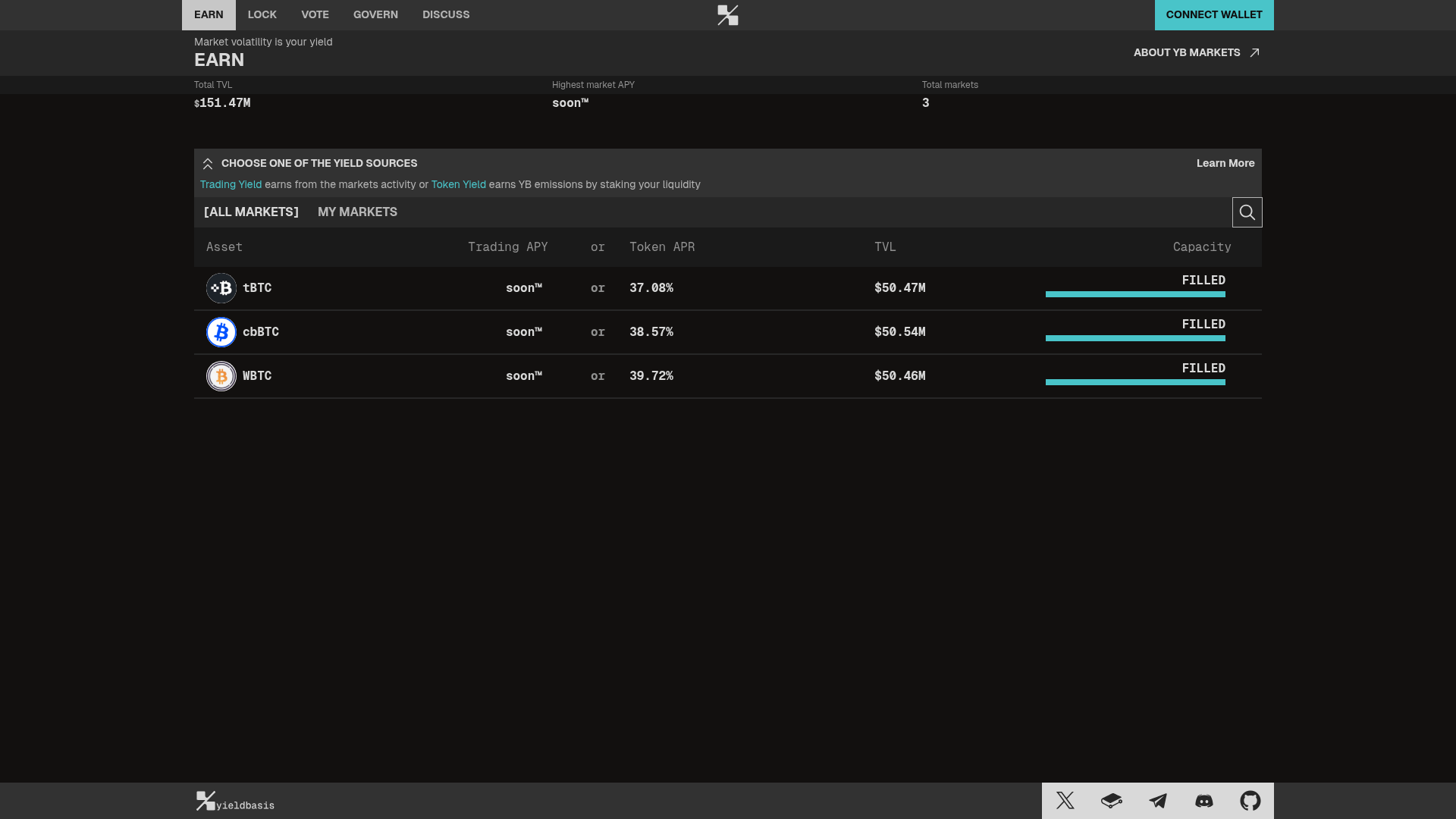

Yield Basis is a DeFi protocol (launched 2025 by Curve founder Michael Egorov) that delivers BTC/ETH-denominated yield to tokenized-asset holders while reducing impermanent loss. It employs constant-leverage liquidity provisioning and automated rebalancing, minting ybBTC as an LP token alongside YB/veYB governance. Trading-fee distribution and dynamic admin fees aim to create sustainable, BTC‑paid real yield for LPs and institutional users.