About

Empowering financial freedom through smart contract-driven loans and real-time credit insights

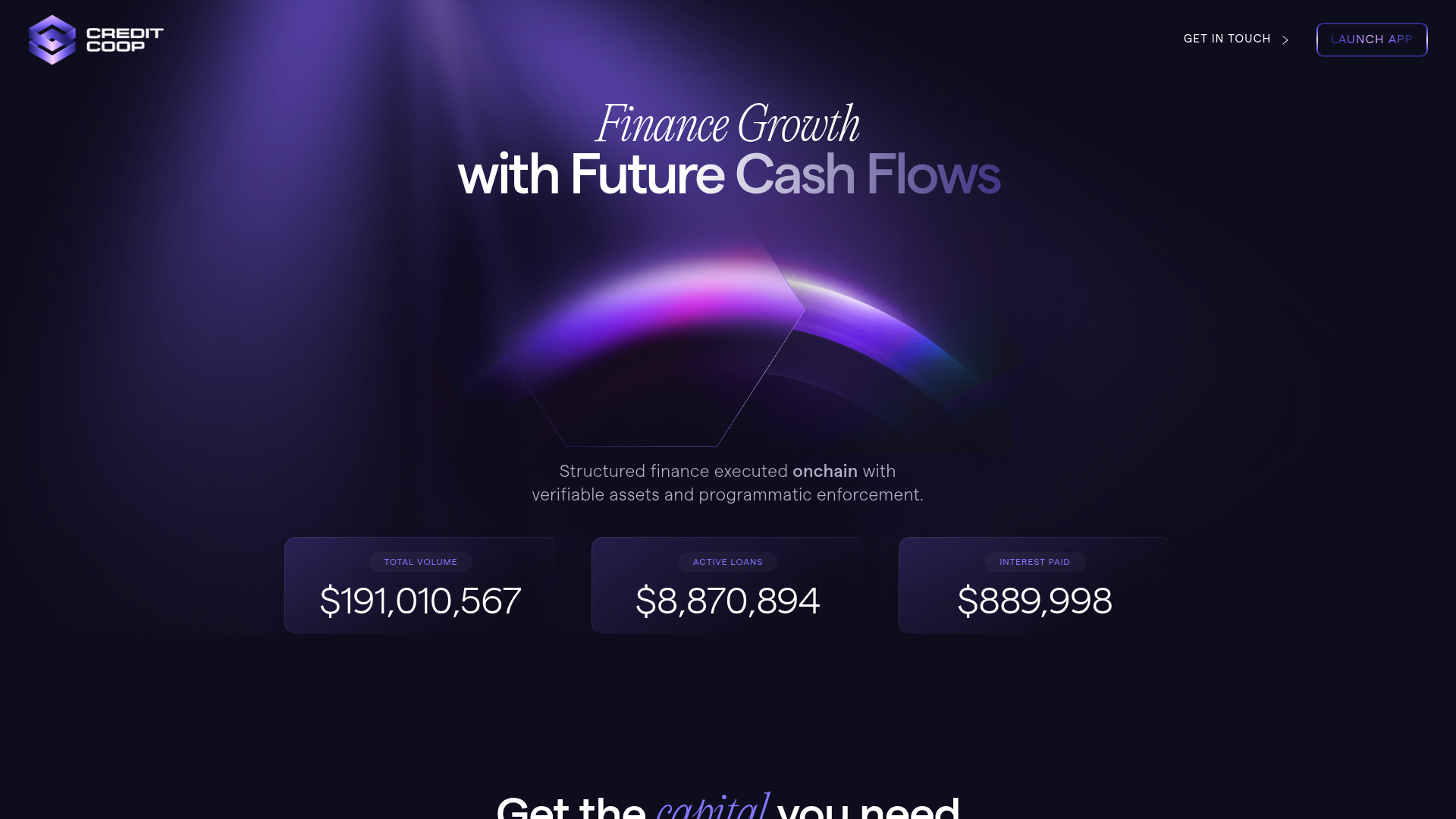

Credit Coop: Revolutionizing Web3 financing with a private credit platform launched in 2024. Automating loans via smart contracts & real-time data for 24/7 monitoring.

Use Cases

Web3 Startups Financing

Startups use future cash flows as collateral to access flexible, low-interestloans via automated smart contract loans.

Lenders Risk Management

Lenders monitor loans in real-time with 24/7 blockchain data, enabling priorityclaims and secure capital deployment.

Credit Line Expansion

Established businesses expand credit lines efficiently with programmable financeautomating repayments and risk control.

Decentralized Loan Automation

Users automate loan terms and repayments securely with smart contracts, ensuringtransparent and trustless interactions.

Key Features

Onchain Credit & DeFi Innovation

- Provides structured finance executed onchain.

- Enables businesses to use future cash flows as collateral.

- Smart contracts manage loan and cash flow transactions.

- Offers programmatic credit for the stablecoin economy.

- More capital efficient than traditional DeFi protocols.

Impact & Traction in Web3 Finance

- Processed $180 million in total volume.

- Has $8.7 million in active loans with zero defaults.

- Secured $4.5 million in seed funding.

- Aims to make all business cash flows instantly financeable.

- Combines traditional finance standards with blockchain.

(Co-Founder & CTO)

Thomas Hepner

(Founder/Co-founder)

Chris Walker

Website

creditcoop.xyz

180M

total volume processed

8.7M

active loans with zero defaults