Stabled Up by The Rollup

Curve founder Michael Egorov's deliberate 'slow start' amid 50x oversubscription highlights a growing market preference for risk management and sustainable design over rapid, hype-driven growth.

October 15, 2025

Companies mentioned:

Curve Founder's Launch Strategy for Real Yield Product: Small, Safe, and Sustainable

Stabled Up - Ep. 3

The decentralized finance (DeFi) landscape is currently defined by a massive and growing pool of stablecoin capital searching for a home. As one market observer noted, "We are seeing the influx of stablecoins coming into the market." This is more than a casual observation; it's a quantifiable macro trend. In 2025, the total stablecoin market capitalization surpassed $300 billion, marking a 46.8% year-to-date expansion after adding $40 billion in the third quarter alone.

This capital flood, led by giants like Tether (USDT) at over $176 billion and USD Coin (USDC) at over $74 billion, represents a market-wide search for credible, sustainable yield. After previous cycles washed out overly speculative and risky yield farms, today's liquidity providers (LPs) and fund managers are demonstrating a clear preference for returns generated from trusted, non-speculative, and protocol-native sources. This environment of discerning capital set the stage for the intense demand seen by Yield Basis, a new project from a well-regarded founder.

Loading...

At the center of this dynamic is Michael Egorov, the founder of Curve Finance. With a background as a physicist and experience scaling infrastructure at LinkedIn and co-founding NuCypher, Egorov has established a reputation as a "DeFi pioneer" who has weathered multiple market cycles since launching Curve in January 2020. His track record is validated by Curve's resilient performance, including processing a record $34.6 billion in trading volume in the first quarter of 2025 and maintaining a Total Value Locked (TVL) of over $2 billion.

This history positions Egorov as a figure who understands the difference between fleeting hype and foundational value. In a market often driven by "degen" culture, his established "builder" reputation means that when he acts, sophisticated market participants pay close attention. His perspective is one of experience, making his strategic decisions a key indicator of market evolution.

The launch of Yield Basis provided a clear data point on the market's sentiment. The event was met with what Egorov himself described as "quite insane" demand, resulting in a 50x oversubscription. While such a figure is a powerful headline, its true meaning lies in what it signals about the market.

This level of interest represents far more than a simple chase for yield. It signifies a powerful vote of confidence in a trusted founder and a flight to perceived quality in a crowded and often risky market. While a 50x oversubscription is significant, it exists within a market where extreme demand is becoming more common; for instance, the recent launch of prediction market Limitless saw a 200x oversubscription.

The key insight comes from viewing the 50x figure not as a simple metric of success, but as a measure of the challenge Egorov aimed to manage: absorbing overwhelming demand in a safe, controlled manner.

The most significant signal from the Yield Basis launch is found in the deliberate decision to cap its initial phase. This counterintuitive move to throttle the launch in the face of massive demand represents a masterclass in long-term, risk-managed strategy. Egorov expressed this philosophy directly, stating, "I'm very glad that we started small."

His reasoning is grounded in operational reality. He noted that it was "a little bit more stressful to uh to actually get the first uh deposits going," revealing that "there were all sorts of things which... didn't go exactly as I thought." This candor highlights the practical wisdom of a controlled rollout. A small, capped launch allows a team to identify and resolve inevitable deployment issues without exposing the protocol and its users to magnified risks at scale.

This "start small" approach is a direct lesson from DeFi history, which is littered with protocols that suffered catastrophic exploits after rapid, hype-fueled launches.

The viability of Egorov's "slow start" strategy is anchored in the fundamental mechanics of the Curve ecosystem. The value of Yield Basis is derived from the proven, fee-generating power of crvUSD, not from launch-day hype. As Egorov explained, the model works because "Other venues create pools with Curve USD to earn those fees."

This composability is the engine of the protocol. crvUSD functions as a collateralized-debt-position (CDP) stablecoin with a novel Lending-Liquidating AMM Algorithm (LLAMMA) that enables "soft liquidations," a less risky process for borrowers. The yield is generated from two primary sources:

These fees are then distributed to veCRV (vote-escrowed CRV) holders and liquidity providers. By building on this existing, battle-tested primitive, the Yield Basis launch was an extension of a resilient system, reinforcing the core themes of risk management and sustainable design.

Zooming out, the Yield Basis launch model offers a potential new blueprint for launching high-quality DeFi products in a market saturated with stablecoin liquidity. As projects compete to attract this capital, the "start small" strategy presents a compelling alternative to the high-risk, high-reward launches of the past.

While a controlled launch might appear to cede early market share, it builds a more defensible long-term position. By prioritizing security, stability, and community trust, this model can create a "stickier" user base and a more resilient protocol. The positive reception to this approach suggests that other founders and funds may increasingly adopt a similar model, signaling a broader maturation of the DeFi market away from pure TVL metrics toward strategies that favor longevity.

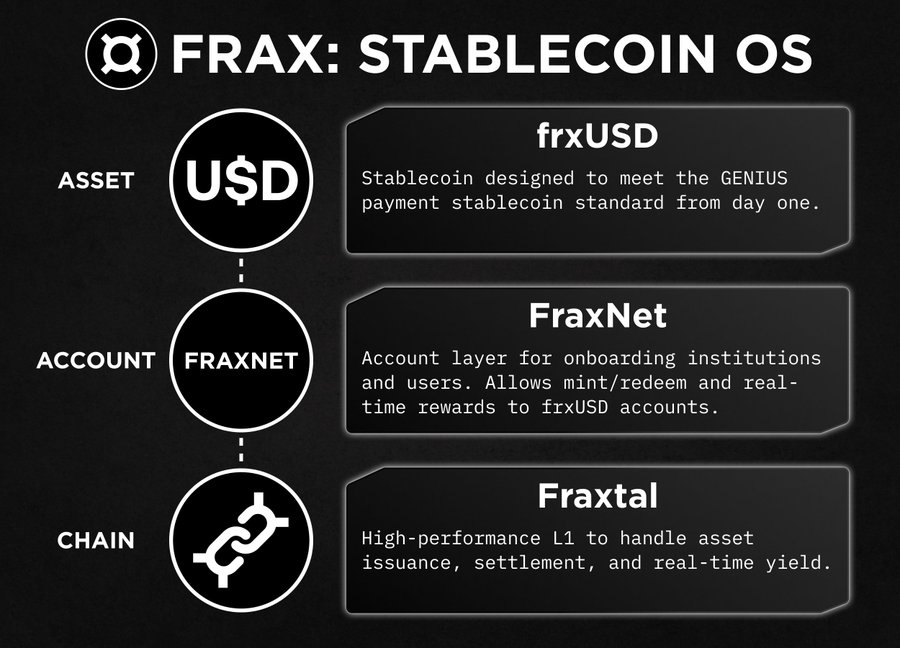

Egorov's strategy is not happening in a vacuum. It is a calculated move within the highly competitive "stablecoin wars," with major players like Frax Finance preparing to launch its own chain, Fraxtal. This context makes the choice for stability over speed even more significant.

The competition is increasingly a battle of design philosophies. Frax has pursued a "one-stop shop" ecosystem built around its hybrid stablecoin, integrating a DEX (FraxSwap) and lending protocol (FraxLend). However, this approach comes with its own trade-offs, including navigating security risks, as seen in the GMX hack, and potential regulatory headwinds from frameworks like MiCA in Europe. Curve's ecosystem-centric, organically grown model, exemplified by the Yield Basis launch, presents a different philosophy—one that prioritizes building methodically on proven components.

The Yield Basis launch offers several clear, actionable takeaways for sophisticated market participants who can distinguish the signal from the noise.

In the end, the Yield Basis launch may be remembered not for the 50x demand it generated, but for the strategic wisdom of choosing to manage that demand in favor of building correctly from day one.

The Stabledash newsletter keeps you off the timeline and dialed into modern money.

Join leaders at Circle, Ripple, and Visa who trust us for their stablecoin insights.