About

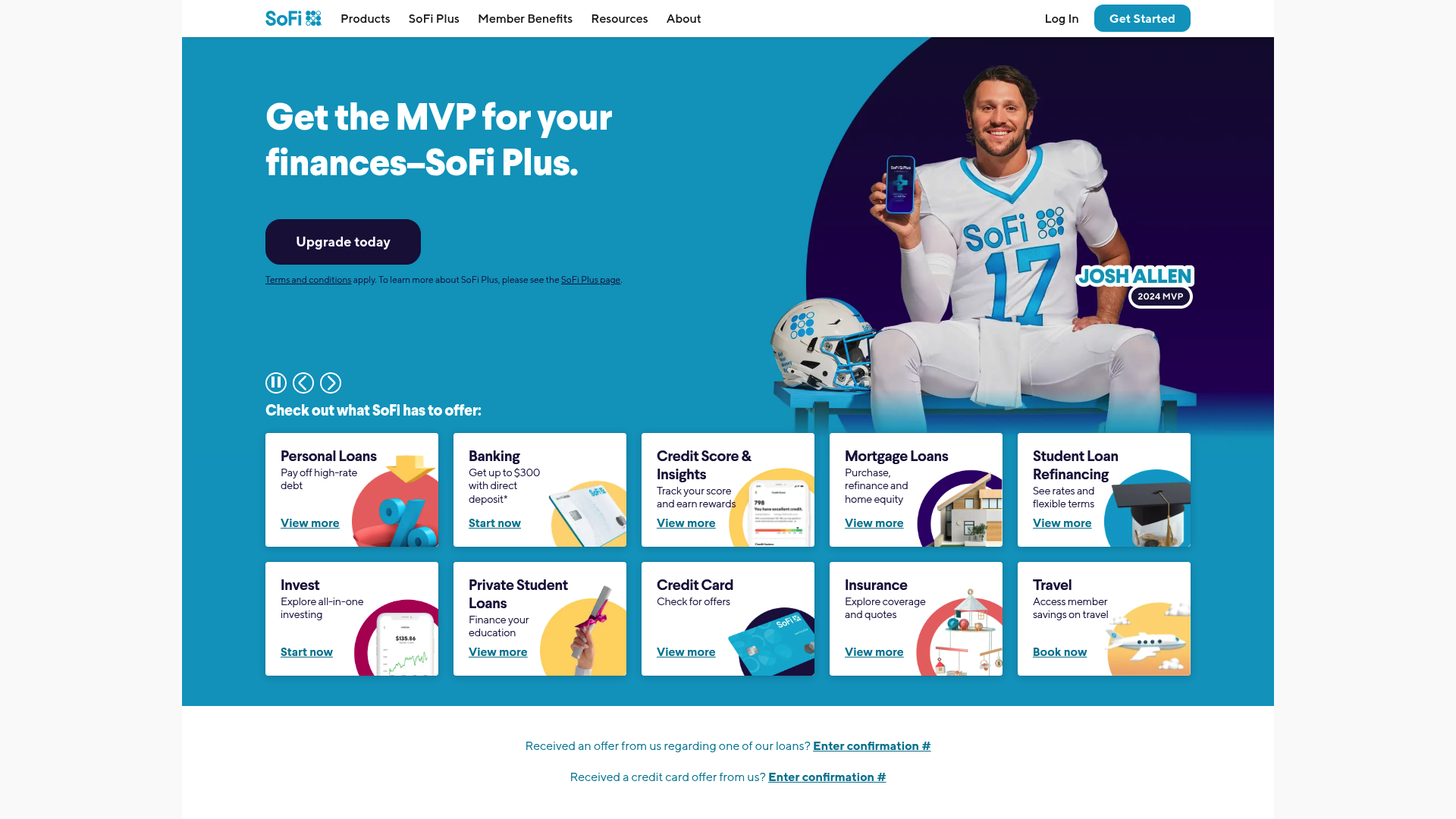

Empowering Your Financial Journey with Tailored Solutions

SoFi is a digital financial-services platform offering banking (checking & savings), lending (student‑loan refinancing, personal, mortgage, auto), investing (self‑directed trading, robo‑advisor, IRAs), credit cards, and insurance. Its app‑first service combines credit monitoring, financial planning and account aggregation with member perks (SoFi Plus, rewards, stadium benefits) to help members pursue financial independence.

Use Cases

Student Loan Refinancing Help

Young professionals use SoFi to refinance student loans, lowering monthlypayments and interest rates.

Personal Financial Growth

Users leverage SoFi's investing options and robo-advisor to build a diversifiedportfolio and save for retirement.

Comprehensive Banking Solution

Individuals use SoFi's checking and savings accounts with perks for everydaybanking needs and rewards.

Insurance and Protection

Families buy renters, auto, and life insurance through SoFi to safeguard assets with easy online management.

Key Features

Product & Platform Crypto Capabilities

- SoFi announced a return to crypto investing (buy/sell/hold Bitcoin, Ethereum)planned to launch later in 2025.

- Today SoFi routes crypto trading through external partners (e.g.,Blockchain.com, BitGo) rather than native execution or custody.

- SoFi is building self-serve international money transfers that useblockchain-enabled rails (crypto-enabled remittances).

- Roadmap items include SoFi-issued stablecoins, borrow-against-crypto products,and staking features as future offerings.

- Galileo is positioned to provide blockchain/digital-asset infrastructure andservices to fintechs and partners.

Regulation, Custody & Market Positioning

- SoFi owns a nationally chartered bank (SoFi Bank, N.A.) and cites OCCinterpretive guidance permitting certain bank crypto custody/reserve activities.

- Legal disclosures reference state licensure for SoFi Digital Assets, LLC,indicating licensing steps for digital-asset services.

- Current custody/execution for SoFi crypto flows through partners (e.g.,BitGo); SoFi discloses referral/partner compensation.

- SoFi highlights regulatory and consumer-risk warnings for crypto (volatility,differing regulatory regimes) in disclosures.

- Market posture frames SoFi as bridging traditional finance and crypto viaregulated banking, partnerships, and Galileo infrastructure rather than as a purely decentralized provider.

(CEO and co-founder of SoFi)

Mike Cagney

(SoFi co-founder)

Dan Macklin

Headquarters

🇺🇸 San Francisco, California

Website

sofi.com

2025

planned crypto investing launch year by SoFi

3.80% APY

savings rate with eligible crypto deposits