri and his co-founder Alfonso Gomez, the company initially focused on NFTs during the height of their popularity.

Rodri, an engineer by training with a background in financial services at McKinsey & Company, dropped out of Stanford and Harvard MBAs to pursue entrepreneurship—via an unexpected detour into monastic life and NFT sales.

"We started by building our own NFTs," Rodri explained. "Then we realized there's so much friction. Let's build a company making it easier to build on chain."

As market demands shifted, Crossmint pivoted to stablecoins about two and a half years ago, applying the same infrastructure to abstract away blockchain complexities.

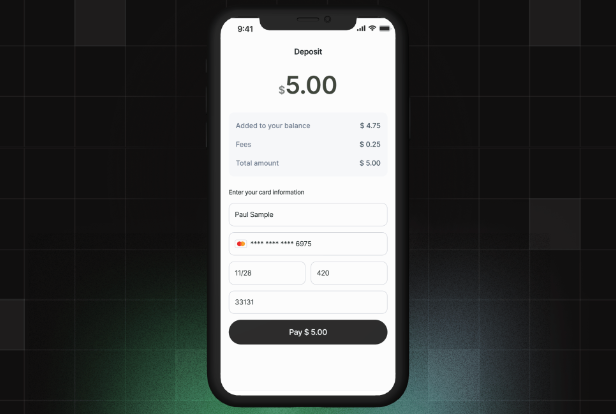

Today, Crossmint offers an all-in-one platform for fintechs and enterprises, handling everything from on-ramps and off-ramps to wallet infrastructure, compliance, and AML screening—all via simple Web2 APIs.

This evolution wasn't a drastic change but a natural progression. "Essentially what you've been building has never changed," Drew noted. "The infrastructure to hold, move, onboard, transact, custody, build with tokenized products or tokenized assets. The flavor has changed, the focus has changed, but really the underlying capabilities that are sort of similar."

A year and a half ago, Crossmint foresaw the rise of agentic finance—AI agents autonomously handling financial tasks—and began building accordingly. By acquiring teams from two startups, they positioned themselves to lead in this space. As Rodri put it, "We foresaw the emergence of agentic finance... and started building the team to tap into that new wave that now it's coming."

The primary barrier to mass stablecoin adoption is no longer desire, but implementation complexity. For enterprises, the path to integration is littered with technical and regulatory hurdles. Crossmint’s core mission is to solve this problem by abstracting the entire blockchain stack into a suite of simple, developer-friendly tools.

The firm's central thesis is that the key to unlocking stablecoin adoption is to make the underlying technology disappear. Rodri explains that Crossmint provides "simple web two APIs" that "abstract away all of the complexity of building with stable coins."

This abstraction layer handles the entire lifecycle of a digital dollar transaction. It consolidates the functions of what would otherwise be a dozen different vendors, including wallet infrastructure, on/off-ramps, multi-chain orchestration, and natively embedded compliance for AML and Travel Rule.

The result is a radical acceleration in speed-to-market. The goal is to empower enterprises to build sophisticated, compliant financial products in weeks, not years. This is not a theoretical benefit. As Rodri notes, Crossmint's infrastructure enabled a major partner to achieve a landmark deployment with unprecedented efficiency.

"Moneygram, for example, we were able to help them go live from zero to something live in production in like two months with one and a half engineers on their side," he states.

This metric demonstrates that by solving for complexity, Crossmint delivers its most critical deliverable: speed.

Looking under the hood of Crossmint’s platform reveals how it achieves this level of abstraction.

While the front-end experience for a developer is a simple API call, the back-end is a powerful, consolidated suite of services designed to eliminate the need for specialized blockchain expertise. This all-in-one solution is built on four core pillars:

The strategic advantage of this model is vendor consolidation.

Traditionally, building a stablecoin-powered application required stitching together "10 different providers," each with its own integration costs, technical debt, and compliance overhead. Crossmint’s integrated platform eliminates these friction points, allowing product teams to focus on user experience and business logic instead of backend infrastructure management.

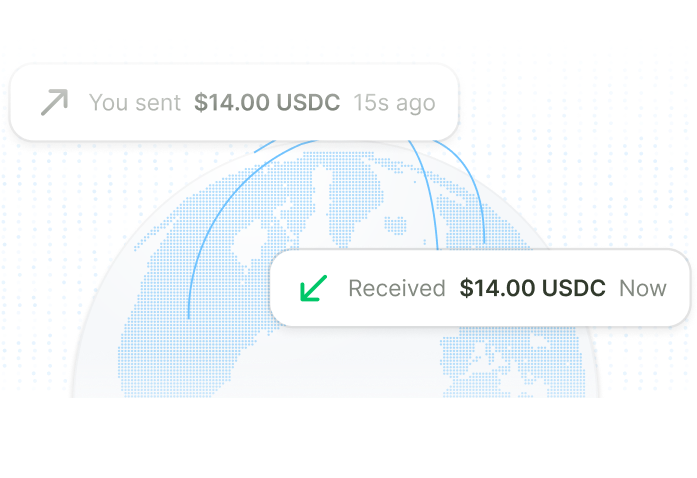

The partnership with MoneyGram provides a powerful, real-world case study of this "invisible infrastructure" in action. The collaboration, which powers MoneyGram's new mobile wallet in Colombia using USDC on the Stellar network, re-engineers the entire remittance flow.

The transformation is profound, particularly for the end-user. As Rodri explains, the experience is seamless.

"The user, nor the sender, nor the receiver need to know there's stable coins anywhere in the flow," he says. "They just get a message, 'hey, you received $200,' click here, you open it, and suddenly, magically, instantly, there's $200 in your account."

This model, launched in just two months with minimal engineering resources from MoneyGram, showcases the power of abstracting complexity. Beyond the immediate benefits of speed and cost reduction, it unlocks a significant secondary opportunity.

By providing recipients in emerging markets with their first digital dollar account, remittance companies are now in a "race to capture that recipient" by offering a suite of embedded financial services like yield-bearing accounts and spending cards. This transforms a simple payment rail into a full-scale digital banking platform.

With a proven stack for traditional fintech use cases, Crossmint is already focused on the next major wave of digital commerce: autonomous AI agents.

The company recognized over a year and a half ago that the existing financial system is fundamentally incompatible with a world where AI can transact on behalf of users.

Legacy payment rails, like credit cards, are built on a foundation of human-centric friction designed to prevent fraud. Rodri points to specific technical barriers that make them unsuitable for autonomous agents.

"Let's say that you're a user, you're talking to an LLM, you want to buy something...the agent tries to buy. It stumbles upon a...recap chat," he explains. "You have so many different players on the payment stack that are incentivized to prevent fraud...They will just take a really long time and stable coins are just a better technology to solve that problem."

Stablecoins, as a programmable and peer-to-peer payment technology, bypass this legacy friction.

They are the native payment rail for an agentic future, enabling AI to hold and move value autonomously and securely. Crossmint's foresight in building for this paradigm positions it as a key infrastructure provider for what could be the largest commercial shift since the dawn of e-commerce.

To make the concept of agentic commerce concrete, Crossmint developed a simple internal Slack bot that demonstrates the core technical components required for an AI to spend money.

The process is a microcosm of a massive enterprise opportunity. An employee can ping the bot to autonomously handle office procurement, from ordering supplies to coordinating lunch.

This is made possible by a specific architecture built on Crossmint’s APIs:

wallet, giving it a distinct financial identity.pre-funded with a stablecoin balance, allowing it to operate without requiring human approval for every transaction.smart accounts allow developers to "embed logic and policies inside of the contract itself." These on-chain rules can set spending limits, restrict purchases to approved vendors, or define other business logic. This ensures that even if the AI "hallucinates," it is programmatically prevented from making unauthorized or erroneous transactions.checkout API to autonomously purchase items from merchants like Amazon or Shopify.This internal tool illustrates a powerful model for the future of corporate spend management. Platforms like Brex and Ramp are already exploring stablecoins, and this agentic architecture provides a clear roadmap for how AI can automate procurement, travel booking, and other B2B financial workflows with embedded, compliant safeguards.

A digital dollar balance is only as useful as its ability to be spent.

Rodri states the problem bluntly: "There's no point in having a stablecoin balance if you can actually not use it."

While the industry moves toward direct merchant acceptance of crypto, the reality today is that the vast majority of commerce still runs on traditional card rails.

This is where Crossmint's partnership with Rain becomes essential. Rain provides the "critical part of the stack" that bridges the gap between on-chain balances and real-world utility. By offering a card-based off-ramp, Rain allows users to spend their stablecoin balances anywhere that accepts traditional payment cards.

Together, Crossmint and Rain deliver a "prepackaged" NeoBank experience.

Crossmint provides the core infrastructure—wallets, on-ramps, and stablecoin orchestration—while Rain provides the card component that unlocks spending. This partnership reinforces Crossmint's all-in-one value proposition, delivering a complete, end-to-end solution that gives immediate, practical utility to the financial products built on its rails.

The conclusion for financial services leaders is clear. The stablecoin tipping point has passed, the technology is mature, and the only remaining barrier is the complexity of implementation. Infrastructure providers like Crossmint have now solved that final problem, creating an urgent mandate for action.

Rodri frames it as a matter of competitive survival.

"If you're a fintech company. And you're not already building with stablecoins? Start now or you'll be too late."

His message is that peers are already building, and companies that fail to move quickly risk being left with an uncompetitive product. Crossmint's value proposition is providing the speed and compliance necessary to not just compete, but win.

The scale of this opportunity is expanding rapidly. Hinting at what's to come, Rodri mentions a forthcoming project with a government partner, which he calls "the absolute most incredible application of stable coins that I have ever seen."

The involvement of government-level entities signals the ultimate validation of this technology, moving it from a niche innovation to core global financial infrastructure. For fintechs and enterprises, the time to build is now.

Read More:

"Crossmint" - https://www.crossmint.com/

"Stablecoin orchestration" - https://www.crossmint.com/products/stablecoin-orchestration

"Wallet infrastructure" - https://www.crossmint.com/products/wallet-infrastructure

"Remittances" - https://www.crossmint.com/solutions/remittances

"Treasury solutions" - https://www.crossmint.com/solutions/treasury-optimization

The Stabledash newsletter keeps you off the timeline and dialed into modern money.

Join leaders at Circle, Ripple, and Visa who trust us for their stablecoin insights.