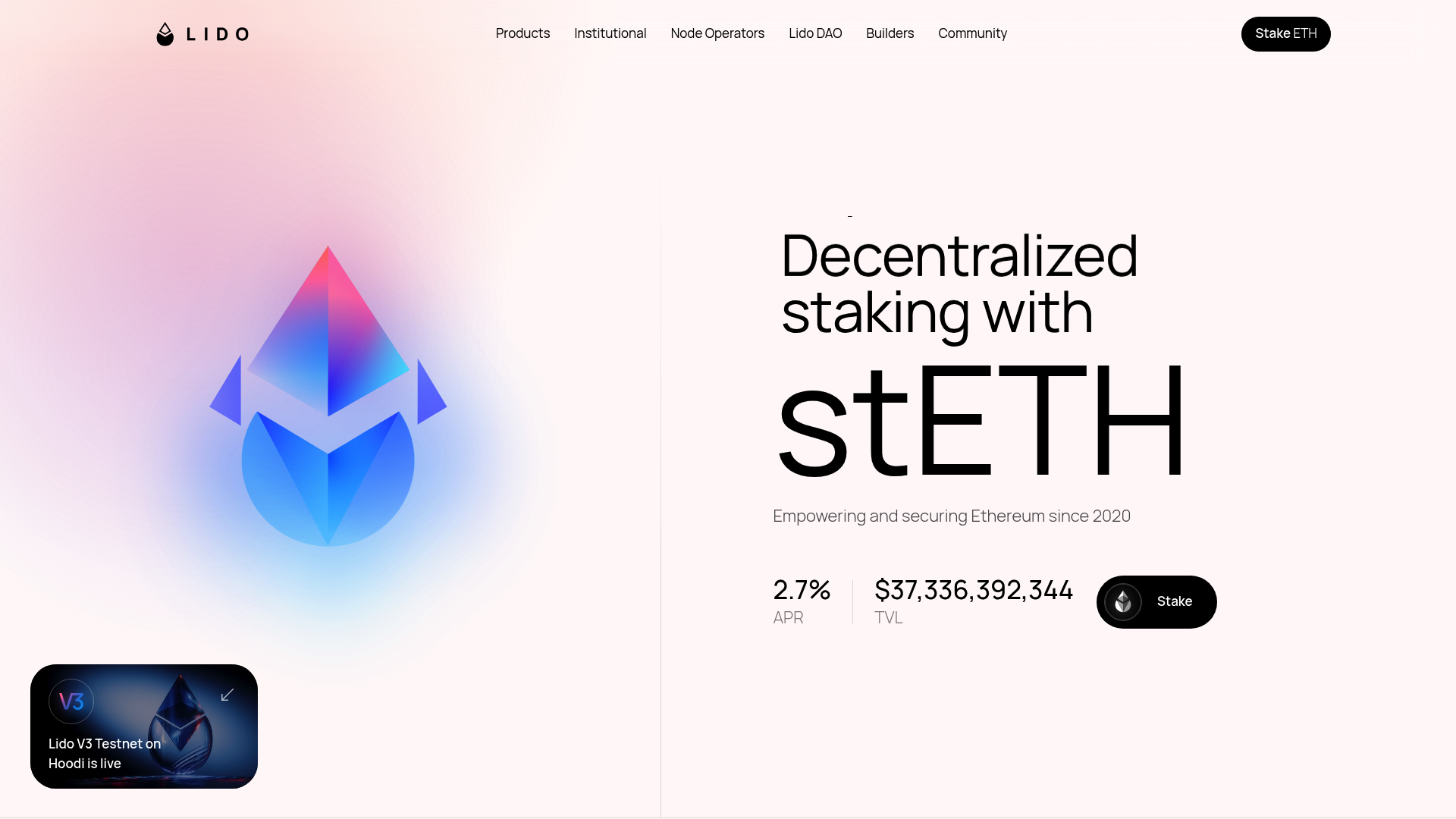

- Lido's primary product is stETH, enabling secure and liquid ETH staking.

- stETH allows users to stake Ethereum while maintaining liquidity.

- stETH is integrated with popular platforms like Metamask, OKX, Safe, and CowSwap.

- stETH can be used across multiple chains, offering lower fees.

- stETH can be utilized as collateral in DeFi, though with associatedthird-party risks.