Research

Everything You Need to Know About Hyperliquid's USDH and Each Proposal Submitted (so far)

Hyperliquid’s USDH vote could redefine stablecoin economics. This is your one-stop hub: analysis of every proposal, context on what’s at stake, and a curated “Follow the Conversation” feed of tweets, Spaces, and videos.

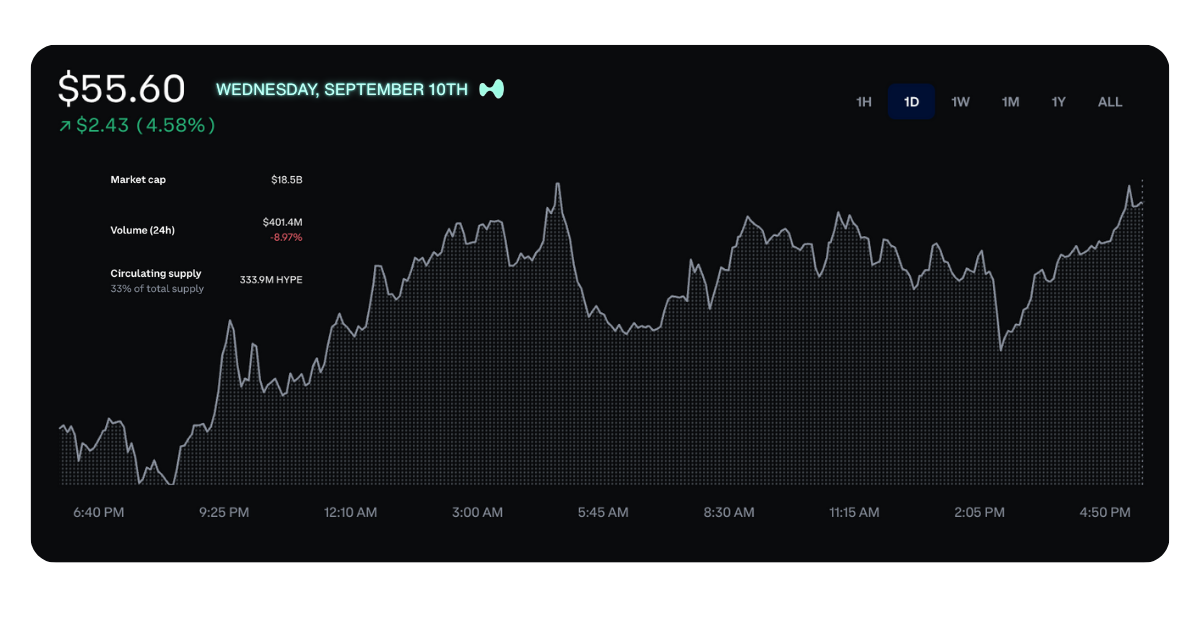

September 9, 2025

Everything You Need to Know About Hyperliquid's USDH and Each Proposal Submitted (so far)

Proposals are in from Paxos, FRAX, Agora, Native Markets, Sky, Ethena, and Bastion, with validator voting closing Sept 14.

This article breaks down each submission — reserves, revenue splits, compliance paths, and ecosystem commitments.

Join us on Stabledash Live, Sept 11 for a full walk-through of the final proposals.

Hyperliquid’s USDH Bid War – Reclaiming $220M in Leaked Yield

Hyperliquid dominates DeFi perps with 73% market share and $5.5B in deposits, but with 95% in USDC, about $220M/year in Treasury yield flows to Circle, not the Hyperliquid ecosystem.

USDH fixes this. It’s a native, fully-backed stablecoin designed to recycle yield into HYPE buybacks, lower fees (up to 80% off spot pairs), and validator rewards.

This Polymarket embed shows current prediction market odds on the USDH race. For informational purposes only. Local restrictions may apply, Stabledash does not endorse or promote any wagering.

Who Won?

Native Markets won the governance vote to issue and manage the USDH stablecoin on Hyperliquid. The vote, conducted by Hyperliquid validators using staked $HYPE tokens, concluded on September 14, 2025. Native Markets, a team formed specifically for this purpose on September 5, 2025, emerged as the clear victor after leading polls and securing the majority amid competition from established players like Paxos, Ethena Labs (which withdrew), Sky (formerly MakerDAO), Agora, and Frax Finance.

What It Means

- For Hyperliquid: This is a major win, allowing the platform to internalize the yield from its massive stablecoin liquidity pool (currently generating ~$220M annually for Circle via USDC). USDH will integrate natively, enabling seamless trading, lending, and DeFi composability without relying on external issuers. It positions Hyperliquid to capture revenue, boost TVL, and reduce dependency on centralized stablecoins, potentially increasing $HYPE token value and ecosystem growth.

- For Native Markets: As the issuer, they'll manage USDH reserves (likely backed by U.S. Treasuries and other low-risk assets for 1:1 USD peg stability). This gives them control over a high-volume stablecoin in a top-tier DEX, opening doors to fees, partnerships, and expansion in DeFi. It's a breakout opportunity for the new team to build credibility.

- Broader Implications: The auction-style vote (a novel governance mechanism) highlights Hyperliquid's innovative approach, drawing public companies and top protocols into its orbit and generating massive buzz. It could spark more native stablecoin launches on other chains, democratizing issuer selection and prioritizing community alignment. Expect USDH to launch soon, enhancing liquidity for perps, spot trading, and derivatives on Hyperliquid while competing with giants like USDC and USDT in DeFi.

Why It Matters

USDH transforms Hyperliquid from a venue into a full-stack economy. Owning the money supply creates a flywheel for growth:

more deposits → more yield → stronger buybacks/rewards → lower fees → deeper liquidity.

Circle has already responded with native USDC, but HL’s move signals the broader DeFi shift to protocol-owned stablecoins.

👉 For readers who want the full picture — including how governance works, the mechanics of the value flywheel, and a detailed comparison of every proposal — dive into the full analysis below. This is a living document, and we’ll continue adding context, including embedded tweets, charts, and videos, as the situation develops.

Last Update: September 14, 2025 5:05PM EST.

Updates Made - Who Won section added,Flowscan USDH Voting Image updated, Revisions made to Governance and Decision Process to better reflect process outlined from Hyperliquid Foundation, OpenEden and BitGo proposals added, tweets outlining various validators support added. Kraken support news added for Paxos V2

Disclosure: This is a living document, updated as new proposals and news emerge. It is not financial advice. Always do your own research.

An Overview of USDH

At the center of DeFi’s liquidity engine, Hyperliquid is attempting to rewrite who captures its economics. The platform’s plan to launch a native stablecoin, USDH, directly targets the roughly $220 million in annual yield generated by its ecosystem but currently flowing to external issuers, primarily Circle. That figure, based on the potential yield from Hyperliquid’s $5.5 billion in stablecoin balances, underscores the significance of this shift: it is a direct challenge to the prevailing economic model of DeFi.

With Hyperliquid processing $6.7 billion in daily trading volume and holding a commanding 73% market share in decentralized perpetuals, its transition to a native stablecoin marks a pivotal moment for both the platform and the broader stablecoin sector. The initiative has ignited a high-stakes competition for the USDH ticker, with proposals from institutionally-backed Paxos, DeFi-native Frax Finance, and coalition-led Agora. Hyperliquid’s experiment reflects a broader industry trend: dominant platforms are no longer content to grow someone else’s stablecoin—they are moving to internalize the value they generate.

The 220 Million Dollar Problem Leaking Value from DeFi

Hyperliquid’s meteoric rise has created an unprecedented concentration of liquidity — but also revealed a structural flaw in DeFi’s value chain. The platform’s success, marked by more than $1 trillion in cumulative trading volume and a TVL above $5 billion, has paradoxically enriched external issuers more than its own ecosystem in one critical area: stablecoin yield.

Today, about 95% of Hyperliquid’s $5.5 billion in deposits sit in USDC, issued by Circle. Those balances are fully backed by cash and U.S. Treasuries, which generate steady returns. Yet none of that interest flows back to Hyperliquid’s users, validators, or token holders. Instead, it flows to Circle’s corporate balance sheet.

Put simply: roughly $220 million per year in yield is being siphoned out of Hyperliquid’s economy. Traders pay fees, supply liquidity, and build volume, but the passive income from their deposits never returns to them. It subsidizes an external institution that contributes little to the ecosystem’s growth.

This “value leak” is more than a missed opportunity — it’s an ongoing tax on the community. And it explains why USDH exists at all. The native stablecoin initiative is designed to reclaim that yield, recycle it into HYPE buybacks, validator rewards, and fee reductions, and convert Hyperliquid from a tenant of someone else’s currency into the owner of its own.

Hyperliquid has already built the infrastructure to recapture value through its Assistance Fund, launched in January 2025, which directs 97% of protocol revenue toward HYPE buybacks. The fund has purchased over $100 million worth of HYPE to date, but this is just from trading fees. USDH would multiply this mechanism's power by adding $220 million in annual stablecoin yield to the buyback engine.

How Native Stablecoins Create a Value Flywheel in DeFi

Hyperliquid’s answer to the $220 million value leak is USDH — a native, protocol-owned stablecoin that redirects yield from its massive deposit base back into the ecosystem. At its core, USDH transforms what is now passive value extraction into an active flywheel for Hyperliquid growth.

For Hyperliquid as a platform, USDH marks the step from being a derivatives venue to becoming a full-stack financial ecosystem. By issuing its own stablecoin natively on HyperEVM and HyperCore, Hyperliquid eliminates dependence on Circle and external issuers. Instead of paying fees to Bridge in USDC, users will be able to trade, settle, and move capital in a stablecoin that is designed for Hyperliquid’s own infrastructure. This creates a moat — one that makes the exchange not just the market leader in perps, but also the owner of its own monetary layer.

For HYPE token holders and validators, the design is even more direct. USDH proposals all commit reserve yield to the Assistance Fund—Hyperliquid's proven value capture mechanism that already allocates 97% of protocol revenue to HYPE buybacks. Since January 2025, the fund has purchased over $100 million in HYPE, providing both a safety net for the ecosystem and consistent buy pressure.

With USDH adding $220 million in annual yield (at 4% on $5.5 billion deposits) to this existing infrastructure, the Assistance Fund transforms from a fee recycler into a full-scale value engine. The fund's transparent dashboard tracks all holdings (16.63 million HYPE as of March 2025) and can hold other native assets meeting fair launch criteria, creating a diversified treasury that benefits all stakeholders.

The effect is a self-reinforcing loop: more USDH adoption → more reserves → more revenue → more buybacks → stronger HYPE price and validator rewards → more incentive to keep the system healthy.

For the everyday trader and community, USDH unlocks immediate, tangible benefits:

- Lower costs — up to 80% fee reductions on USDH spot pairs compared to other stablecoin pairs.

- Safer rails — no Bridge risk, since USDH is native to HyperCore and HyperEVM.

- Transparency — proposals commit to public proof-of-reserves, bankruptcy-remote custody, and regulated structures under the GENIUS Act.

- Broader access — coalition and alliance partners plan to expand USDH into wallets, cards, and vaults, making it not just a trading asset but a payment and settlement currency.

In short: USDH is not just another stablecoin. It is a mechanism to internalize value creation, align incentives across validators, token holders, and users, and position Hyperliquid as the first major venue to capture the full economics of its own liquidity.

Governance and Decision Process

IMPORTANT NOTE FROM THE Hyperliquid FOUNDATION:

“To reiterate, this vote is just for the USDH ticker. USDH does not gain any special privileges by nature of its ticker name. Hyperliquid’s native financial primitives and general programmability comprise a chain uniquely optimized for stablecoin issuance and payments. There will continue to be multiple stablecoins on the Hyperliquid blockchain and new stablecoin teams who join the Hyperliquid ecosystem. USDH will be only one of many such stablecoins. As shared previously, becoming a quote asset will become permissionless pending technical implementation."

The USDH selection process represents what the Hyperliquid Foundation describes as "a successful experiment in decentralized governance," with thoughtful dialogue and proposal iteration based on user feedback driving the process forward.

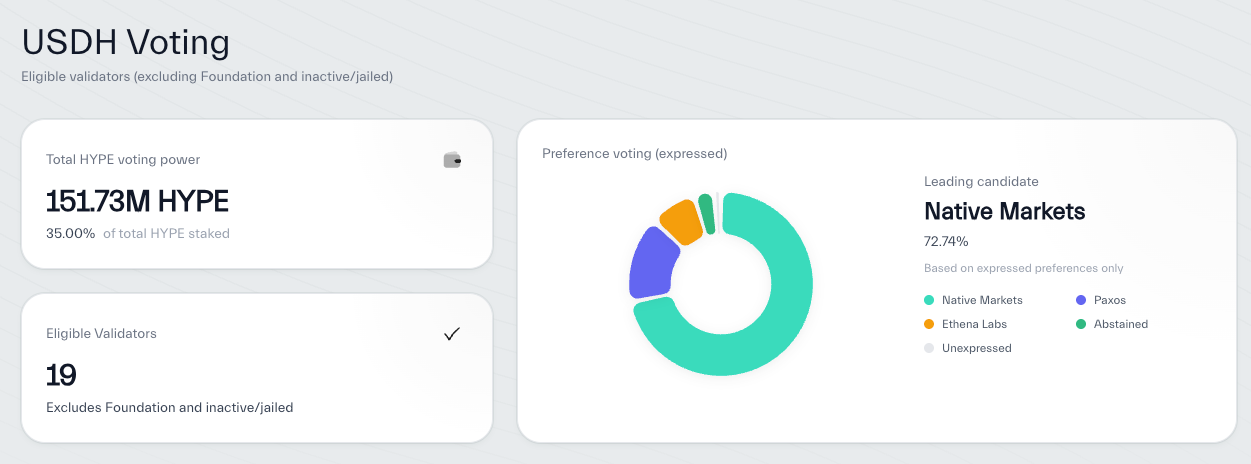

The governance structure involves 21 validators (19 eligible, foundation excluded), a notably smaller set compared to Ethereum's 40,000+ validators. However, in a significant move toward decentralization, the Foundation validators committed to effectively abstain by voting for the team with the most non-Foundation votes — based on validator commitments made on September 11, weighted by stake on September 14.

Screenshot taken September 11, 2025. For up to date USDH voting visit: https://www.flowscan.xyz/usdh

The process timeline:

- September 5 — Proposals opened

- September 10 — Submissions closed at 11:59 p.m. UTC

- September 10–14 — Public review window in the Hyperliquid Discord (#usdh-proposals) for discussion, critique, and validator feedback

- September 14, 10:00 UTC — Voting begins through fully onchain transactions on the Hyperliquid blockchain

- Decision Made — The USDH issuer will be determined as soon as 2/3 quorum is reached after voting opens on September 14

- Post-vote — Upon selection, the winning team's designated address can bid on the "USDH" ticker in the spot deploy gas auction

While the Hyper Foundation controls approximately 60% of staked HYPE, their decision to follow the non-Foundation validator consensus effectively distributes decision-making power across the remaining validators. This approach aims to balance the efficiency of a smaller validator set with meaningful decentralization in the selection process.

Stakers can participate by aligning with validators who match their preference, though there's a 1-day cooldown after staking to a new validator before unstaking is possible. The Foundation emphasized that regardless of the outcome, many of these proposals are expected to launch and contribute to the Hyperliquid ecosystem's growth.

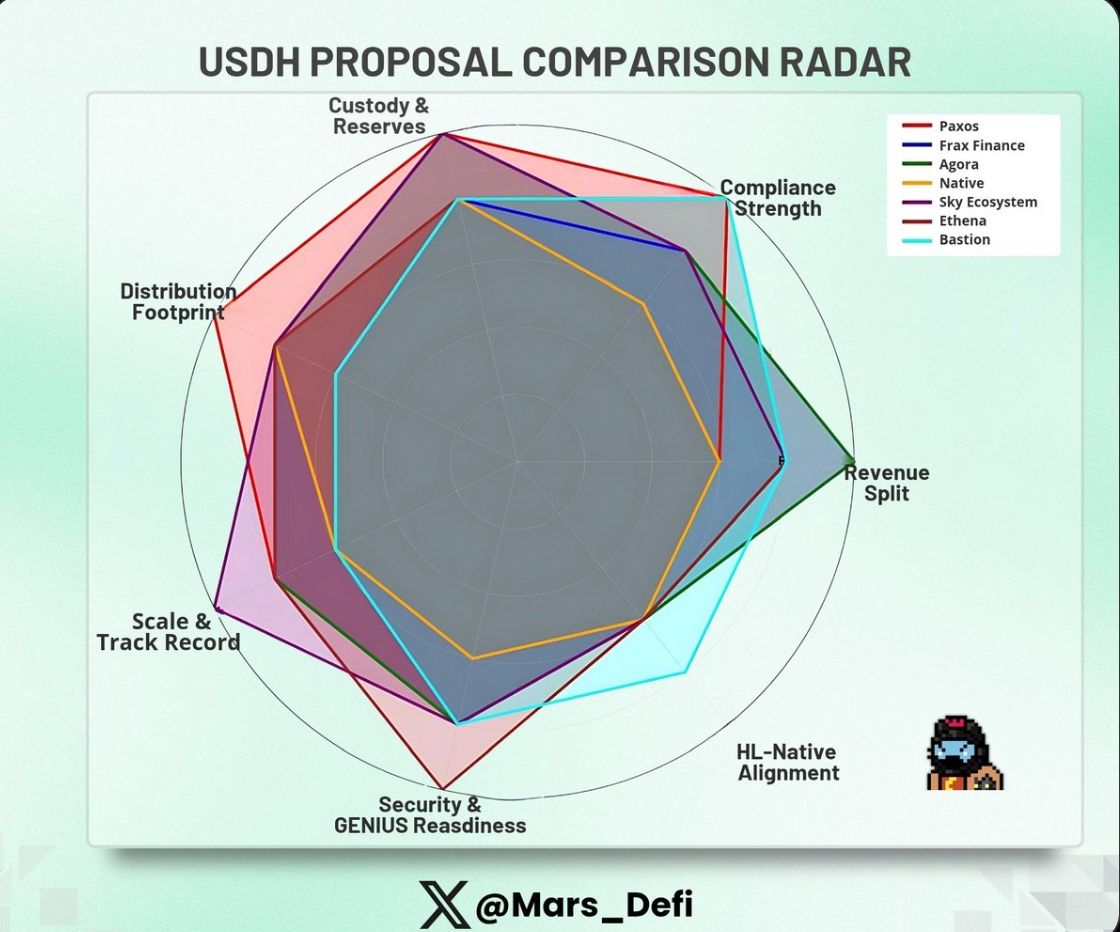

Comparing the Proposals: What’s Shared, What’s Different

Shared Baselines

In our view, all credible USDH proposals must meet the same technical and regulatory minimums to bring Hyperliquid to the masses and built the best possible product for consumers:

- 100% backing by Treasuries and cash (no algo components).

- Bankruptcy-remote custody and proof-of-reserves.

- Native deployment on HyperEVM and integration with HyperCore order books.

- GENIUS Act compliance in the U.S. and readiness for MiCA in Europe.

Credit to @Mars_defi for this image. Source tweet here

Key Differences

Revenue Split

- FRAX & Agora: 100% yield to HL.

- Paxos: 0% fees until $1B TVL, capped at 5% at $5B (paid in HYPE).

- Native: 50/50 split between HL and growth.

- Sky: 4.85% yield to HL buybacks (above T-bills); potential future user-directed sUSDH.

- Ethena: ≥95% yield to HL; KPI-based milestone approach with validator flexibility. PROPOSAL WITHDRAWN

- Bastion: 95% yield to HL (50% AF, 40% incentives, 5% USDH/HYPE growth); 5% ops.

- BitGo: 30bps to BitGo for operations, remainder to HYPE staking with 20% max per validator, community-directed Assistance Fund allocation

- OpenEden: 100% fees and yield to HYPE/ecosystem, zero retention, plus 3% $EDEN token allocation for incentives

Compliance & Licensing

- Paxos: NYDFS-chartered trust; longest regulatory track record.

- Agora: Coalition model; GENIUS-compliant; neutral issuer.

- FRAX: Permissionless DeFi roots; now adds Tier-1 partners (BlackRock, Fidelity, WisdomTree).

- Native: GENIUS compliance via Bridge (Stripe-owned; conflict concerns).

- Sky: Decentralized protocol; inherits MakerDAO/Sky governance; S&P-rated; Basel III risk models.

- Ethena: Anchorage Digital Bank (OCC charter, GENIUS-compliant); only federal bank in the race. PROPOSAL WITHDRAWN

- Bastion: NYDFS-chartered trust; dozens of MTLs + MSB; GENIUS-ready; neutral issuer.

- BitGo: Six regulated trust companies globally (US, New York, Germany MiCA, Denmark, Dubai VARA, Singapore MAS), multi-jurisdictional coverage

- OpenEden: Bermuda Class M Digital Asset License, bankruptcy-remote SAC structure ensures reserve segregation from issuer liabilities

Custody & Reserves

- Paxos: Multi-bank custody (incl. State Street); 100% cash + Treasuries. PYUSD added in V2 Proposal

- Agora: State Street custodian; VanEck asset manager; on-chain PoR via Chaos Labs.

- FRAX: Diversified collateral across BlackRock BUIDL, Fidelity, WisdomTree, Superstate.

- Native: Bridge-managed reserves; BlackRock, Superstate, BNY Mellon, Fidelity.

- Sky: $13B diversified collateral; PSM with $2.2B instant USDC; Basel III frameworks.

- Ethena: USDH backed 100% by USDtb (BlackRock BUIDL + Anchorage custody). PROPOSAL WITHDRAWN

- Bastion: Bankruptcy-remote reserves (cash, Treasuries, RRP, tokenized MMFs via BUIDL + WisdomTree).

- BitGo: $90B+ assets on platform, pioneered multi-sig technology, T-bills/repos/cash reserves, decade of zero-breach custody operations

- OpenEden: BNY custody with $55T under management, TBILL reserves with dual ratings (Moody's A, S&P AA+f/S1+), one of three globally

Distribution Footprint

- Paxos: PayPal ecosystem distribution — 400M users, 35M merchants, $1T+ payment volume, plus full stack integration.

- FRAX: 50+ DeFi integrations (Curve, Aave, Balancer); frxETH momentum; new TradFi alliance.

- Agora: Rain (global cards), LayerZero, MoonPay, EtherFi, Centrifuge; $10M day-one liquidity.

- Native: HL-native builders (Liquity, Uniswap alumni); embedded team + HL history.

- Sky: Stars system (Spark $1.2B TVL); LayerZero multichain; $25M Hyperliquid Genesis Star.

- Ethena: $13B balance sheet (USDe + USDtb); validator guardian network; HIP-3 integrations (hUSDe, equity perps). PROPOSAL WITHDRAWN

- Bastion: Global on/off-ramps (50+ countries) + partners Rain, LayerZero, Securitize, Borderless.

- BitGo: Thousands of institutional clients, WBTC ($14.2B) and USD1 ($2.65B) existing networks, established market maker and exchange partnerships globally

- OpenEden: AEON Pay network 20 million merchants across Southeast Asia/LatAm/Africa, Monarq liquidity provision, proven USDO rails already processing real payments

What Matters Most

For validators, the decision boils down to:

- Maximizing ecosystem yield (100% vs 95% vs 50%).

- Long-term alignment (issuers need skin in the game)

- Regulatory safety vs. DeFi purity.

- Execution credibility (proven issuers like Paxos vs. coalitions vs. HL-natives).

- Conflict of interest (Stripe/Bridge vs. neutral issuers).

Proposal Showdown: Expanded Profiles

Paxos Labs — The Regulatory Fortress

Key Differences: Paxos V1 → V2

Paxos completely pivoted from "we're the safe choice" to "we only win if Hyperliquid wins."

The Big Three Changes:

- PayPal Goes All-In: V1 mentioned PayPal as a partner. V2 delivers a full strategic partnership — HYPE gets listed on PayPal/Venmo, USDH gets free on/off-ramps globally, plus $20M in ecosystem incentives. That's 400M users and $1T in payment volume.

- Revenue Alignment Flipped: V1 took a flat 5% cut. V2 takes nothing until $1B TVL, caps at 5% after $5B, and takes all fees in HYPE tokens. The Assistance Fund pledge starts at 20% but scales to 70% as USDH grows.

- From Infrastructure to Growth Partner: V1 pitched regulatory compliance and safety. V2 commits to bringing builder codes to enterprises, asset issuers to HIP-3, and making Hyperliquid "a cornerstone of the global financial market." All while doubling down on "Paxos is the only issuer positioned to legally issue stablecoins globally-no one else can legally issue in Europe, full stop–ensuring that USDH can scale globally in a fully compliant manner."

Bottom Line: V1 was Paxos asking to be Hyperliquid's stablecoin issuer. V2 is Paxos committing to make Hyperliquid the center of global DeFi — backed by PayPal's commitment to grow the Hyperliquid ecosystem with their 400M users and $1T payment network.

Proposal V1 Summary

Design & Reserves

Paxos Labs would issue USDH as a fully reserved, fiat-redeemable, bankruptcy-remote stablecoin, modeled on its existing products from Paxos: USDP, PayPal’s PYUSD, and PAXG (tokenized gold). Paxos pioneered regulated commodities tokens in 2019 and continues to publish monthly attestations by Withum. Reserves are held strictly in T-Bills, Repos and USDG, segregated and bankruptcy-remote.

Offer

Paxos proposes to direct 95% of all reserve yield to buy back HYPE and redistribute it to ecosystem initiatives, partners and users, while retaining 5% to cover compliance, audits, and operational sustainability. They argue this margin ensures USDH can scale without relying on subsidies or deferred costs.

Compliance & Licensing

Paxos is a NYDFS-chartered trust company, one of the most heavily regulated entities in crypto. It was issuer of BUSD, which peaked at ~$23B supply before NYDFS ordered a halt in 2023 (no reserves were lost, and redemptions continued seamlessly). Paxos is the exclusive issuer of PayPal’s PYUSD, one of the most prominent corporate-backed stablecoins, and was the first company to receive a U.S. OCC no-action letter for crypto custody in 2021. Paxos has a long track record of navigating SEC and NYDFS scrutiny without user losses — unique among stablecoin issuers.

Custody

Paxos employs a multi-bank custody model, historically working with Tier-1 custodians like State Street. For USDH, a similar structure would apply, paired with proof-of-reserves and independent attestations.

Distribution

Paxos’ distribution footprint is unmatched among competitors. It powers PayPal and Venmo’s stablecoin programs, has integrations with MercadoLibre, Nubank, Interactive Brokers, and Revolut, and services institutions across fintech and TradFi. In August 2025, Paxos also acquired Molecular Labs, the Hyperliquid-native team behind LHYPE and WHLP, which had previously issued wrapper tokens to bootstrap HL liquidity. This acquisition was widely read as Paxos embedding itself directly into HL culture rather than approaching solely as an outsider.

Track Record

Founded in 2012 by Charles Cascarilla (CEO) and Rich Teo (Co-founder), Paxos has issued more than $160B in stablecoins cumulatively, with zero reserve shortfalls. It has weathered every major crisis — Terra’s collapse, FTX’s implosion, and the BUSD wind-down — without failing redemptions. Its record of compliance and solvency is arguably the strongest of any issuer in crypto.

Positioning

As Bhau from Paxos Labs put it:

“The Paxos USDH proposal didn’t include specific partners because we aren’t trying to make exclusive coalitions. Our goal is to provide the infrastructure that makes USDH the most liquid and cost-efficient asset in the ecosystem, open for everyone — on/off-ramps, DeFi protocols, fintech apps, and payment providers. And yes, we already work with partners like Rain and LayerZero.”

Risks

Validators may question the 5% retention compared to 100% yield pass-through rivals. Others may prefer coalition-led approaches with visible HL-native distribution, while Paxos’ infrastructure-first stance could be seen as less community-aligned.

Conclusion

Paxos frames itself as the safe, regulated, and proven choice. Its infrastructure-first approach avoids exclusive coalitions, instead positioning USDH as open for all partners to build on. With more than a decade of regulatory trust and billions issued without a single reserve loss, Paxos is the most battle-tested issuer in this contest. The trade-off is alignment: its 95/5 revenue split is less generous than 100% offers, and some validators may prefer more visible HL-native partnerships. The question for HL governance is whether stability, compliance, and trust outweigh maximal yield capture.

Proposal V2 Summary

Design & Reserves

USDH maintains the same bankruptcy-remote structure but expands reserve composition to include PYUSD alongside existing GENIUS-compliant assets (cash, T-bills, regulated MMFs).

Offer

Paxos replaces the flat 95/5 split with a TVL-gated schedule that prioritizes the Assistance Fund first. Paxos earns nothing until USDH reaches scale, and all fees are taken in HYPE tokens for alignment.

- $0–1B TVL: 20% yield to Assistance Fund (AF), 80% to ecosystem incentives, 0% Paxos

- $1–2B: 30% AF, 69% ecosystem, 1% Paxos

- $2–3B: 40% AF, 58% ecosystem, 2% Paxos

- $3–4B: 50% AF, 47% ecosystem, 3% Paxos

- $4–5B: 60% AF, 36% ecosystem, 4% Paxos

- > $5B: 70% AF, 25% ecosystem, 5% Paxos (capped)

This model ensures Paxos only wins if Hyperliquid wins — prioritizing ecosystem growth and HYPE buybacks first, with Paxos capped at 5% even at scale.

It's also worth noting the Paxos explicitly mentions.

"At each milestone, we will hold a governance vote via the Hyperliquid validators on whether to amend or revise the next proposed milestone’s distribution structure."

Compliance & Licensing

No core changes from V1 to V2, but the updated proposal maintains NYDFS regulatory framework while emphasizing unique global capabilities — specifically that Paxos is the sole issuer positioned for compliant European operations under MiCA.

Custody & Infrastructure

Beyond standard mint/redeem rails, V2 integrates PayPal's payments stack including Venmo (P2P payments), cross-border global payouts app (Hyperwallet), remittance (Xoom), and merchant processing (Braintree) infrastructure.

Liquidity

The centerpiece: PayPal commits to list HYPE across its platforms, provide free USDH on/off-ramps, deploy $20M in ecosystem incentives, and integrate USDH into its global payments network serving 400M+ users.

Kraken has now agreed to list Paxos-issued USDH with free USD on/off-ramps plus HYPE from day one (pending standard listing diligence). This creates dual exchange infrastructure—PayPal/Venmo for retail, Kraken for crypto-native traders.

Track Record

Leverages existing enterprise relationships (Stripe, Mastercard, Robinhood, Mercado Libre, Nubank, Interactive Brokers) as proof of execution capability at institutional scale.

Positioning

Radical reframing from safety-first to growth-first. As they state: "Paxos only wins if Hyperliquid wins." The proposal explicitly targets three strategic expansions: bringing builder codes to enterprise platforms, attracting asset issuers to HIP-3, and scaling DeFi through traditional fintech rails. Direct commitment:

"All of finance will come onchain, and our belief is that this transition will happen in the Hyperliquid ecosystem."

Conclusion

The transformation from V1 to V2 reflects aggressive community responsiveness. Paxos pivoted from institutional credibility arguments to direct value alignment — taking nothing until proven scale, capping upside, and denominating success in HYPE itself.

The PayPal partnership isn't just distribution; it's validation that a $1T payment processor believes Hyperliquid represents the future of finance. As they conclude: "It will start with USDH, but we will eventually turn Hyperliquid into a cornerstone of the global financial market."

This isn't positioning as the safe stablecoin choice anymore — it's positioning as the only partner capable of bridging Hyperliquid to global financial infrastructure.

Frax Finance — The DeFi Purist (Now Leading an Institutional Alliance)

Design & Reserves

FRAX began as a fractional-algorithmic stablecoin that balanced collateral with governance token seigniorage. Following the collapse of UST in 2022, FRAX governance shifted to CR=100%, fully collateralized by cash, T-bills, and tokenized RWAs. In early 2025, the DAO passed FIP-418, enshrining BlackRock’s BUIDL fund via Securitize as part of its collateral stack.

Offer

FRAX commits to 100% of yield flowing to Hyperliquid.

Compliance & Licensing

Historically, FRAX operated in a permissionless DeFi-first model, but in September 2025 it announced the Frax-led USDH Alliance:

- BlackRock (BUIDL fund backing)

- Fidelity (asset management backing)

- WisdomTree (tokenized assets backing)

- Superstate (RWA backing, tokenized Treasuries)

- Securitize (transfer agent, RWA integration)

- LayerZero (cross-chain interoperability)

- Stablecoin Inc. (alliance orchestration)

- Tier-1 institutions TBA

This partnership signals FRAX’s pivot into institutionally credible rails while keeping its DAO-driven governance and yield-sharing ethos intact.

Custody

Collateral and issuance would be diversified: BlackRock/Fidelity/WisdomTree/Superstate (asset managers), Securitize (transfer agent). This multi-party structure rivals Paxos and Agora in credibility.

Distribution

FRAX remains deeply integrated across 50+ DeFi protocols (Curve, Aave, Balancer, Fraxswap). Its frxETH token is the #2 liquid staking derivative by Curve TVL. Through its Alliance partners, FRAX adds potential TradFi distribution rails that extend USDH beyond HL.

Track Record

Founded by Sam Kazemian and Travis Moore, FRAX peaked at $2.9B supply in 2022 and remains ~$600M today. It survived the Terra implosion with peg stability intact, pioneered Algorithmic Market Operations (AMOs) to manage on-chain liquidity, and launched frxETH (a core LSDfi product).

Risks

The Alliance brings governance complexity across multiple Tier-1 institutions. FRAX also lacks an HL-native footprint (unlike Paxos or Native), leaving execution risk in onboarding directly into HL. Validators must weigh whether the combination of 100% yield + institutional credibility outweighs these operational uncertainties.

Conclusion

FRAX has transformed its image from a DeFi purist into the leader of a TradFi–DeFi alliance. By uniting BlackRock, Fidelity, WisdomTree, Superstate, and LayerZero, FRAX presents the broadest institutional coalition in the race. Its 100% yield-sharing pledge is the most validator-friendly, but it comes with complexity: governance across multiple Tier-1 partners and no direct HL-native presence. FRAX’s bet is that the validator set values scale, alignment, and credibility enough to accept those risks — positioning USDH as both decentralized in ethos and institutionally compliant in execution.

Agora Coalition — Maximum Alignment, Maximum Complexity

Design & Reserves

Agora proposes USDH as a Hyperliquid-native, fully collateralized stablecoin with reserves held in short-dated U.S. Treasuries, Overnight Reverse Repo, and cash. Custody is provided by State Street (>$49T AUC/A), while reserves are managed by VanEck ($130B+ AUM). Liquidity management is supported by Cross River Bank and Customers Bank, both of which provide settlement and on/off-ramps for the largest stablecoin market makers. Proof-of-reserves would be published on-chain through Chaos Labs.

Offer

Agora commits to 100% of net revenue flowing back to Hyperliquid’s Assistance Fund and HYPE buybacks. Unlike Paxos’ 95%, Agora pledges the maximum possible yield distribution — with “net” defined as after custody and operational expenses.

Compliance & Licensing

Agora’s infrastructure is designed to be GENIUS-compliant from day one and holds licenses across multiple jurisdictions to pave the way for institutional adoption. It positions itself as a neutral, prudentially licensed issuer — unlike Paxos (which also runs its own brokerage and settlement rails) or Stripe/Bridge (which Agora argues is conflicted by its own Tempo blockchain and wallet infrastructure).

Custody & Infrastructure

- Custodian: State Street — GSIB-scale, $49T AUC/A.

- Asset Manager: VanEck — $130B AUM, run by the VanEck family including coalition leader Nick van Eck.

- Liquidity Management: Cross River & Customers Bank for fast settlement.

- Proof-of-Reserves: On-chain, powered by Chaos Labs.

Distribution

Agora is built as a coalition of top-tier partners:

- Rain — global cards and fiat rails, enabling payments across 5 continents.

- LayerZero — cross-chain interoperability for minting and liquidity migration.

- MoonPay — 20M+ verified users, licensed globally, consumer rails.

- EtherFi — LSDfi protocol (~$500M TVL), providing vault integrations and DeFi-native user base.

- Centrifuge — RWA protocol supporting collateral expansion.

At launch, Agora commits $10M in day-one liquidity for USDH pairs, seeded directly into Hyperliquid markets to maximize the impact of fee incentives.

Track Record

Coalition led by Nick van Eck, drawing on VanEck’s decades of TradFi credibility. Partners like Rain, MoonPay, and LayerZero are proven leaders in their fields, with combined reach across consumer payments, cross-chain messaging, and DeFi. Keith Grossman of MoonPay emphasized that MoonPay “has more licenses and KYC’d users than both Stripe and Bridge,” underscoring its advantage in global consumer coverage.

Positioning

From Nick van Eck:

“If Hyperliquid relinquishes their canonical stablecoin to Stripe, a vertically integrated issuer with clear conflicts, what are we all even doing?”

Agora argues its neutrality is critical: it does not run its own chain, brokerage, or settlement network, making it a Hyperliquid-first, Hyperliquid-aligned issuer. Its proven white-label infrastructure would ensure USDH is branded as Hyperliquid’s own stablecoin, not as a redeployed token from another ecosystem.

Risks

Agora’s coalition model means governance is spread across multiple firms, which could create coordination overhead compared to Paxos’ single-issuer structure. The definition of “net yield” also remains slightly ambiguous. Critics argue the complexity of the partnership could slow decision-making, though supporters counter that this breadth is exactly what ensures institutional-grade scale.

Contrast with Stripe/Bridge. Agora is outspoken against choosing Bridge (Native’s issuer):

- Insufficient financial scale — Bridge’s provider has <$2B balance sheet vs. State Street’s $49T.

- Vendor capture — Stripe owns Bridge and Tempo L1, creating long-term competitive conflicts with Hyperliquid.

- Lack of DeFi experience — Agora argues it is the only team with both deep blockchain experience and infra ready for global scale.

Conclusion

Agora frames itself as the obvious choice for long-term institutional-grade success: deep reserves, GSIB custodian, Tier-1 asset management, on/off-ramp partners with billions in users, and the strongest consumer rails. The coalition promises not just to issue USDH, but to scale it globally — with no conflicts of interest.

Native Markets — The HL-Native Pitch

Design & Reserves

Native proposes USDH as a Hyperliquid-native stablecoin issued directly on-chain, backed by Treasuries and cash. Reserves and compliance rails are handled by Bridge, a Stripe-acquired stablecoin infrastructure platform. According to Bridge founder Zac Abrams, 90%+ of reserves will be custodied at BlackRock and Superstate, with additional reserve support from BNY Mellon, Fidelity, and others as the program scales. Proof-of-reserves and bankruptcy-remote structures would ensure transparency.

Offer

Native commits to splitting yield 50% to Hyperliquid’s Assistance Fund and 50% toward ecosystem growth — including liquidity incentives, HYPE buybacks, and long-term roadmap funding.

Compliance & Licensing

Bridge provides full GENIUS Act compliance and payments-scale infrastructure, with on/off-ramps, debit card issuing, and integration across both HyperCore and HyperEVM. Zac Abrams emphasized:

“We fundamentally believe ecosystems like Hyperliquid should control their money. Using someone else’s dollar will permanently subordinate your interests; building with your own stablecoin ensures full economic alignment and roadmap control.”

Distribution

Native’s advantage lies in its HL-native focus. With Bridge as its partner, Native gains access to billions in monthly payment infrastructure, orchestration, and compliance services already used by brands like MetaMask, Stripe, and FelixPago.

Team & Support. Native’s leadership includes:

- Max Fiege (@fiege_max): DeFi builder, Liquity alum, HL contributor. Co-Founding Native Markets to “reclaim this value leakage for the ecosystem and kickstart Hyperliquid’s next chapter.”

- MC Lader (@Mclader): Former COO of Uniswap Labs, ex-BlackRock (energy trading).

- Anish Agnihotri: Paradigm alum, researcher, MEV and perps specialist.

Crucially, Native’s bid carries the full technical and public endorsement of Bridge, led by founder Zac Abrams. Bridge powers billions in monthly payment volume and supports major brands like MetaMask, Stripe, and FelixPago. Abrams has been explicit about Bridge’s commitment to HL:

“The Hyperliquid community deserves more than the Flashlight App of stablecoins. Dedicated teams will deliver the best products. We’re incredibly excited about the proposal from Max and the Native Markets team — they are 100% focused on a stablecoin tailor-made for Hyperliquid.”

This direct backing positions Native not just as a local HL builder team, but as a partnership between HL-native developers and one of the leading global stablecoin infrastructure providers.

Positioning

Proponents argue that dedicated, HL-focused builders will deliver a better stablecoin than coalition models. As Abrams framed it:

“Stablecoins are products, just like mobile apps or websites. Adding a new ticker to someone else’s stablecoin is no different than putting a new logo on someone else’s generic iPhone app.”

This distinguishes Native’s bid as ecosystem-first, not an AUM grab. While others pitch cross-ecosystem expansion, Native’s sole focus is on Hyperliquid and compounding improvements for USDH over time.

Context

Native’s proposal initially sparked debate because its deployer address was funded just hours before submissions opened, and the bid landed within an hour of the announcement. Critics suggested insider advantage, but supporters highlight that Native has been preparing for months as HL-native builders.

Risks

Stripe’s ownership of Bridge raises long-term questions about vendor capture, especially since Stripe is developing its own blockchain (Tempo). Still, Bridge insists HL is a “priority chain” with dedicated orchestration, and Native maintains full roadmap control.

Conclusion

Native Markets makes the case for being the HL-native alternative: a purpose-built stablecoin, developed by HL builders, with Bridge providing institutional-grade reserves, compliance, and public endorsement from Zac Abrams. For validators who prioritize alignment with HL’s culture and long-term control, Native’s focus on community ownership and tailored design offers a compelling path — even if the economics are less aggressive than rivals.

Sky Protocol — The Balance Sheet Behemoth

Design & Reserves

Sky proposes USDH as a Hyperliquid-native stablecoin backed by one of the most diversified balance sheets in DeFi. With more than $13 billion in collateral across Treasuries, RWAs, CLOs, and DeFi positions, Sky brings unmatched scale and diversification. USDH would also inherit the Peg Stability Module (PSM), offering 2.2 billion USDC in instant redemption liquidity. This structure ensures users can frictionlessly exit to USDC while maintaining deep peg stability.

Offer

Sky pledges a 4.85% return on all USDH held on Hyperliquid, higher than Treasury yields, thanks to its diversified portfolio and Basel III-style risk framework. 100% of this yield would be funneled into HYPE buybacks and the Assistance Fund, aligning growth directly with ecosystem incentives. Sky also proposes a $25M “Hyperliquid Genesis Star” to bootstrap DeFi innovation on Hyperliquid, modeled after Spark, which today holds $1.2B in TVL.

Compliance & Licensing

Sky is the only decentralized stablecoin protocol with an official S&P credit rating (B-), obtained in August 2025. Its risk management framework is adapted from Basel III banking standards, applied both to RWAs (e.g., Treasuries, CLOs) and DeFi collateral. While USDH would not launch fully GENIUS-compliant, Sky emphasizes that its Generator Agent model allows USDH to evolve into a GENIUS-compatible asset over time.

Custody & Infrastructure

Collateral is spread across institutions like BlackRock, Fidelity, Superstate, and BNY Mellon, with live proof-of-collateral dashboards at info.sky.money. LayerZero provides multichain interoperability, ensuring USDH can move seamlessly across chains while retaining HyperCore and HyperEVM integration.

Distribution

Sky offers immediate reach through its existing stablecoins, DAI and USDS, with more than 8B in circulation today. USDH would integrate natively with Sky’s PSM and its Sky Savings Rate (currently 4.75%), offering users permissionless yield. The Sky team commits to moving its native Buyback Engine (which deploys $250M in annual profits for SKY token liquidity) onto Hyperliquid, setting a precedent for protocol-native buybacks.

Track Record

Sky, formerly MakerDAO, is the longest-operating decentralized stablecoin protocol, with 7+ years of continuous uptime and no losses for holders. Its Lindy effect, combined with its diversified balance sheet, make it arguably the safest and most tested issuer in this contest.

Positioning

Sky frames USDH as more than a stablecoin: it’s a balance-sheet-as-a-service, offering Hyperliquid the scale, safety, and credibility of the fourth-largest stablecoin project globally. Its Lindy effect, credit rating, and proven buyback systems create a moat unmatched by other bidders. Sky emphasizes that it is not offering a “bribe,” but rather a sustainable economic alignment: while Hyperliquid would capture nearly all the economics, Sky retains a small spread (10bps) to ensure the model’s durability.

Risks

Complexity may be the biggest drawback. Sky’s proposal spans Stars, Generator Agents, multichain PSMs, and advanced collateral management. Validators may worry about governance overhead or difficulty tailoring USDH specifically for Hyperliquid’s culture. Critics also note that Sky’s scale could overshadow HL-native teams, creating dependence on an external balance sheet.

Conclusion

Sky offers the most scale, the deepest reserves, and the longest track record of any USDH contender. Its 4.85% guaranteed yield, $25M Genesis Star, and $2.2B instant redemption liquidity set a high bar. While governance complexity and external alignment remain concerns, Sky positions itself as the safest long-term partner. For validators, the choice is whether Hyperliquid should entrust USDH to a proven balance sheet behemoth — or take a bet on leaner, HL-native or coalition-driven models.

Ethena — PROPOSAL HAS BEEN WITHDRAWN

Design & Reserves

USDH launches 100% backed by USDtb, issued with Anchorage Digital Bank (OCC-chartered; GENIUS-compliant). USDtb reserves are ~100% in BlackRock BUIDL (via Securitize). Future optional diversification to USDe or hUSDe would require a separate validator vote.

Offer

≥95% of net reserve revenue goes to Hyperliquid (HYPE buybacks/Assistance Fund and, subject to a later vote, optional distributions to staked HYPE/validators). Ethena will cover migration costs for USDC→USDH if pairs are redenominated.

Compliance & Governance

Anchorage’s OCC bank charter provides the clearest immediate path to GENIUS. Ethena proposes a guardian network of elected HL validators (e.g., LayerZero has signaled willingness) empowered to freeze/reissue USDH in emergencies—mitigating multisig/Bridge or issuer-side risks.

Custody & Infrastructure

Reserves custodied on HyperEVM in public, segregated wallets (Anchorage primary). Securitize deploys tokenization stack on HyperEVM; native USDtb will be live on HyperEVM to make USDH create/redeem fast and low-cost.

Liquidity

USDtb has strong CeFi/DeFi/OTC liquidity and direct redeem. Ethena will seek to whitelist USDH in USDe’s $5B+ USDC/USDT backing for near-zero-cost swaps to market makers, improving USDH/USDC spreads and perps microstructure on HL.

Distribution & Ecosystem

Ethena will push HIP-3 markets (reward-bearing collateral, prime brokerage/portfolio margin, and equity perps), and has set aside $75M–$150M in incentives for HIP-3 front-ends. Partners include Based (builder codes exchange), Liminal (delta-neutral; launching hUSDe on HL), Unit (tokenization), and Securitize (RWA rails).

Track Record

Ethena has minted/redeemed >$23B across USDe + USDtb with zero downtime or security incidents; USDe ~$13B supply ranks among the largest digital dollars. USDtb is already a top-10 stablecoin by supply.

Positioning

Ethena's pitch centers on security, compliance, and scale (Anchorage + BUIDL), validator-controlled safety levers, and expanding HL’s TAM (HIP-3, equity perps). Ethena argues it is uniquely positioned to backstop liquidity and accelerate growth far beyond USDH’s base yield.

Risks

Validator scrutiny on future backing changes (USDe/hUSDe optionality), plus reliance on centralized custodians and an active governance layer (guardian network design and elections). Execution spans many initiatives; prioritization will matter.

Conclusion

Ethena offers a GENIUS-first launch with Anchorage + BUIDL, ≥95% revenue to HL, strong liquidity pathways, and a plan to grow HL’s markets (HIP-3, equity perps). The trade-off: more moving parts and policy choices for validators to steward (guardian design, KPI-based economics, optional diversification later).

Bastion — Neutral, GENIUS-Compliant, Infrastructure-First

Design & Reserves

USDH would launch as a full-stack stablecoin (not a wrapper) with its own legally segregated, bankruptcy-remote reserves. Backing includes cash, short-duration U.S. Treasuries, overnight RRP, and tokenized MMFs via BlackRock BUIDL (Securitize) and WisdomTree. Structure designed to be GENIUS-compliant at inception.

Offer

95% of reserve yield distributed to HL: 50% Assistance Fund, 40% trader/builder/liquidity incentives, 5% for USDH/HYPE growth. 5% retained for ops. Flexibility for allocations to evolve with community governance. Mint/redemptions in USD = free; other fiat/stablecoin pairs vary by jurisdiction.

Compliance & Governance

Bastion operates under a New York limited-purpose trust charter (NYDFS) with dozens of money transmitter licenses and MSB registration at FinCEN. Its regulatory posture is closest to GENIUS equivalence at the state level, mapping directly to the new federal standard. Unlike issuers with conflicts (own stablecoins or chains), Bastion stresses neutrality: it does not run a competing coin, chain, or exchange.

Custody & Infrastructure

Reserves are bankruptcy-remote and custodied with major U.S. banks. Full transparency and regulatory oversight under NYDFS supervision. Bastion partners with Rain, LayerZero, Securitize, and Borderless for cross-chain interoperability, tokenization, and fiat ramps. Global coverage spans 50+ countries with ACH, Wire, SWIFT connectivity.

Liquidity

Day-one liquidity programs seeded via Bastion and partners. Integration with Rain and LayerZero enables cross-border ramps and multichain transferability. Global fiat access designed to make USDH “spendable” out of the box, from card rails to exchanges.

Distribution & Ecosystem

Bastion’s role is infrastructure-as-a-service: neutral rails for issuance, liquidity, and compliance. The model: USDH as the base stablecoin (L1 of money), with other partner stablecoins issued as wrappers on top of USDH. Focus on growing adoption through regulated fiat channels and ecosystem incentives (liquidity mining, swaps, builder code rewards).

Track Record

Team combines deep regulatory, compliance, and product experience across a16z, Meta Libra, Anchorage, Kraken, DOJ, Capital One, Ripple, Cash App, Coinbase, Goldman Sachs and more. Members previously launched stablecoins (e.g., PayPal PYUSD), built custody banks, and designed compliance/risk programs for global institutions.

Positioning

Bastion’s pitch: the most regulatory-derisked option, ready to be GENIUS-compliant on day one. No competing coin or ecosystem — purely an enabler. Emphasis on security, transparency, and giving maximum economics back to HL (95%) while covering costs for long-term sustainability.

Risks

Slower go-to-market vs. DeFi-native issuers due to regulatory processes and approvals. Less flashy ecosystem integration (compared to FRAX or Ethena) — Bastion focuses on rails and compliance, not DeFi-native growth mechanics.

Conclusion

Bastion offers the safest compliance pathway, with NYDFS charter credibility, neutral posture, and a 95% revenue share to HL. Its pitch resonates for validators prioritizing regulatory certainty and neutrality over complex ecosystem plays. The trade-off: slower innovation and less optionality, but maximum assurance that USDH remains a secure, sovereign, GENIUS-compliant asset.

BitGo USDH Proposal

Design & Reserves

BitGo would issue USDH as a fiat-backed stablecoin deployed natively on both HyperEVM and HyperCore. Each token would be fully backed 1:1 by liquid USD-denominated assets: bank deposits, permitted money market funds, short-term T-bills, and overnight repos. BitGo emphasizes USDH won't be a wrapper but a native asset, with Chainlink CCIP for cross-chain interoperability and twice-monthly audits by top-tier US firms.

Offer

BitGo takes 30bps (0.3%) on total reserves. The remaining yield purchases and stakes HYPE proportionally across validators (max 20% per validator). A community-determined portion flows to the Assistance Fund. Unstaked HYPE and all staking rewards return to USDH holders pro rata, everything on-chain and transparent.

Compliance & Licensing

BitGo operates six regulated entities globally:

- BitGo Trust Company (state chartered)

- BitGo Trust Company New York (state chartered)

- BitGo Europe GmbH (MiCA compliant, Germany)

- BitGo Europe ApS (Denmark)

- BitGo Custody MENA FZE (VARA licensed, Dubai)

- BitGo Singapore Pte. Ltd. (MAS regulated)

This isn't just a list, it's global infrastructure with established banking relationships ready to build the largest fiat rails into USDH.

Custody

BitGo invented multi-sig. They custody $90B+. That's the pitch.

Distribution

Access to thousands of institutional clients for instant minting. Existing partnerships with market makers, exchanges, fintechs, and banks. 24/7/365 minting and redemption across USDC, USDT, and fiat. BitGo's distribution isn't theoretical — they already move billions through these rails.

Track Record

Founded in 2013, BitGo launched WBTC ($14.2B market cap) and USD1 ($2.65B market cap). They manage one of the largest staking positions globally and have never had a security breach affecting client funds. Over a decade of operations, $90B+ in custody, zero drama.

Positioning

"We think that the best solution is a simple one, because complexity adds operational risk."

BitGo's entire pitch is trust through simplicity. No fancy yield strategies, no complex coalitions, just proven infrastructure and willingness to adapt. They acknowledge the community built Hyperliquid and position themselves as collaborative partners rather than prescriptive architects. As they note: "Stablecoins are no longer just about issuance, it's about trust."

Risks

The 30bps fee is conservative — almost boring — compared to rivals offering 100% yield pass-through. BitGo acknowledges this directly, citing concerns about future rate drops and operational sustainability. Some validators will inevitably prefer flashier economics or more aggressive HYPE accumulation strategies. The simplicity BitGo champions might read as lack of innovation to a community that built the most sophisticated perp DEX in crypto.

Conclusion

BitGo is betting that Hyperliquid values bulletproof execution over aggressive economics. Six global licenses, $90B in custody, WBTC's success story — it's a resume that speaks for itself.

But in a competition where others promise to give away everything, BitGo's sustainable 30bps take might be too traditional for a protocol that's anything but.

The question: Does Hyperliquid want the most trusted name in custody, or the most generous offer on the table?

OpenEden USDH Proposal

Design & Reserves

OpenEden would issue USDH through its Bermuda-regulated subsidiary using a bankruptcy-remote segregated accounts company (SAC) structure. Reserves would consist entirely of TBILL, their tokenized Treasury fund with dual ratings: A from Moody's and AA+f/S1+ from S&P. Only three funds globally have achieved this. BNY, managing $55 trillion in custody, handles everything.

Offer

100% of minting and redemption fees go to HYPE buybacks and validators. 100% of the ~4% TBILL yield flows to HYPE buybacks and ecosystem initiatives.

"All fee revenue flows back to Hyperliquid. All yield flows back to Hyperliquid."

Zero retention. Plus 3% of $EDEN token supply as additional USDH incentives.

Compliance & Licensing

OpenEden Digital holds a Class M Digital Asset Business License from the Bermuda Monetary Authority, granted after what they describe as "deep examination into OpenEden's business, tech, compliance, and risk management processes."

The bankruptcy-remote SAC structure legally segregates reserves from issuer liabilities. This is institutional-grade protection that goes beyond standard regulatory compliance. Even in issuer insolvency, USDH reserves remain untouchable.

Custody

BNY. That's it. That's the pitch.

America's oldest bank, top-10 global asset manager, world's largest custodian. The same institution managing trillions in traditional assets would secure USDH.

Distribution

Direct fiat on/off ramps through US banking partners. USDC rails for crypto-native users. But here's the real kicker: AEON Pay already enables their wrapped stablecoin cUSDO at 20 million merchants across Southeast Asia, Mexico, and Nigeria. As they note:

"The same framework that has enabled the adoption of cUSDO and USDO globally will extend to USDH, positioning it as a stablecoin with clear institutional and retail utility."

Monarq Asset Management (majority owned by FalconX) provides dedicated liquidity. This isn't a promise of future partnerships. It's live infrastructure ready to deploy.

Track Record

Founded in 2022, OpenEden has become Asia's largest issuer of on-chain Treasury bills. Their TBILL fund maintains one of the longest track records among tokenized money market funds. USDO operates under the same Bermuda framework proposed for USDH. Two years isn't twenty, but they've achieved regulatory milestones others haven't attempted.

Positioning

OpenEden positions USDH as the institutional Bridge Hyperliquid needs to scale beyond crypto-native users. Their vision is clear:

"We believe Hyperliquid is that platform, and the next phase of its growth requires an institutional-grade stablecoin."

The consortium approach with Chainlink for infrastructure, BNY for custody, AEON for payments, Monarq for liquidity isn't piecemeal partnerships but what they call "industry-leading capabilities in scalability, security, and interoperability." They're betting that institutional credibility matters more than DeFi-native innovation.

Risks

Two years of operations versus competitors with decade-long track records. The 100% pass-through model sounds generous until you wonder how they'll fund operations long-term. Are they betting entirely on $EDEN appreciation? Bermuda regulation might not carry the same weight as US or European licenses for some institutional players. The heavy consortium reliance could be seen as unnecessary complexity for a protocol that values self-sovereignty.

Conclusion

OpenEden brings the most institutionally bulletproof proposal to the table: BNY custody, dual credit ratings, proven payment rails at 20 million merchants, and complete value return to Hyperliquid. As they emphasize,

"the biggest opportunity in the Hyperliquid ecosystem is ensuring that the revenue generated from stablecoin balances and trading fees flows directly back to ecosystem builders and users."

They've built exactly that. The question for validators: Is institutional-grade infrastructure and 100% value flow worth betting on a younger issuer? OpenEden is gambling that when it comes to Hyperliquid's future, credibility trumps tenure.

Notable Companies in the Conversation

Circle — The Incumbent Defends Its Turf

Circle, issuer of USDC, has the most to lose. With $5.5 billion in USDC balances on Hyperliquid — around 7% of global USDC supply — the platform represents an estimated $220 million annually for Circle, or 10–12% of its total revenue.

Rather than oppose USDH outright, Circle responded with defensive cooperation:

- Deploying native USDC on HyperEVM.

- Launching Cross-Chain Transfer Protocol v2 (CCTP v2) to eliminate Bridge risk.

- Promising deeper integration with Hyperliquid’s settlement layer.

Circle’s statement signaled its awareness:

“Don’t Believe the Hype. We are coming to the HYPE ecosystem in a big way.”

Community reaction has been mixed. Some traders see Circle’s presence as safe and liquid, while others argue it underscores just how much value HL has been leaking.

Circle’s defensive entry shows that USDH has already shifted the balance of power. Even if USDH stumbles, HL has forced the world’s largest stablecoin issuer to respond, clawing back leverage for the ecosystem.

M0 Protocol — Neutral Infrastructure

M0, a distributed stablecoin issuance stack, explicitly chose not to bid for USDH. Instead, it has pledged to support any credible USDH issuer with its modular infrastructure. M0 already powers USDhl (~$10M supply )earlier in 2025.

M0’s statement captured its stance:

“M0’s distributed issuance stack is made for ecosystems like HL, and we intend to support every credible project building in the space. Innovation and alignment will have to be proven over the years and not during a weekend of self-referencing virtue signaling on X.”

This neutrality preserves relationships with multiple bidders while ensuring its rails remain indispensable regardless of the vote’s outcome.

M0 is the Switzerland of this contest — staying neutral but already embedded in HL’s stablecoin experiments. Its absence from the vote signals confidence that, whichever team wins, M0 infrastructure will still capture value.

Implementation Reality

Winning the validator vote—scheduled for September 14, 2025—is merely the first hurdle in Hyperliquid's USDH stablecoin rollout. The selected issuer (among frontrunners like Paxos, Frax, Agora, Sky, and Native Markets) must navigate a demanding sequence of technical, financial, regulatory, and operational milestones. These steps ensure USDH's seamless integration into Hyperliquid's ecosystem, spanning HyperCore and HyperEVM, amid a projected $5 billion reserve scale. Below is a briefer expansion on each milestone.

- Secure the Ticker — Acquire sufficient HYPE in a gas auction to control the “USDH” ticker.This mandatory post-vote step requires the winner to bid aggressively with HYPE tokens in Hyperliquid's spot deployment gas auction on Layer 1 to claim the USDH symbol. It decentralizes allocation and boosts HYPE demand, potentially surging its price by 3-5%, as issuers like Paxos and Agora plan pre-auction buys. Without it, USDH can't deploy on spot markets or integrate with HyperCore, enforcing economic commitment from the issuer.

- Deploy Contracts — Launch smart contracts on HyperEVM and integrate directly with HyperCore order books.The issuer deploys USDH's core contracts on HyperEVM, including minting/burning logic and oracle integrations, targeting 2-4 weeks post-vote with testnet stress-testing. Native bridging to HyperCore enables USDH as collateral for perpetuals, replacing USDC to cut fees, with multichain support via LayerZero. Proposals from Frax and Sky emphasize HyperCore-ready designs to avoid oracle risks in sub-millisecond trading.

- Custody & Reserves — Establish bankruptcy-remote custody arrangements and begin allocating reserves to Treasuries and cash.Reserves must be overcollateralized (100-105%) in segregated, bankruptcy-remote accounts via regulated custodians like U.S. banks, prioritizing Treasuries and cash for ~4-5% yields. Issuers like Paxos and Agora commit to $5B+ capacity from day one, with legal SPVs for isolation and initial funding from grants or capital. This setup, per Basel III frameworks, funnels yields back as HYPE buybacks to prevent depegging like Terra's collapse.

- Proof-of-Reserves — Publish on-chain attestations or audits (monthly or real-time) to meet transparency commitments. Issuers pledge real-time or monthly attestations using Merkle trees and oracles like Chainlink PoR, verifying 1:1 backing on HyperEVM dashboards. Paxos plans SOC 2 audits by Deloitte, while Frax and Sky focus on on-chain verifiability with zero-knowledge proofs for privacy. Due within 30 days of launch, this shares 95-100% reserve revenue to HYPE, building trust for perps adoption.

- Liquidity Bootstrapping — Seed deep liquidity into USDH pairs, with some proposers (e.g., Agora) committing $10M day one.To avoid slippage, issuers seed USDH pairs on spot and perps markets via AMMs, with Agora at $10M and Sky at $25M day-one commitments. Incentives like yield boosts and liquidity mining (e.g., Frax's alliance) target 0.1% slippage on $10M trades over weeks 1-4. Validators monitor metrics to grant full HyperCore collateral status, driving USDH toward USDT-level volume.

- Compliance Infrastructure — Implement GENIUS Act and MiCA-aligned procedures for KYC, AML, and global issuance.USDH requires GENIUS Act and MiCA compliance from launch, with KYC/AML via rails like Paxos' NYDFS framework or Stripe integrations for whitelisted minting. Geo-fencing and monitoring tools (e.g., Elliptic) enable global rollout, with optional U.S.-only toggles per Sky's proposal. This positions USDH for institutional inflows, enforced by validators to avoid fines or blacklisting.

- Security Audits — Undergo independent contract audits to mitigate risk of exploits. Pre-launch audits by firms like Trail of Bits cover reentrancy and oracle vulnerabilities, with multiple rounds mandated (e.g., Paxos' internal plus external). Sky leverages its hack-free history and Basel models, followed by $1M bug bounties via Immunefi and code open-sourcing. Validator sign-off gates deployment, critical given Hyperliquid's TVL and past DeFi exploits like Ronin.

Execution risk is real: HL’s user base is large, volumes are high, and traders will only adopt USDH if it matches or exceeds the safety and liquidity of USDC. This rollout will test not just the winning team’s credibility, but the entire premise of a protocol-owned stablecoin.

Closing Thesis: The Era of Protocol-Owned Stablecoins

Market signals and early validation

The market has already voted with its feet. HYPE jumped on the USDH announcement, and prominent voices framed Hyperliquid as a “decentralized Binance” with perps dominance now converging with stablecoin and spot liquidity. The clearest tell: Circle chose cooperation over confrontation, committing native USDC and upgraded transfer rails—an implicit acknowledgment that venue-native stablecoins are no longer hypothetical but competitive.

The protocol-owned stablecoin thesis (revenue and user upside)

USDH isn’t a feature—it’s a cash-flow rerouting mechanism that keeps value inside the Hyperliquid economy.

- Reclaiming yield at scale. With $5.5B in stablecoin balances, even conservative T-bill rates (4%) translate to about $220M/year that can fund HYPE buybacks, validator rewards, audits/security, liquidity programs, and product velocity—instead of exiting to an external issuer.

- Fee relief for users. Proposals explicitly tie that revenue to cheaper trading, including up to 80% fee reductions on USDH spot pairs, while deepening native liquidity and eliminating Bridge risk. That’s a day-one UX win for traders.

- Alignment and resilience. A fully reserved, proof-of-reserves stable integrated with HyperCore + HyperEVM reduces third-party dependencies, tightens risk management, and aligns incentives: more USDH → larger reserves → more yield → stronger buybacks & rewards → better markets.

- Broader access. With issuers/coalitions bringing cards, on/off-ramps, and DeFi integrations, USDH can become a payment & settlement currency, not just a base asset on order books.

Why USDH strengthens the moat

Owning the monetary layer turns Hyperliquid from “exchange with collateral” into platform with its own currency. That unlocks atomic settlement, unified collateral efficiency across spot/perps/DeFi, and predictable programmatic funding for growth—all of which are hard to replicate and compound over time.

Execution risks & what to watch

These aren’t deal-breakers; they’re the dials to monitor so USDH delivers what’s promised.

- Liquidity migration. If depth stays on USDC, spreads/slippage suffer. Watch: daily book depth and % of volume in USDH pairs; time-to-fill vs. USDC.

- Convertibility/peg operations. Even with T-bills, ops lags or custody frictions can stress redemptions. Watch: redemption SLAs, cadence/quality of PoR, named banks/custodians.

- Regulatory UX friction. KYC/transfer-agent rules can blunt UX for some segments. Watch: issuer licensing footprint, policy docs, permissioned vs. permissionless flows.

- Coalition coordination (if chosen). More parties can mean slower decisions. Watch: clear ownership (reserves/issuance/PoR/incidents), RACI, escalation paths.

- Vendor capture. Vertically integrated providers may misalign incentives later. Watch: no-lock-in covenants, exit ramps, COI mitigations.

- Subsidy durability. Fee cuts funded by yield compress if rates fall. Watch: policy for fee schedules across rate regimes; retained earnings for down-cycles.

- Liquidity fragmentation. Running USDC + USDH can split depth. Watch: market-maker programs/routing that consolidate depth without killing choice.

- Governance concentration. Small validator set can move fast—and break trust if misused. Watch: published guardrails, quorum/thresholds, Foundation posture.

- Reputation standard. USDH will be judged against USDC’s “always-on” bar. Watch: transparent incident reports; time-to-resolution.

The precedent and the stakes

Regardless of who wins the mandate, the precedent is the story: venues with sufficient scale can own their monetary base, recycle yield to users and builders, and lower costs while deepening native liquidity and transparency. If USDH executes, expect copycats across major venues; users stand to benefit from lower fees, tighter markets, and clearer proof-of-reserves.

The Future is Protocol-owned Economics

USDH isn’t just a governance vote—it’s a proof point for a bigger shift in DeFi economics. For the past decade, protocols built the markets while external issuers captured the yield. That model made sense in an early industry dependent on outside infrastructure. It makes far less sense now that platforms like Hyperliquid are systemically important in their own right.

The move from protocol-owned liquidity to protocol-owned stablecoins is the natural progression. In practice, this means:

- The venue that generates liquidity also owns the unit of account.

- The revenue loop closes: usage → reserves → yield → incentives → more usage.

- Communities directly benefit from the capital they create, not external shareholders.

If USDH succeeds, it will demonstrate that exchanges can function not only as markets, but as monetary systems with their own currencies. That’s a shift with implications far beyond HL: dYdX, GMX, Vertex, and others will be pressed to follow suit. Regulators, investors, and users alike will begin to expect venues to capture and recycle their own economics.

This is why the stakes extend beyond HL. The vote on September 14 is about one stablecoin on one exchange—but the precedent could reshape how DeFi protocols define sovereignty, sustainability, and alignment for the next decade.

Disclaimer & Update Note:

This analysis is for informational purposes only. It is not financial, investment, tax, or legal advice. Always do your own research and consider your own risk tolerance before making decisions. This article was produced with the assistance of AI research tools (including OpenAI’s ChatGPT 3.5 and 4, Anthropic’s Claude 4.1, and xAI’s Grok/SuperGrok) and then reviewed and edited by our editorial team. We strive to ensure accuracy and validate all information against reliable sources, but errors or omissions may occur, and circumstances may change over time. We are an independent media outlet delivering news, research, and data. Our goal is to provide clear and well-sourced analysis, but readers should treat this as contextual information, not as professional advice. Last updated: September 9, 2025. This is a living document and may be revised as proposals evolve, partners are disclosed, or market conditions change.

Follow the Conversation

This section is designed to capture the evolving discussion around USDH — across Twitter/X, Spaces, podcasts, and community calls — so you don’t have to scroll the timeline.

Instead, you’ll find a curated feed of content to dive deeper into the story.

The Race for USDH

KrakenFX Joins forces with Paxos to Support USDH

Chorus One Validator Support for Paxos

Hyperrbeat Support for Paxos

Ethena Withdraws

Hyperliquid Foundation Update

Support for Paxos from ValiDAO

Hypurrscan Support for Native Markets

OpenEden Proposal

BitGo Proposal

Native Markets Doubling Down on Bridge Choice as Issuer

Agora Founder's Response to Native Markets Evaluation Criteria

Paxos support from Hyperliquid Extremist, building HyBridge

Paxos AMA on V2 Proposal

Paxos and Native Markets alliance suggested by community, Paxos open to the conversation

Rekt Gang Hyperliquid Validator Voicing Support for Native Markets Team

Paxos Proposal V2

Purrposeful x HyBridge x PiP will be endorsing Paxos in the upcoming USDH governance vote

Hyperliquid vs Circle: The Future of Stablecoins - Mikhil from Network Spotlight

Who Will Win The Hyperliquid Stablecoin Battle? - The Rollup

Paxos Take: Issuers need skin in the game

Bastion Proposal

Hypurr Collective Spaces

Thoughts from Frax Founder

Thoughts from Bridge on Native Market

Thoughts from Native Market

Framework Ventures Clip from The Rollup

Neutrality Edger Over Competition

Polymarket Update

Ethena Proposal

Paxos Proposal

M0's Stance

Who will win the USDH ticker on Hyperliquid?

TLDR analysis of USDH Proposals on Hyperliquid

Unique Positioning of Native Markets

Hyperliquid Daily Alpha — Sep 8

One of the First Major Breakdowns to Go Viral

Flowdesk Support for Native Markets and USDH

Based One Team Support for Ethena

Hyperliquid Community Support for Paxos

Hyperliquid Community Support for Ethena

Change Log

- September 9, 2025 10:03pm PST. Updates Made - Information added on Hyperliquid Assistance Fund, Paxos Proposal V2 Details added

- September 10, 2025 9:31am PST. Updates Made - Polymarket embed added, Bastion added to table, small grammar fixes, tweets added to "Follow the Conversation", image embed from mars_defi

- September 11, 2025 9:49am PST. Updates Made - Flowscan USDH Voting Image updated, Revisions made to Governance and Decision Process to better reflect process outlined from Hyperliquid Foundation, OpenEden and BitGo proposals added, tweets outlining various validators support added. Kraken support news added for Paxos V2

Zach Fowler

Author

Head of Media at Stabledash, Zach Fowler writes about stablecoins, DeFi, and the evolution of global payments. He built his career through strategic content creation and personal branding, growing from crypto payroll sales at Rise to becoming a recognized voice in the stablecoin ecosystem. Zach specializes in uncovering practical use cases that demonstrate how digital dollars are transforming business operations worldwide.

Drew Rogers

Author

Don't Miss the Next Big Shift

The Stabledash newsletter keeps you off the timeline and dialed into modern money.

Join leaders at Circle, Ripple, and Visa who trust us for their stablecoin insights.