Insights

Navigating the Stablecoin Regulatory Maze

How regulatory legitimacy is accelerating the shift from correspondent banking to programmable liquidity rails.

February 3, 2026

Companies mentioned:

Navigating the Stablecoin Regulatory Maze

Regulatory clarity has arrived: The GENIUS Act legitimizes stablecoins at the federal level, accelerating enterprise adoption and triggering a global credibility cascade.

A two-tier market is emerging: OCC-chartered banks now have “batteries-included” issuance rights, while fintechs must choose between slow MTL licensing or fast partnership models.

A 6–12 month strategic window is open: Decisions on charter strategy, bank partnerships, and compliance architecture will determine who builds the new programmable payment rails and who rents them.

What GENIUS Act Actually Means for Your Payment Business

In July 2025, the U.S. Congress redrew the map of who gets to build the next generation of payment infrastructure. While the headlines focused on the political theater of the GENIUS Act, a fundamental shift occurred in the plumbing of the global financial system.

Global finance runs on invisible rails. For decades, a select group of correspondent banks have quietly decided who gets access to the dollar economy. The GENIUS Act didn't just clarify regulations; it signaled the beginning of a new operating system for liquidity.

Here is what I am seeing in real conversations with compliance teams and payments leaders—a quiet ripple effect that most outside the industry miss. International banks are calling compliance teams. Fintechs that spent three years navigating state-by-state licensing are watching OCC-chartered banks leapfrog them. Companies waiting for "full regulatory clarity" are discovering that clarity arrived—and the race to build the rails has already begun.

I believe the GENIUS Act created a strategic window of approximately 6-12 months. The decisions made during this period will determine which companies capture disproportionate value in the emerging stablecoin economy.

Why I’m Paying Attention to GENIUS (And Why You Should Too)

I’ve spent my career building the plumbing that makes this possible.

From leading Visa’s crypto product division where we pioneered USDC settlement, to founding Portal and building stablecoin developer platforms for companies like WorldRemit and PayPal, and now as Head of Stablecoins & Payments at Monad Foundation, I have lived in the trenches of this infrastructure shift.

I field questions about "what the GENIUS Act actually means" constantly.

This isn't theoretical to me. I see the cognitive leap companies are trying to make, and I know where the regulatory landscape intersects with product reality.

The Credibility Catalyst

The significance of the GENIUS Act extends far beyond U.S. borders. It serves as a global legitimization event. When the United States establishes a federal framework for stablecoins, it triggers a credibility cascade across international markets.

At the highest level, the most exciting thing about the GENIUS Act is that it legitimized stablecoins and increased their credibility, not just in the U.S., but globally.

This credibility unlocks the design space for enterprise innovation. Previously, legal and compliance teams viewed stablecoins through a lens of extreme risk aversion. Today, those same teams are comfortable approving product roadmaps that integrate stablecoin rails.

This shift allows companies to move from theoretical exploration to active implementation.

The Two-Tier Market: OCC vs. MTL

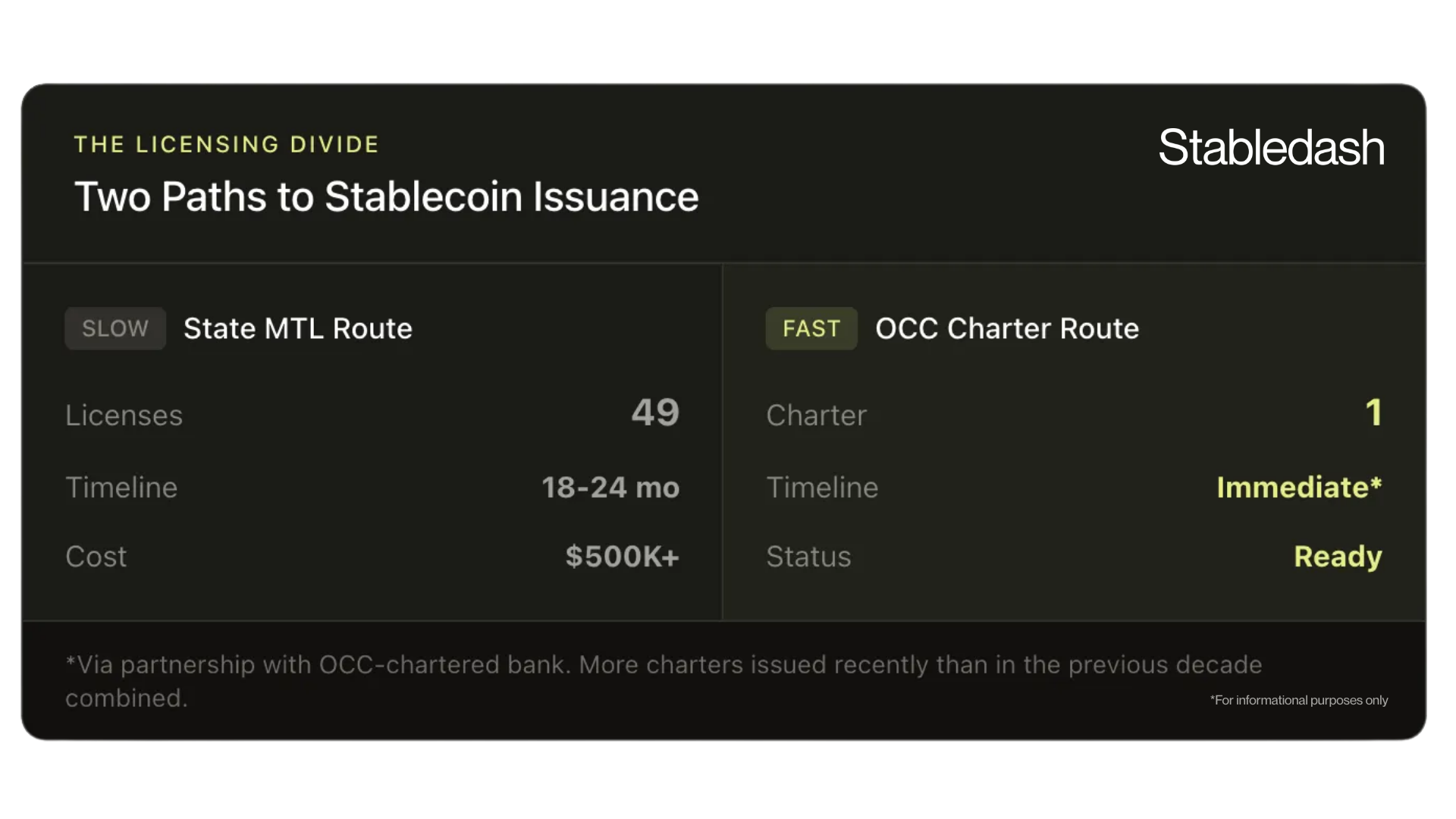

To understand the strategic landscape, you must look at the "insider mechanism" of licensing. I see the market currently bifurcating into two distinct regulatory pathways: the OCC charter and the state-level Money Transmitter License (MTL) patchwork.

For years, non-bank fintechs have had to navigate the MTL regime a grueling process requiring licenses in 49 distinct states, taking 18 to 24 months, and costing hundreds of thousands of dollars. It is a slow, capital-intensive grind.

The GENIUS Act illuminates a different path for federally chartered institutions. Banks today that are OCC chartered are now "batteries included" for stablecoin issuance. You can be a run-of-the-mill bank chartered 60 years ago, and now you can actually issue a stablecoin.

This creates a two-tier velocity in the market. We have seen more OCC charters issued recently than in the previous decade combined. Banks possess the "batteries included" regulatory status but often lack the technical infrastructure. Fintechs possess the technology but face the MTL friction. This structural divergence forces a choice: build the license slowly, or partner for speed.

The Partnership Equilibrium

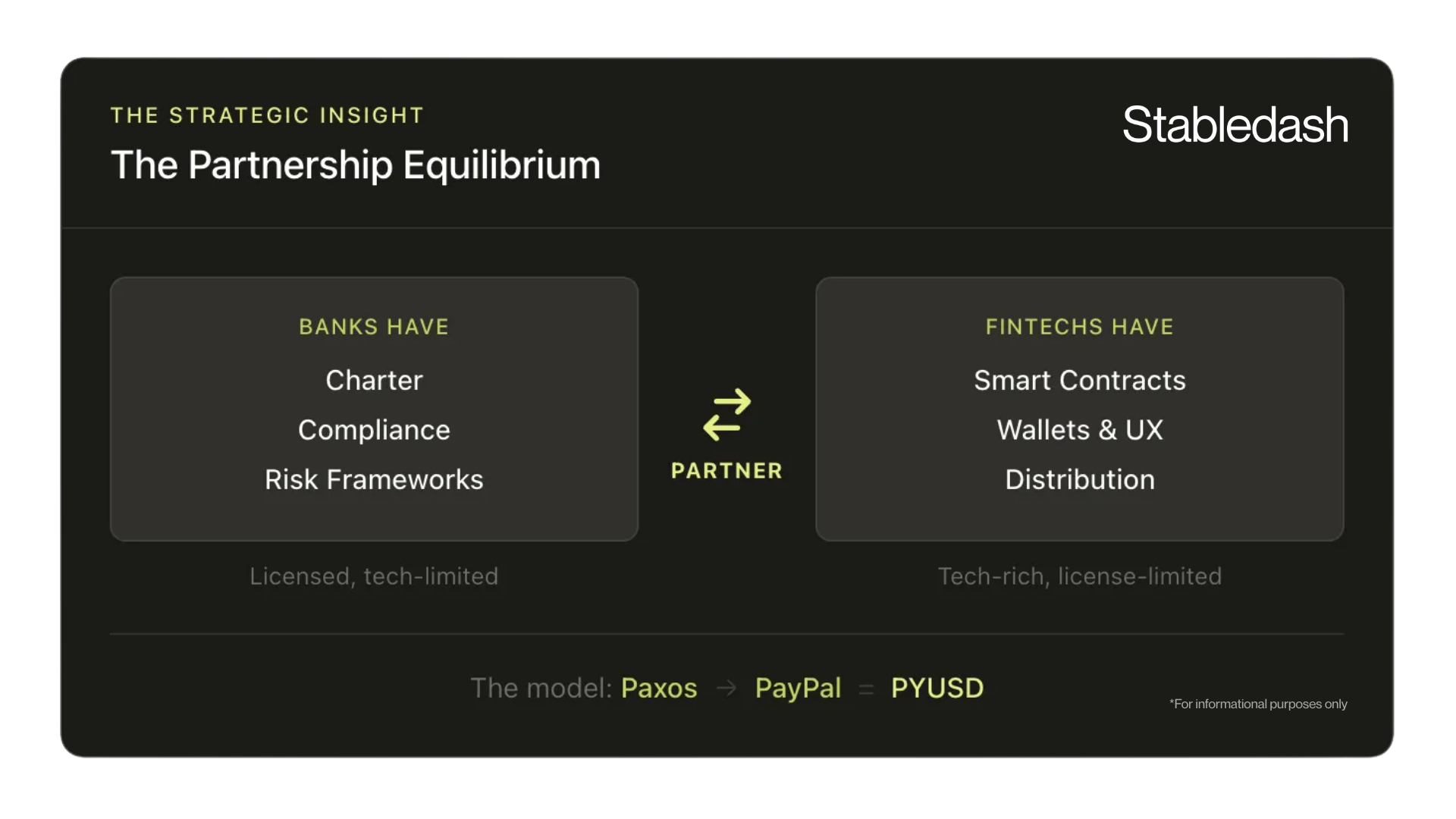

A common misconception suggests that banks and fintechs are locked in a zero-sum competition for stablecoin dominance. The reality points toward a partnership equilibrium.

Banks maintain the privilege of the charter and risk management frameworks. Crypto-native companies and fintechs hold the technical expertise regarding smart contracts, wallet infrastructure, and user experience.

We have the stablecoin space as we know it today, starting with technology first, licensing second. But now we have banks who have the licensing, but they don't have any of the tech they remain risk-averse.

The winning strategy lies in collaboration.

The model I point to is the partnership between Western Union and Anchorage Digital, where a chartered bank handles the issuance and reserves, while the remittance giant manages the distribution and user interface. For executives, the question is not whether to compete with banks, but which bank partner understands that their charter is now a platform for innovation.

Stablecoins as "Mini Programs"

We must reframe stablecoins. They are not merely digital dollars; they are programmable value transfer networks.

I personally think of stablecoins as mini programs. You can think of them as mini apps. All of them look and feel different.

Consider the healthcare sector. A stablecoin designed for a healthcare supply chain functions as a bespoke payment network. It can programmatically route interest yield to subsidize transaction fees between hospitals and suppliers. In import/export corridors, a "mini program" stablecoins can automate settlement based on shipping data.

This is the "App Store" moment for money. Just as mobile apps unbundled software, programmable stablecoins are unbundling payment networks. The value lies in the specific utility of the program, not just the currency itself.

The Compliance Debt Trap

In software engineering, technical debt accumulates when teams choose short-term speed over long-term scalability. In the regulated payment space, companies face "compliance debt."

Treating compliance as a reactive checkbox exercise builds a rigid infrastructure that breaks under the weight of new product lines. A compliance framework built solely for fiat savings accounts cannot easily pivot to cross-border stablecoin remittance.

I tell teams to treat compliance as a product and as its own roadmap, and to always give compliance teams visibility into what is to come.

Executives must make intentional trade-offs. Building a flexible compliance architecture now, one that anticipates stablecoins issuance or settlement requires more upfront investment. However, it prevents the need to unwind years of rigid processes when the market demands a pivot.

The International Expansion Play

The "last mile" of this innovation is where the theoretical meets the practical. Multi-billion dollar companies are already leveraging stablecoins as their primary vehicle for international expansion.

This strategy goes beyond incremental efficiency.

In corridors like Nigeria-to-China, businesses face exorbitant costs and delays due to liquidity fragmentation in the correspondent banking system. Stablecoins bypass these chokepoints, offering cost reductions of 40-60% by removing intermediaries.

I'm seeing firsthand where there are a lot of companies that have scaled to multi-billion dollars here in the U.S., and they realize they have tapped out growth domestically. Now they want to scale internationally. Their whole plan around international expansion is actually revolving around stablecoins.

This is the expansion arbitrage. Companies that integrate stablecoin rails gain a structural cost advantage in emerging markets that competitors relying on SWIFT cannot match.

The 6-Month Decision Framework

The regulatory signal is clear. The technology is ready. The window for strategic positioning is open, but it is narrowing. If you are leading payments, you face three critical decisions in the next six months:

- Charter Strategy: Do you pursue the arduous MTL path to own the license, or do you leverage the "batteries included" status of an OCC-chartered partner?

- Partnership Positioning: Which banking partners view the GENIUS Act as an opportunity rather than a threat? Locking in these relationships now secures access to the rails.

- Compliance Architecture: Are you building compliance debt, or are you treating regulatory infrastructure as a scalable product?

Waiting for "full clarity" is a decision in itself, a decision to choose the harder path.

Capital in Motion

The GENIUS Act did more than regulate a digital asset class. It created the conditions for a new operating system for liquidity one where capital moves on programmable rails rather than through gated, siloed networks.

Some companies will build this infrastructure. Others will pay rent on it. The banks have the licenses. The fintechs have the technology. The GENIUS Act forces the question of who builds the bridge.

That question has a deadline. And that deadline is not when the next regulation passes it is when the partnerships, charters, and compliance architectures get locked in.

The rails are being laid now.

Don't Miss the Next Big Shift

The Stabledash newsletter keeps you off the timeline and dialed into modern money.

Join leaders at Circle, Ripple, and Visa who trust us for their stablecoin insights.