Industry

22 Minutes of Video featuring Boots on the Ground Coverage from Builders in Kenya

September 2, 2025

Three conversations with key ecosystem players reveal the infrastructure, adoption patterns, and regulatory landscape shaping Africa's digital currency future

The African stablecoin market is experiencing unprecedented growth, driven by payment fragmentation challenges and the need for efficient cross-border transactions.

Through exclusive interviews with three leading operators in Kenya's ecosystem, a clearer picture emerges of how stablecoins are solving real-world problems across the continent.

From regulatory compliance to user experience design, these conversations reveal the market dynamics that are positioning Africa as a global leader in practical cryptocurrency adoption.

Felix Macharia's Kotani Pay represents the critical infrastructure layer that makes African stablecoin adoption possible.

Operating across seven countries with regulatory licenses in South Africa, Kotani Pay has captured a unique market position by solving the "last mile" problem in cross-border payments.

The company's data reveals striking market preferences: 80-90% of transactions involve stablecoins, with USDT commanding 80% market share on the Tron blockchain.

The regulatory landscape Macharia describes suggests a coordinated move toward legitimacy across Anglophone African markets. South Africa led with 2022 regulations focused on crypto asset service providers, followed by Kenya's parliamentary bill this past August.

This regulatory clarity is creating a competitive advantage for early movers like Kotani Pay, which secured financial service provider licensing ahead of the wave. Most significantly, Macharia identifies stablecoins as the solution to Africa's payment fragmentation problem—where East Africa relies on mobile money (M-Pesa dominant in Kenya), Nigeria operates on bank-and-cash systems, and South Africa uses bank-and-cards infrastructure.

Stablecoins provide the first unified payment fabric across these disparate systems, enabling seamless cross-border commerce that was previously impossible through traditional rails.

Ronald Nzioki's perspective from Celo Africa's Prezenti incubator program offers crucial insights into actual user behavior and adoption patterns among Nairobi's predominantly young, tech-savvy population.

His data points reveal a market driven by practical necessity: gig workers who cannot access PayPal are turning to stablecoins for international income, while students and young professionals use peer-to-peer platforms for arbitrage opportunities and remittances.

The application-focused Celo ecosystem Nzioki describes illustrates a mature, diverse market beyond simple speculation. Binance's P2P dominance stems from superior exchange rates and liquidity, while Opera's MiniPay captures campus networks through user-friendly interfaces.

The emergence of specialized on-ramp/off-ramp providers like Fonbnk, Kotani Pay, and BitGet suggests increasing market sophistication and competition. Nzioki's confirmation of USDT's 95% market share on Tron blockchain reinforces the network effects driving adoption—users prefer established liquidity pools and low transaction costs over newer alternatives.

This behavior pattern indicates that first-mover advantages in stablecoin markets may be particularly durable, especially when combined with superior user experience and established merchant networks.

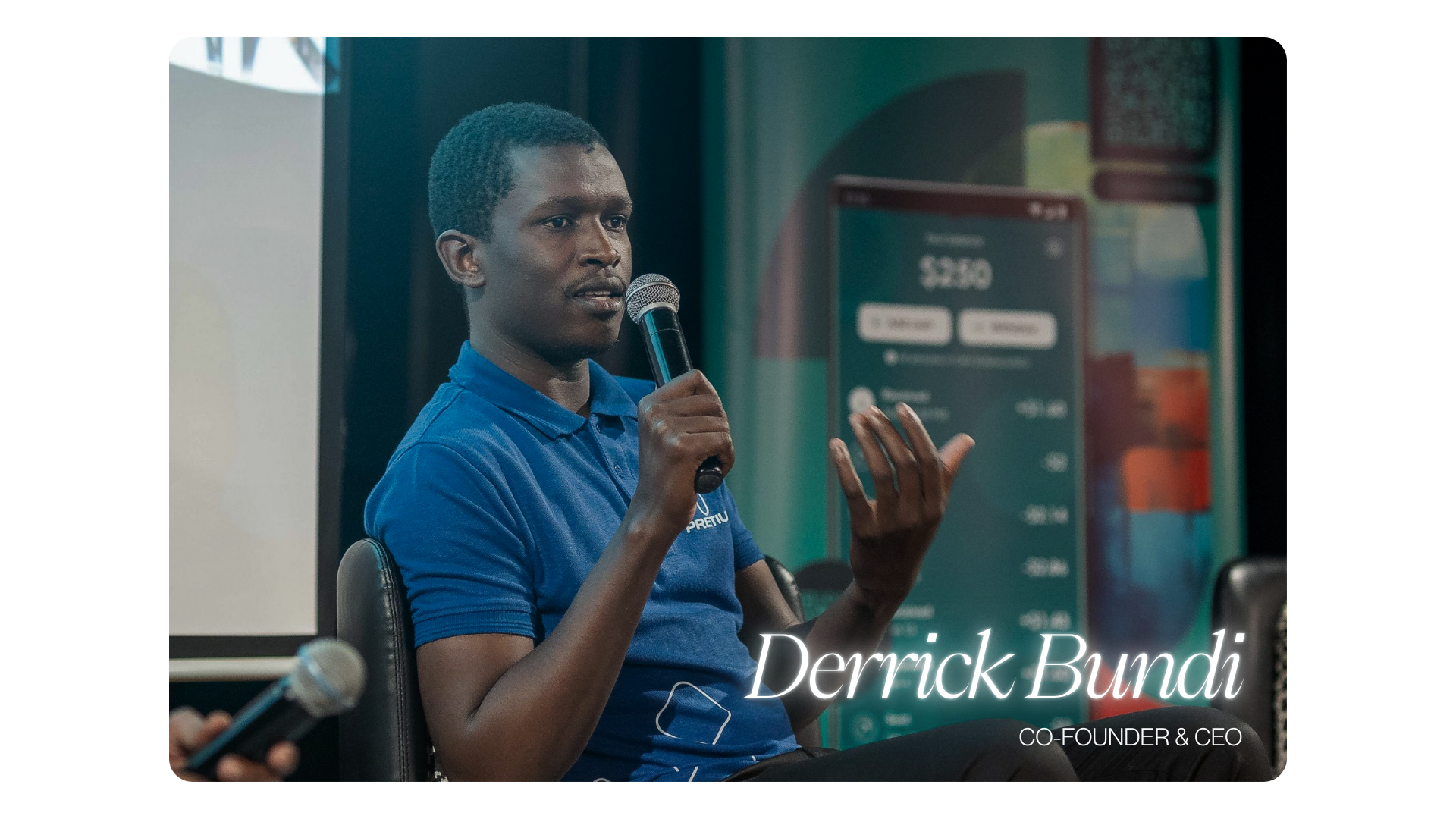

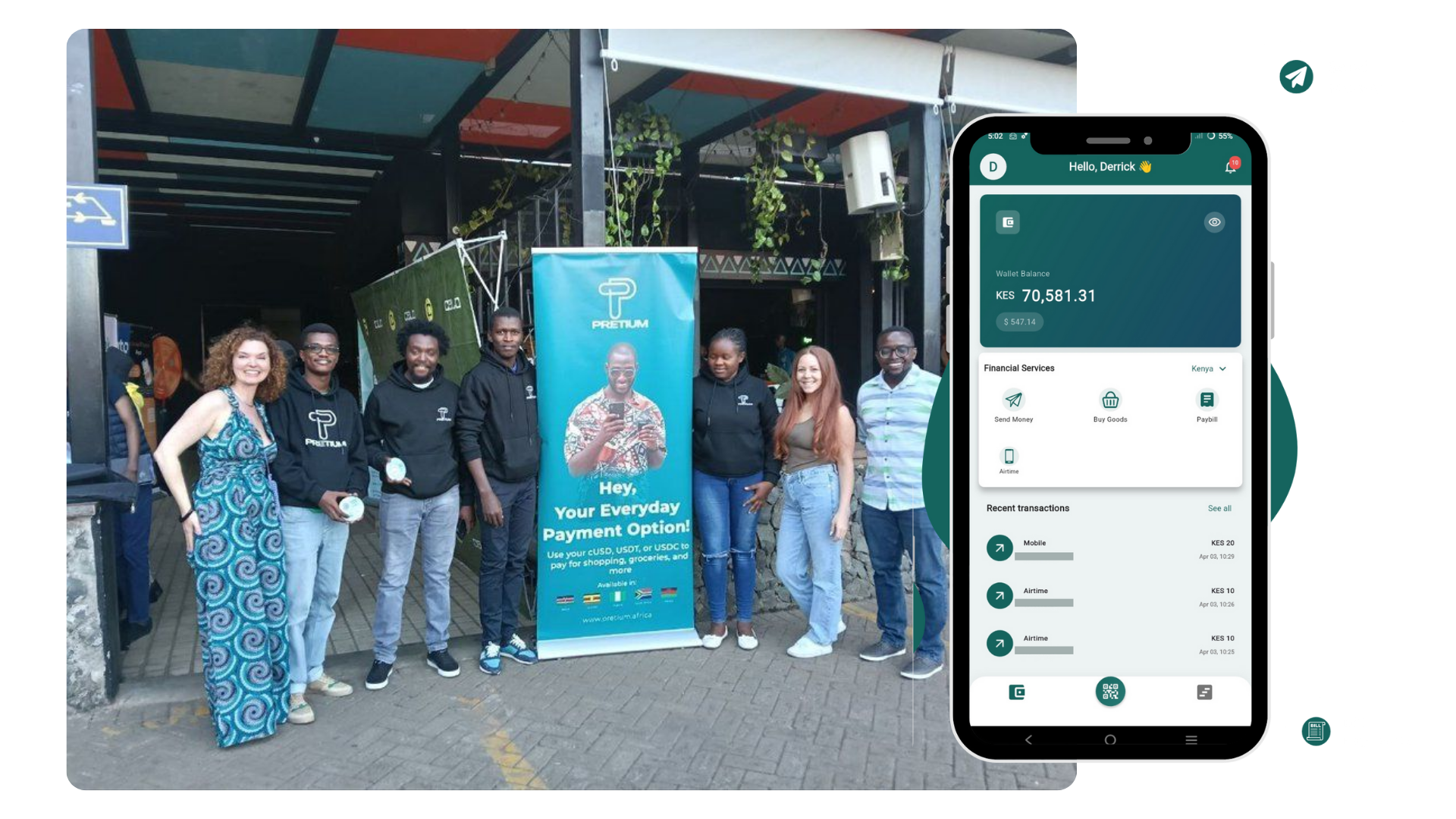

Derrick Bundi's Pretium Finance represents the next evolution in African stablecoin infrastructure: making digital assets as accessible as traditional payments for everyday transactions.

Operating across eight countries, Pretium's dual-product approach reveals sophisticated market segmentation. Retail users via the mobile app predominantly use USDT, while business customers accessing APIs prefer USDC—a split that suggests different risk tolerances and use cases between consumer and enterprise segments.

Pretium's technical architecture offers a glimpse into the future of stablecoin user experience. By abstracting blockchain complexity into familiar banking interfaces, the platform enables "grandmother-level" accessibility while maintaining underlying blockchain efficiency.

Derrick's background building traditional FinTech solutions across Africa gave him unique insight into payment rail inefficiencies, leading to Pretium's interoperability-focused approach.

The company's ability to merge multiple blockchain assets into unified wallet balances suggests that successful stablecoin platforms will compete on user experience rather than blockchain-specific features.

Most notably, Derrick's observation about operating in regulatory "grey areas" while preparing for legitimacy indicates that successful players are building compliance-ready infrastructure before regulations arrive, positioning for rapid scaling once legal frameworks clarify.

These conversations illuminate three critical success factors for African stablecoin adoption: regulatory preparation, payment interoperability, and user experience optimization.

The convergence of maturing regulatory frameworks, growing cross-border commerce needs, and increasingly sophisticated user interfaces suggests Africa may lead global stablecoin adoption for practical, non-speculative use cases.

As traditional financial infrastructure struggles with fragmentation and inefficiency, stablecoin-first companies are building the payment rails that will define the continent's digital economy future.

Disclosure: This feature was produced by StableStats in collaboration to Plasma. Stabledash did not participate in content production; we’re hosting and distributing it for informational purposes. Views are those of the creators/speakers, not Stabledash. This is not investment, legal, or tax advice.

The Stabledash newsletter keeps you off the timeline and dialed into modern money.

Join leaders at Circle, Ripple, and Visa who trust us for their stablecoin insights.