About

Accelerate cash flow and simplify finance with instant money transfers for fintech innovators

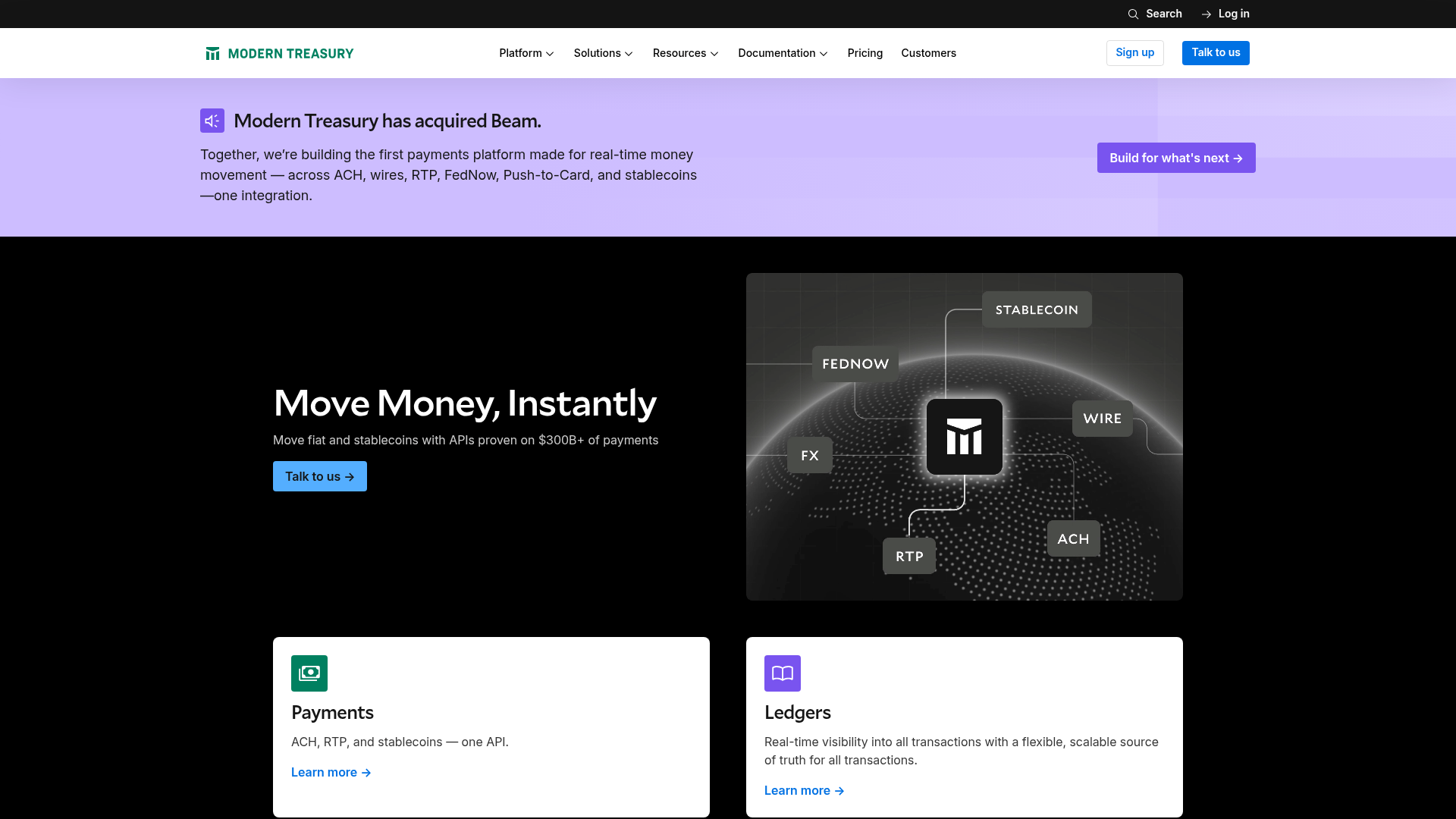

Modern Treasury is an API-first payments operations platform that automates money movement, reconciliation, and ledgering. It offers a unified Payments API for ACH, wires, RTP, FedNow and stablecoins, plus real-time Ledgers and pre-built bank integrations. Trusted on $300B+ of payments, it speeds launches and reduces engineering overhead for fintechs, marketplaces, lenders, and banks.

Use Cases

Fintech Payment Automation

Automate various payment types like ACH, wires, and stablecoins to simplify and speed fintech money movement.

Marketplace Funds Management

Manage marketplace payouts and reconcile transactions real-time via a unifiedpayments API.

Lender Disbursement Processing

Automate loan disbursements and track funds with pre-built bank integrations andledger automation.

Bank Ledger Reconciliation

Enable banks to automate ledgering and reconciliation with real-time transactionand balance visibility.

Key Features

Stablecoin & Crypto Payment Rails

- Move fiat and stablecoins with APIs proven on $300B+ of payments.

- Single API supporting ACH, RTP, and stablecoins, simplifying multi-railpayment integration.

- Automate payments across multiple banks and rails, including ACH, wire,FedNow, RTP, and stablecoins.

- Pre-built bank integrations and multi-rail support that accelerate integrationof stablecoin and fiat flows.

- Designed for scale and production use, enabling high-volume stablecoin and mixed-fiat/crypto payments.

Ledger, APIs & Treasury Automation for Web3/Crypto

- Track every payment from send to settle with a single, scalable database —providing ledger visibility across flows.

- API-first platform delivering payments APIs plus real-time transaction andbalance tracking.

- Save developer time and accelerate launches by offloading integration andpayments infrastructure work.

- End-to-end treasury automation capabilities: payment orchestration,reconciliation, and ledgering suited for web3 businesses.

- Real-time transaction/balance tracking combined with ledgering supportsreconciliation, compliance, and operational control.