DeFi

Reportedly accidental with no circulating impact, the event spotlights centralized stablecoin governance as DeFi venues impose safeguards and demand stricter mint controls.

October 15, 2025

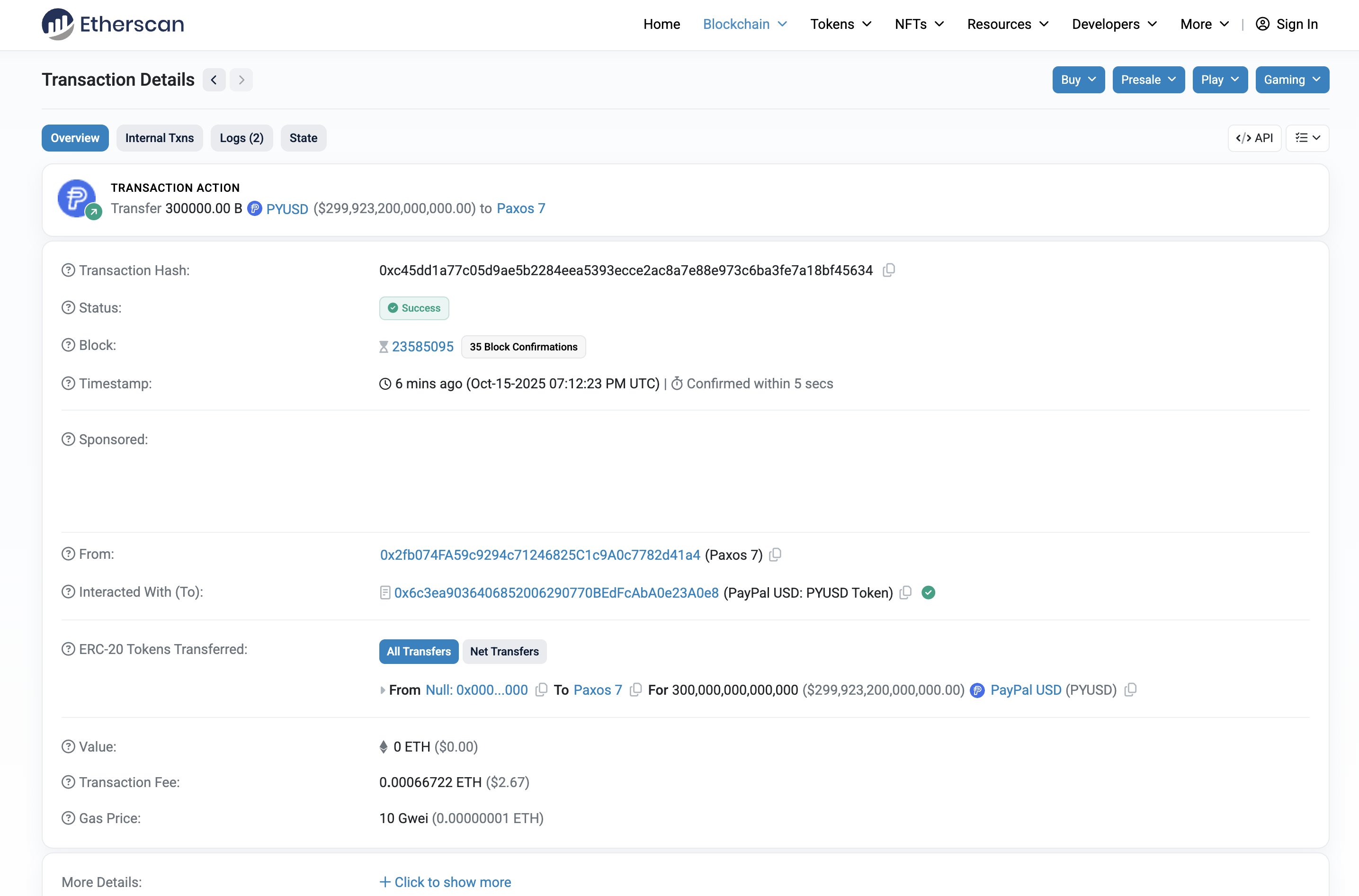

Paxos, the issuer of PayPal's USD-pegged stablecoin PYUSD, executed an unintended mint of approximately $300 trillion worth of tokens on the Ethereum blockchain, only to burn them roughly 20-23 minutes later.

This "fat-finger" error, as described by community observers, had no lasting impact on the circulating supply but exposed vulnerabilities in centralized minting controls. As a result, DeFi protocol Aave temporarily paused PYUSD markets to mitigate potential risks, underscoring the need for enhanced governance in stablecoins.

While the incident was resolved swiftly without affecting users or the token's peg (which remained stable at ~$1.00), it has sparked discussions on operational safeguards, regulatory oversight, and the broader stability of issuer-controlled assets in decentralized finance.

The mint occurred during what Paxos described as an "internal transfer," where excess tokens were accidentally created. Blockchain data shows the tokens were sent to a Paxos-controlled address before being burned, ensuring no circulation or market disruption. For context, $300 trillion dwarfs the global economy (estimated at ~$110 trillion GDP) and would have temporarily made PYUSD larger than all other stablecoins combined, surpassing even Tether's USDT (~$180 billion) and Circle's USDC (~$78 billion).

Paxos, a New York-regulated entity with monthly attestations from auditors, confirmed the mint was erroneous and posed no risk to reserves or users. The gas fees for the transactions were minimal—about $2.67 for the mint and $2.40 for the burn—highlighting Ethereum's efficiency for such operations but also the ease of executing large-scale errors.

Community reactions on X ranged from alarm to humor: some speculated it was a hack or publicity stunt, while others joked about "peak crypto business models" involving imaginary yields. One user noted it as a forensics lesson, suggesting Paxos may have first accidentally burned $300 million (intended transfer) and then over-minted to correct it.

This incident amplifies concerns over centralized governance in stablecoins, where mint/burn privileges are often held by a single key or entity. Unlike decentralized alternatives (e.g., DAI from MakerDAO), PYUSD relies on Paxos' operational integrity, raising questions about "circuit breakers"—automated limits on mint sizes, time-locks, or multi-signature requirements to prevent fat-finger errors or exploits.

For DeFi platforms like Aave, the pause demonstrates proactive risk management but also highlights integration challenges with centralized assets.

In a positive light, the blockchain's transparency allowed for immediate detection and correction, a feature absent in traditional banking where similar errors might go unnoticed. As stablecoins bridge TradFi and DeFi, incidents like this push for hybrid models combining regulation with on-chain safeguards.

The Stabledash newsletter keeps you off the timeline and dialed into modern money.

Join leaders at Circle, Ripple, and Visa who trust us for their stablecoin insights.