About

Empower decision-making with transparent, on-chain markets for real-world event predictions.

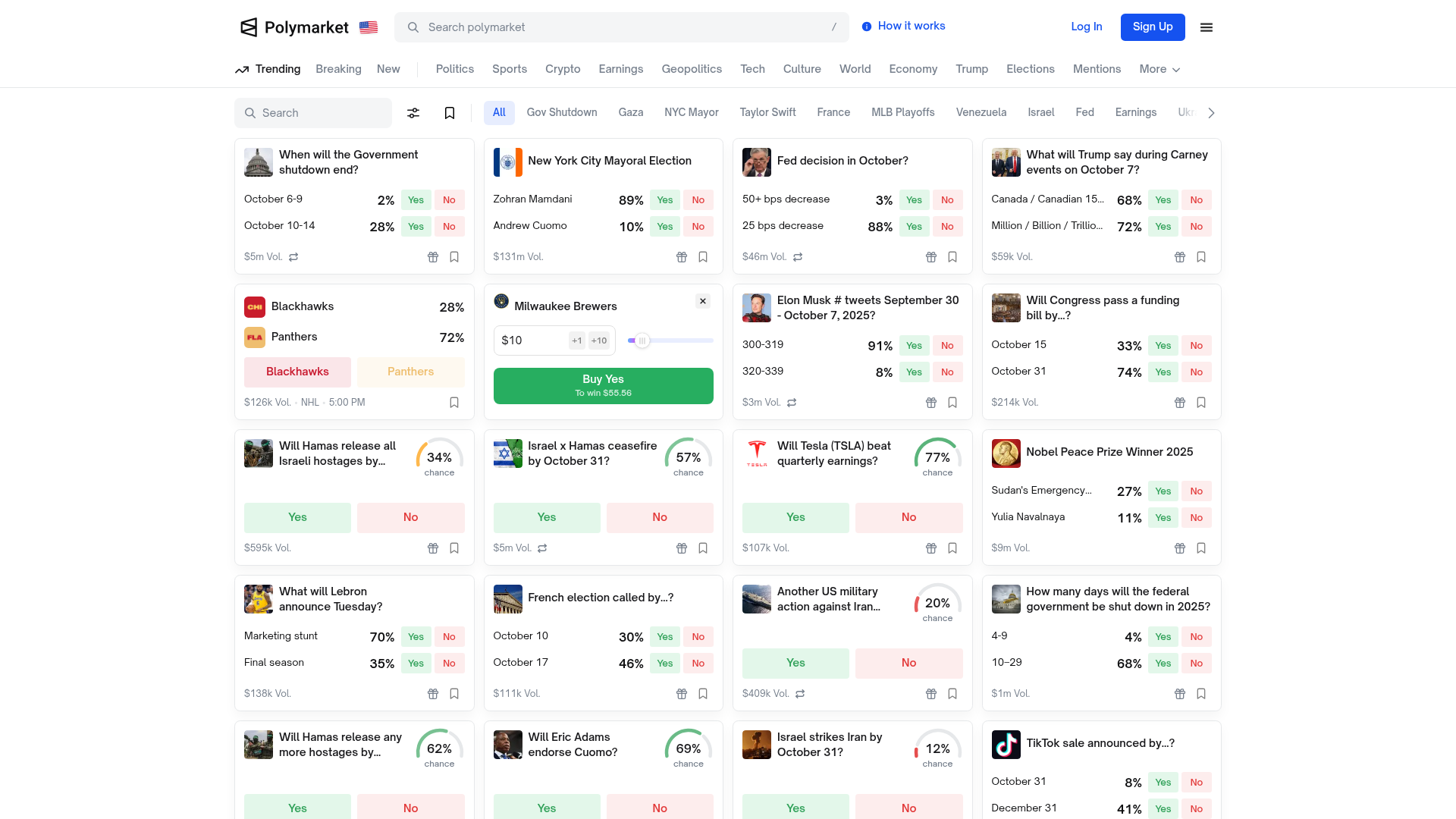

Polymarket is a blockchain-based prediction market where users trade USDC-denominated YES/NO shares on real-world events (politics, sports, tech). Launched in 2020, it aggregates crowd probabilities via on-chain markets, order-book trading, liquidity provision, market creation, oracle-verified resolutions, and multi-chain deposits; it has faced regulatory scrutiny and U.S. access limits.

Use Cases

Event Outcome Prediction

Users trade shares to speculate on real-world event outcomes like elections,sports, and tech developments.

Market Creation for Insights

Users create new markets on trending topics to gather crowd-sourcedprobabilities and insights.

Liquidity Provision for Rewards

Liquidity providers supply funds to markets and earn rewards based on tradingactivity and fees.

Data-Driven Decision Making

Users leverage market probabilities aggregated on-chain for informed decisionmaking and risk assessment.

Key Features

Platform & Market Mechanics

- Prediction-market exchange model: binary and multi-outcome event markets whereusers buy positions that pay $1 if correct.

- Market liquidity & volume: per-event liquidity and aggregate volumes visibleon the site, showing large multi‑million dollar activity.

- UX & market discovery: homepage categories (Crypto, Politics, Sports, LiveCrypto) and sorting by trending, volume, liquidity, ending soon.

- Outcome pricing = market probabilities: UI displays percent odds/price thatreflect implied probability for outcomes.

- Settlement & events: markets resolve on observable outcomes/dates; resolutionmodel drives smart‑contract settlement mechanics.

Crypto & Stablecoin Integration

- Crypto-focused markets: dedicated Crypto category and many markets tied toBTC/ETH and crypto price events.

- On-chain settlement hints: event pages and outcome contract cues indicate useof smart contracts for resolution/payouts.

- Payment rails & stablecoin use: USD‑denominated volumes and historical siteuse of stablecoins (e.g., USDC/USDT) for deposits/withdrawals.

- Custody & KYC signals: region selector and legal/regulatory notices implyjurisdictional access controls and potential KYC for US users.

- Liquidity & crypto market impact: sustained large volumes suggestparticipation by crypto-native liquidity providers with material market impact.