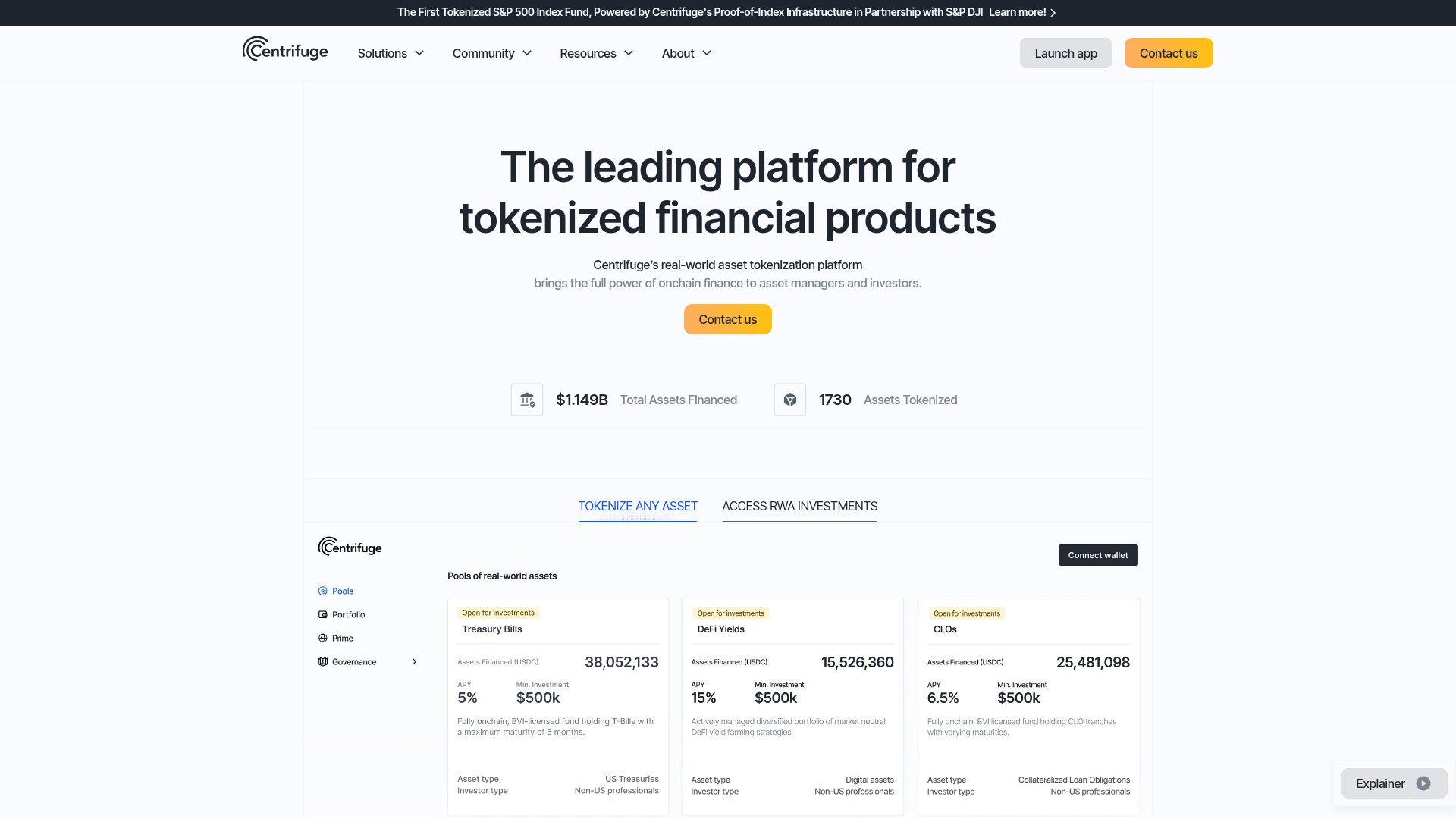

Centrifuge: platform for tokenizing real-world assets (RWAs), connecting asset managers & investors to onchain finance. Features RWA Launchpad, deRWA Tokens, & fund management tools. $646M financed, 1531 assets tokenized.

(Co-Founder)

Headquarters

Website

Total assets financed

Assets tokenized