Insights

With a 15-year roadmap targeting a valuation of up to 1 trillion dollar, the former Circle executive is applying a classic infrastructure-first playbook to the fast-moving crypto market, betting that generational value is built over decades, not market cycles.

October 27, 2025

A deep dive into where KAST is today, and where they are going.

In a digital asset landscape often characterized by rapid cycles of boom and bust, KAST founder and CEO Raagulan Pathy is introducing a strategic vision with an uncommonly long time horizon. His objective is to build a "global bank on stablecoin rails," a project he believes will take over a decade to fully realize.

This patient, infrastructure-first approach signals a significant departure from the short-term speculative culture prevalent in the crypto space. It's aimed at attracting a class of builders and investors focused on creating fundamental, long-term value.

This specific, long-dated target immediately frames the company's ambition as a generational endeavor. He's direct about the contrast with prevailing industry thinking:

"Farm the next thing, which is very, very short term. I'm thinking very, very long-term about this."

The central thesis underpinning KAST's strategy is that sustainable financial systems are built over decades. By reintroducing this classic fintech playbook, backed by deep operational experience in the stablecoin sector, Pathy is positioning KAST as a foundational infrastructure project designed to reshape global banking for the next generation.

KAST's long-term vision isn't just aspirational. It's backed by extraordinary execution velocity.

In just 15 months since launch on Solana, the company has scaled to over 500,000 users worldwide while maintaining bank-grade security for stablecoin holdings.

The company is already profitable, with recent figures approaching $20 million in annual recurring revenue and forecasts to hit $100 million ARR within the next six months.

More remarkably, KAST has released 580 app versions in 484 days of operation, averaging a new version every 21 hours.

This shipping velocity is enabled by aggressive team growth: from a current headcount of around 170, KAST plans to add over 300 new roles by the end of 2026.

This includes more than 100 engineering positions to drive product development, alongside critical leadership hires such as Chief Marketing Officer, Chief Regulatory Officer, Global Head of Crypto Mortgages & Private Lending, Global Director of KAST Token, and community leads/country managers for 30+ regions.

The expansion will support new hubs in cities like New York, London, Dubai, Singapore, and beyond, emphasizing a "winning is everything" culture focused on building the world's biggest crypto neobank.

For a market saturated with vaporware and abandoned roadmaps, these execution metrics establish credibility.

KAST isn't asking investors and users to believe in a vision without proof. They're demonstrating the operational capacity to build at the scale their ambition requires.

Pathy's ambitious vision is grounded in deep domain expertise.His credibility stems directly from his previous role, where he set up and ran Circle's Asia business.

This experience places him at the center of the development and expansion of USDC, the world's second-largest stablecoin. Circle's USDC commands approximately 24 to 28 percent of the stablecoin market and facilitates trillions of dollars in annual on-chain transactions.

Loading...

Pathy's work in Asia involved navigating complex regulatory landscapes and scaling the network in key financial hubs like Singapore and Japan. Circle has identified Asia as the fastest-growing stablecoin market, and Pathy was on the front lines of that expansion.

This background provides a distinct strategic advantage. There is a fundamental difference between building an application on top of a protocol and having been part of the team that built the protocol itself.

Pathy's direct involvement with USDC's underlying mechanics provides him with an unparalleled understanding of how to construct a robust, consumer-facing bank on top of stablecoin rails. His philosophy is defined by a commitment to building foundational systems that can withstand market cycles. This mindset has profound implications for company strategy.

A long-term philosophy naturally influences key operational decisions, from hiring talent committed to a multi-year mission to allocating capital with a focus on building robust foundations before superficial features.

His metrics for success are tied to fundamental disruption rather than fleeting market valuations.

While competitors focus on incrementally improving individual products, KAST is pursuing a fundamentally different strategy. The company is building a complete, vertically integrated technology stack designed to own every layer of onchain banking infrastructure.

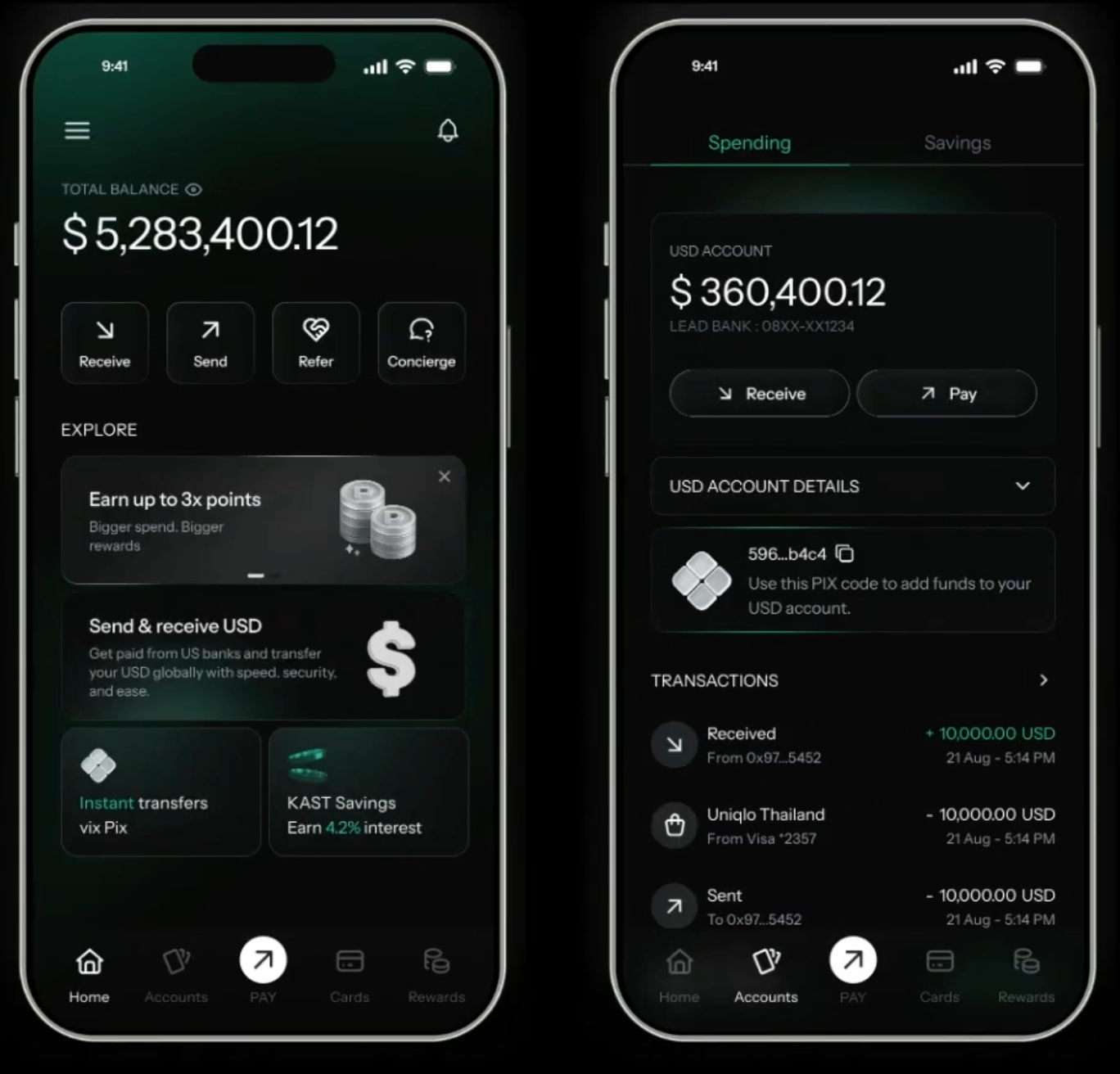

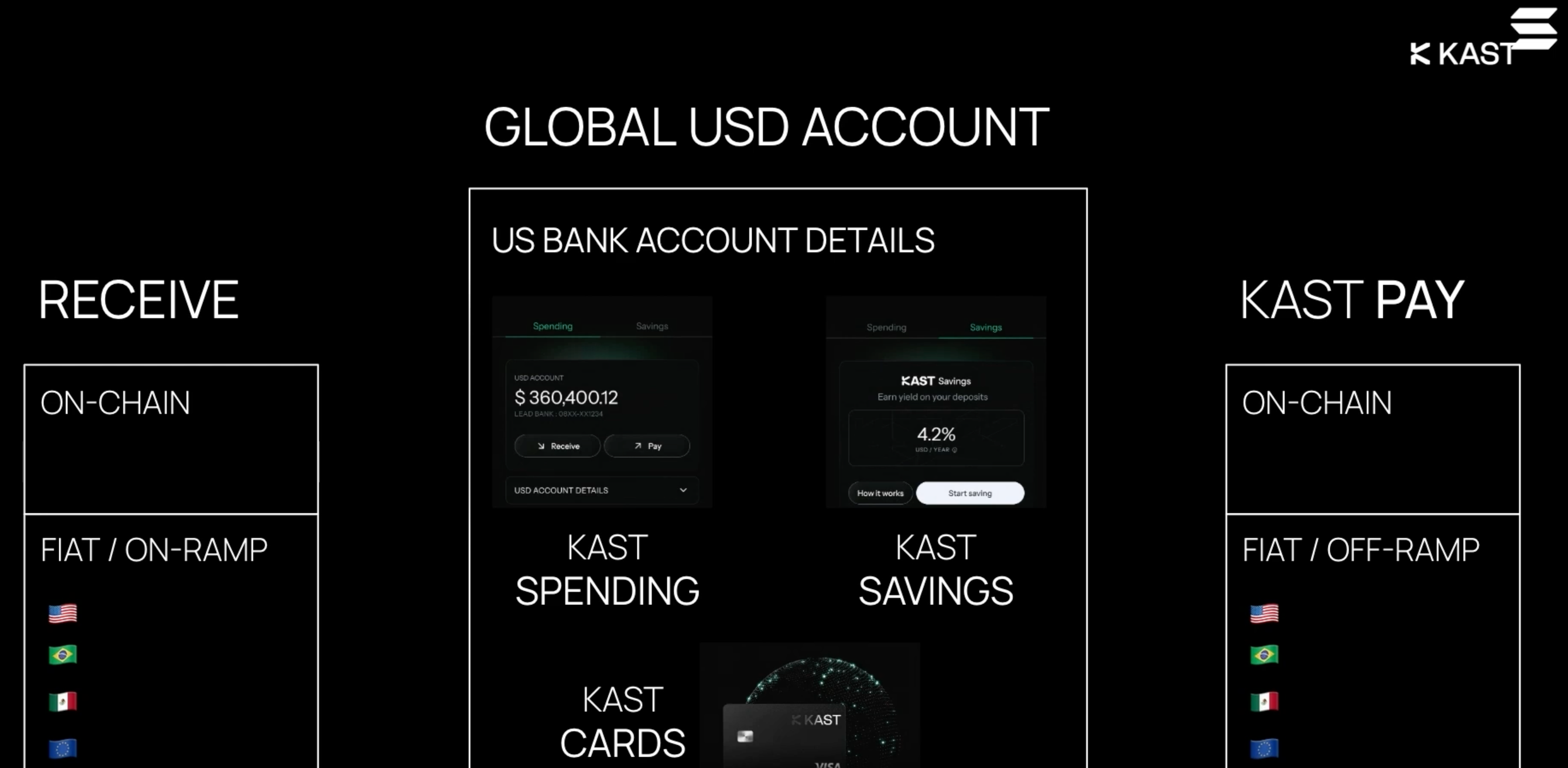

KAST's foundation is a global USD account available in 160+ countries, supporting deposits in cash, USDC, USDT, and other cryptocurrencies. Cards work at 150 million+ merchants and ATMs worldwide. But the differentiation lies in how KAST has structured its tiered offerings to align incentives across user segments.

KAST's crypto cards rewards system offers cashback on all card spend in 2025, along with points boosts on staked SOL (staking SOL earns rewards by securing the Solana network), varying by tier:

The platform functions as what Pathy calls a "full-stack replacement" for traditional banks, enabling seamless SWIFT transfers, crypto wallet sends, QR payments, and direct deposits in either fiat or crypto. This comprehensive feature set is what allows users in regions like Southeast Asia to fully "debank" themselves, relying entirely on KAST for financial services.

KAST's payment infrastructure bridges onchain stablecoin rails and traditional fiat systems, enabling users to receive and send funds seamlessly across borders—ideal for crypto-native businesses from zero to 50 employees. Pathy pitches a simple workflow: start an LLC, set up a KAST account, and encourage partners to do the same for frictionless operations.

Users can access payments onchain or through fiat on-ramps in markets like the US, Brazil, Mexico, the EU, and dozens more.

This creates bidirectional flow between crypto and traditional banking.By December 2025, KAST plans to enable USD transfers via SWIFT anywhere globally, with payments in and out to 80+ countries. Users will be able to send money by phone or email, borrow or stake against crypto holdings, and even access mortgages backed by digital assets.

By Q1 2026, the company aims to provide fiat on and off-ramps via stablecoins to 170 countries with over 600 payment routes.

This targets the massive market of crypto-native businesses that struggle to access traditional banking services, positioning KAST as a go-to for small to medium enterprises in the space—though navigating regulatory hurdles in diverse jurisdictions remains a key challenge.

The centerpiece of KAST's long-term roadmap is its proprietary stablecoin ecosystem, built on M0 infrastructure on Solana for high-speed, low-cost scalability. This enables KAST to issue its own stablecoins, transitioning from distributing third-party assets to creating a unified, programmable foundation for its banking stack.

USDK serves as the payment-optimized stablecoin. It functions as a "bucket" that aggregates multiple stablecoins (such as USDC, USDT, and others) across different chains. As Pathy explains, "The stack looks like the two stablecoins... USDK is a payment style stablecoin." Users can deposit any supported stablecoin, receive USDK equivalents, and withdraw in their preferred asset without bridging or manual swaps.

This addresses multi-chain fragmentation in crypto payments, with target swap fees of just 0.1% and a "true up mechanism" to eliminate fees on same-coin deposits and withdrawals. As tokenized deposits on-chain, USDK ensures transparency and composability. It allows DeFi users to integrate it seamlessly into protocols while maintaining full auditability.

USDKY acts as the yield-bearing "savings account" counterpart. Backed by Treasury rates (currently around 4%), users can effortlessly move funds between USDK (for everyday checking and payments) and USDKY (for interest accrual).

This replicates traditional banking products without intermediaries or associated costs. Conceptually, deposits land as USDK in a checking-style account, and users can transfer portions to USDKY for savings, where they earn treasury-backed yields.

As Pathy shared in a recent Stableminded podcast interview (watch here), the vision is to deliver "the ultimate stablecoin wallet" where "a dollar is a dollar" (a self-custodial experience free from gas fees, bridging, or complexity).

It solves UX and cost frictions like 0.5-1% swap fees on exchanges. This integrates USDK/USDKY into a broader ecosystem including a wallet, protocol, swapper, and paymaster.

Future expansions include borrowing against assets like BTC/ETH/SOL, onchain trading, simplified DeFi access, Apple Pay integration, AI agent permissions, and potentially KAST's own chain.

The focus remains on a specialized "banking wallet" built on stablecoins. It emphasizes real-world utility over general crypto features, with "application centric stablecoins for a whole bunch of reasons" to meet user needs beyond what existing stablecoins provide.

Building on M0 provides key benefits. Its completely programmable and automated DeFi-style infrastructure solves cross-chain liquidity management while preserving a simplified user experience. This allows for customizable rules on access, risk, yield distribution, and onchain upgrades. It fosters interoperability through a shared liquidity layer ($M token) and 24/7 minting.

Strategically, this unlocks programmable money capabilities. It enables automated innovations like dynamic yield routing or ecosystem-specific features.

It also captures unit economics across the value chain, from issuance and liquidity provision to payment processing and card fees. This empowers KAST to retain more value within its platform and drive long-term scalability.

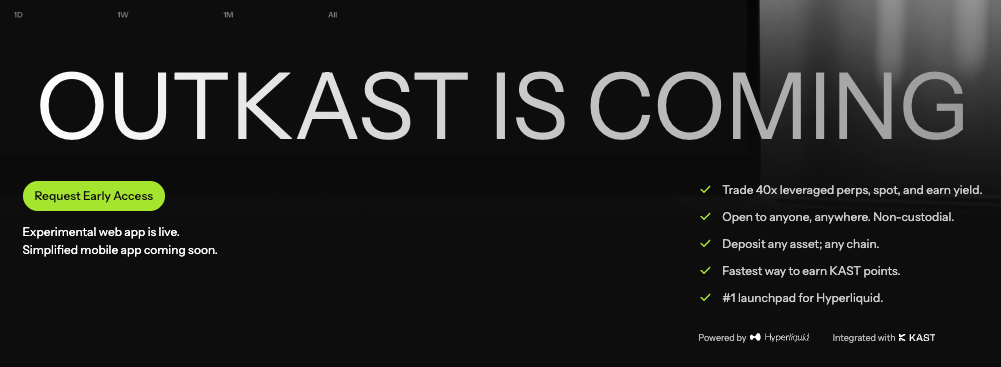

KAST is expanding into DeFi trading with OutKAST, a separate non-custodial platform built on Hyperliquid.

Launched in beta as a distinct app from KAST's custodial stablecoin-focused main app, it targets users seeking leveraged and spot trading, as well as yield without compromising asset control.

OutKAST supports up to 40x leveraged perpetuals, spot markets, and yield earning on held assets. It accepts deposits from any asset or chain, with global accessibility and fewer restrictions than some core KAST features. Integration with KAST includes earning points on trades (perps, spot, referrals), with boosts for card holders: 2x for Premium/X tier, 3x for Luxe.

A referral program offers up to 50% of fees in cash and 20% in points.The experimental web app is live, with a simplified mobile version coming soon. This complements KAST's broader shift toward self-custody, with Pathy noting that while the main stablecoin app started custodial for better UX, tech advancements are enabling a future move to non-custodial options for the core app as well.

By the end of 2025, KAST aims to expand coverage to 170 countries. For Q1 2026, the company plans to launch lending products, which increase capital efficiency by allowing users to borrow against their stablecoin holdings.

Also planned for 2026 is a token launch that will align incentives across the ecosystem, along with the official rollout of non-custodial infrastructure. Points from cards, OutKAST trades, and referrals will fuel one of 2026's largest airdrops, rewarding early users and driving adoption.

These near-term milestones build the infrastructure for the next phase: network density from expansions, capital efficiency from lending, and aligned incentives from the token.

By 2026, KAST aims to have the most comprehensive stablecoin banking infrastructure globally.

Underpinning all of KAST's product development is Pathy's thesis about network effects in stablecoin adoption.

He's not building for today's reality where stablecoins represent just 1 percent of U.S. M2 money supply. He's building for 2030 and beyond, when stablecoins could represent 7 to 10 percent of circulating dollars.

Loading...

"Imagine a world in 2030 where it's like 7 percent or 8 percent of M2 money supply. Stablecoins are like $1.5 trillion, maybe approaching $2 trillion," Pathy explains. "It increases the chance that the person you send it to will have stablecoins already and they have no reason to take the money off and into cash."

Today, if you send someone stablecoins, there's a 99 percent chance they don't have a stablecoin wallet and will immediately convert to fiat. This limits stablecoin utility to crypto-native use cases. But when 7 to 10 percent of people have stablecoin wallets and 7 to 10 percent of dollars circulate as stablecoins, the math changes fundamentally.

At this threshold, stablecoin infrastructure isn't an alternative to traditional banking. It becomes the primary banking infrastructure for a significant portion of the population.

By 2040, Pathy projects 30 to 50 percent of people will have stablecoins, creating a self-reinforcing network where "most of you just stay in stablecoins." When half of all transactions happen in stablecoins, whoever owns the foundational infrastructure captures exponential value. This is why KAST isn't building features to compete with existing banks.

They're building the rails that will obsolete them.

This long-term thinking explains KAST's infrastructure-heavy approach. Building custom stablecoins, a dedicated blockchain layer, and both custodial and non-custodial solutions creates expensive technical debt in 2025. But if Pathy's 2030 to 2040 thesis proves correct, KAST will own critical infrastructure at the foundation of a multi-trillion-dollar ecosystem.

It's the same bet that Stripe made on internet payments in 2010 or that AWS made on cloud infrastructure in 2006. Building ahead of mainstream adoption to own the rails when the shift happens.

For the market today, KAST's long-term vision translates into a powerful, immediate value proposition. The core promise is the ability for users to "debank yourself" and rely entirely on a reliable, full-service alternative to traditional finance—particularly for those in crypto or economically unstable regions.The implications of this strategy are threefold.

While others pursue fleeting narratives, KAST is forging the rails for tomorrow's financial world.

Aligning with it means betting on sustainable, generational disruption: and the metrics already prove it's a winning hand.

The Stabledash newsletter keeps you off the timeline and dialed into modern money.

Join leaders at Circle, Ripple, and Visa who trust us for their stablecoin insights.