About

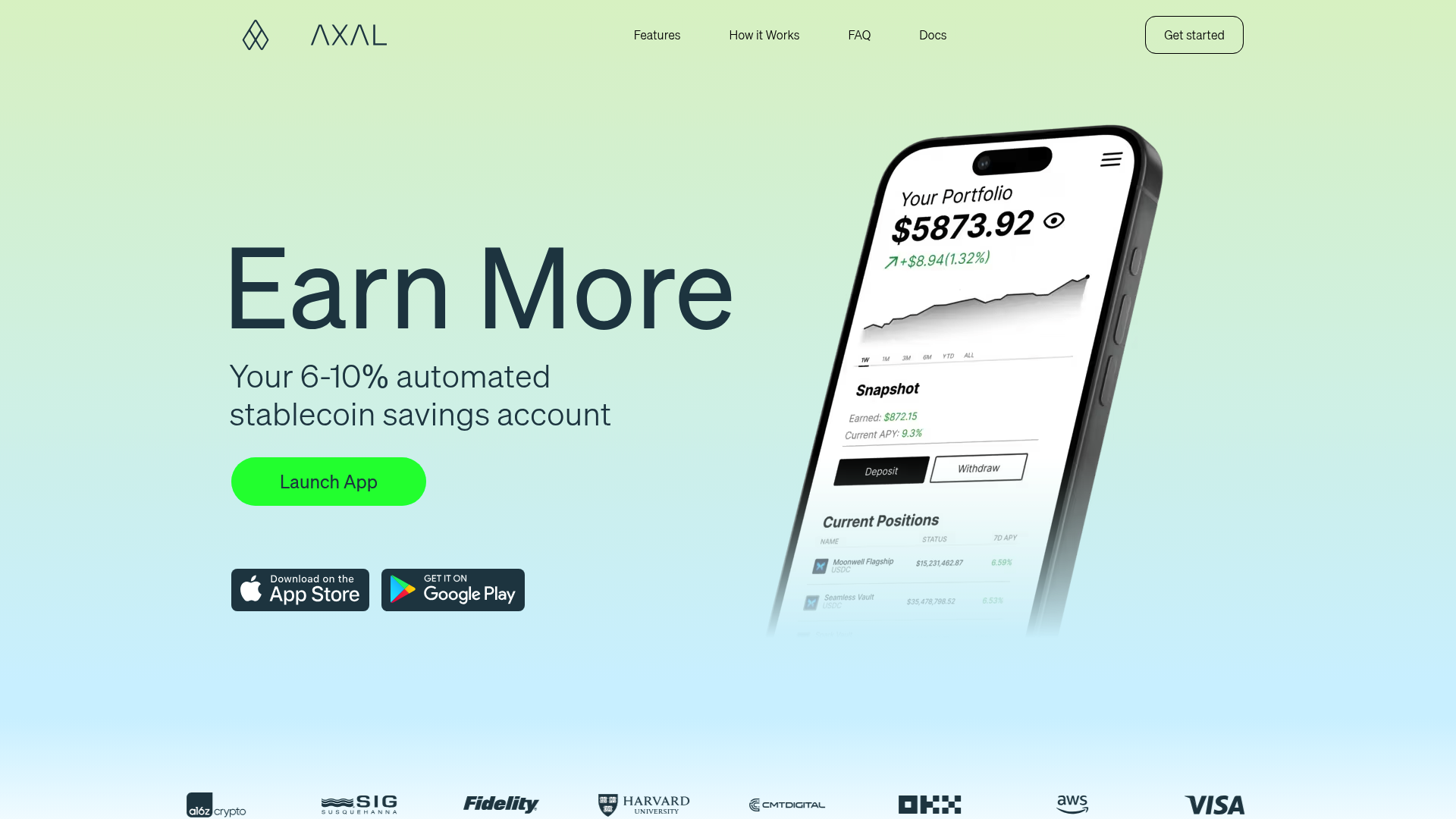

Automated stablecoin savings with reliable returns that grow your wealth safely.

Axal is a non-custodial, automated stablecoin savings product delivering sustainable 6–10% APYs by allocating deposits across audited, overcollateralized lending markets. Users onboard in minutes (email/Google) and fund by card or crypto; Axal continuously optimizes and diversifies yields, enforces safety measures (audits, automated withdrawals, low-latency AWS infra), offers a $50k bug bounty, and charges 15% on earnings.

Use Cases

Stablecoin Yield Maximization

Users deposit stablecoins and earn 6-10% APY through automated optimizationacross DeFi lending platforms.

Beginner Crypto Savings

Novice users easily onboard with email/Google and fund accounts by card orcrypto to start earning savings.

Risk-Diversified Lending Portfolio

Investors gain exposure to diversified audited DeFi lending markets with lowrisk via automated allocation.

DeFi Security-Conscious Investing

Users benefit from automated withdrawals on detected risks and a secure, auditedinfrastructure for peace of mind.

Key Features

Stablecoin Yield & Savings

- 6–10% APY automated stablecoin savings account (Axal Yield).

- Non-custodial model — users retain control while earning yield.

- Uses overcollateralized stablecoin lending markets to generate returns.

- Onboarding via debit/credit card or transferring crypto from an existingwallet.

- Virtual accounts route USDC/USDT into Axal’s smart yield engine for automatedyield optimization.

Autonomous Agents & Trading Automation

- Autopilot AI agents automate trading and DeFi interactions.

- Agents can collect stablecoin yields and engage with DeFi protocolsautomatically.

- Agents can execute multi-step on-chain intents, e.g., swapping non-stabletokens to USDC.

- Supports trading across BTC, ETH, memecoins and custom strategies.

- Raised $2.5M pre-seed to build a verifiable autonomous agent network (backersinclude CMT Digital and a16z Crypto Startup School).