Stabled Up by The Rollup

The new stablecoin initiative seeks to internalize reserve yield, redirecting value back to protocol users and transforming Jupiter's economic model.

November 6, 2025

Companies mentioned:

jupUSD Explained: Jupiter's Native Stablecoin Launches on Solana in Q4 2025

On October 8, 2025, Jupiter Exchange (Solana's dominant DeFi protocol with $3.58 billion in total value locked) announced the launch of jupUSD, a native stablecoin built in partnership with Ethena Labs, targeting a Q4 2025 release pending completion of security audits.

The initiative represents a fundamental shift in how major DeFi protocols approach stablecoin economics: rather than relying on third-party issuers like Circle or Tether, Jupiter will capture the reserve yield that typically flows off-chain and redistribute it directly to protocol users.

This model challenges a longstanding inefficiency in decentralized finance. While stablecoins like USDC function as highly efficient, capital-agnostic assets that provide immense utility, they also create significant financial leakage. The yield generated from billions of dollars in reserves backing these stablecoins flows back to centralized issuers rather than enriching the host ecosystems where the value is created.

On Solana alone, the stablecoin supply has surged past $5 billion, generating hundreds of millions in annual yield for off-chain issuers. Jupiter's jupUSD initiative is designed to internalize this value, transforming the protocol from a transaction layer into a self-sustaining economic engine.

Loading...

A core contributor at Jupiter, known as Kash, articulated this strategic vision in a recent interview, noting the immense opportunity while acknowledging the success of established players.

"if we can internalize that ourselves and then potentially figure out ways to kind of distribute that yield to JLP holders, to jup stakers, to other users of the products, I think that's a really powerful value prop for us."

This statement encapsulates the central thesis of jupUSD. The initiative is engineered to create a direct economic flywheel where the stablecoin's growth perpetually enriches Jupiter's user base, fundamentally altering the value proposition of participating in the ecosystem.

To launch a successful stablecoin, a protocol needs more than a novel idea; it requires massive distribution and an engaged user base. Jupiter has established this foundation by becoming the undisputed cornerstone of DeFi on Solana. Since its inception, the platform has evolved from a simple swap interface into a comprehensive DeFi suite, cementing its role as the primary entry point for on-chain activity.

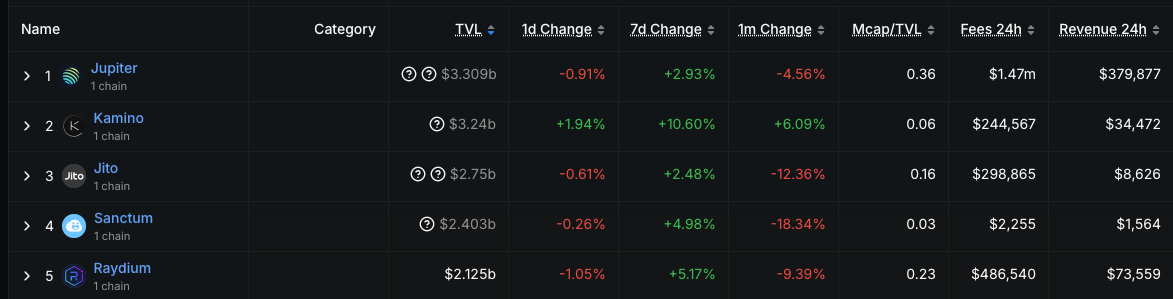

Solana Protocol Rankings from Defi Llama

The data underscores Jupiter's market dominance:

This scale translates directly into stablecoin influence. The velocity of stablecoin movement on Solana reveals an active, liquid market where Jupiter processes a substantial percentage of all activity.

Kash emphasized that Jupiter's approach is rooted in technical and economic merit over tribalism. As he explained, the team's philosophy is grounded in finding superior models, regardless of the underlying blockchain.

"We're technology maxis. Like we're we're Solana Maxis. We like to take a broadstroke view of the ecosystem."

This technology-first mindset is evident in the design of jupUSD. The project is framed not as a competitive move against other chains, but as an intellectually honest pursuit of a more efficient and equitable value accrual model.

This credibility, combined with Jupiter's proven track record of attracting users and facilitating enormous trading volumes, provides the critical infrastructure and community trust necessary to bootstrap a protocol-native stablecoin.

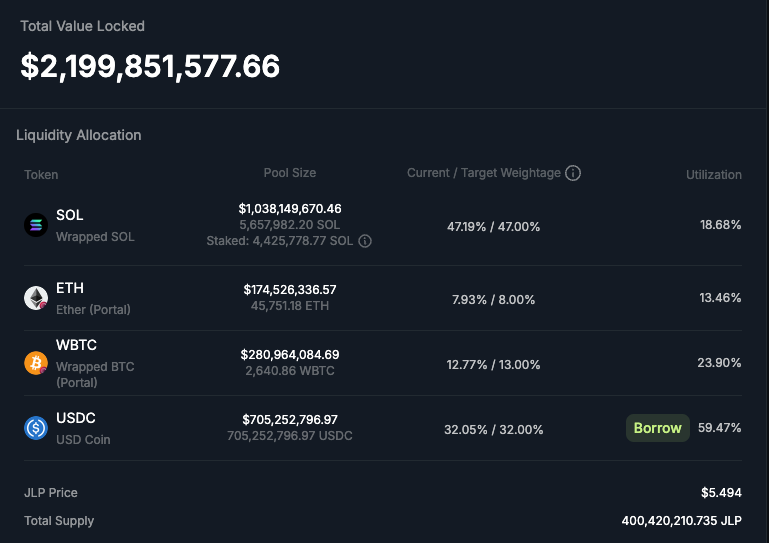

Unlike most stablecoin launches that start from zero, jupUSD will launch into an ecosystem where Jupiter already controls approximately $700 million in stablecoin liquidity across its JLP perpetuals pools. This positions jupUSD for an unprecedented "warm start" that fundamentally changes the launch dynamics.

To understand the significance of this embedded liquidity, it's essential to examine the broader competitive landscape. Solana's stablecoin market is currently dominated by a handful of established players, with USDC maintaining the largest share.

Kash explained the migration strategy in detail during a recent interview:

"JLP, which is the liquidity provider token for [perpetuals] is like $2.1 billion asset... If we replace USDC with jupUSD inside of JLP, it'll only further increase the yield."

The transition won't be instantaneous. Kash noted they're still working out exact percentages with the JLP community, but the path is clear.

This embedded $700 million in stablecoin liquidity represents approximately 15% of Solana's total stablecoin market, giving jupUSD immediate scale that typically takes competitors months or years to build. For reference, Jupiter Lend became the fastest protocol in Solana history to reach $1 billion in supply, achieving in just eight days what typically takes competitors months. This distribution capability, now applied to a stablecoin, suggests jupUSD could scale faster than typical launches.

The strategic advantage is twofold.

First, it provides immediate liquidity depth, making jupUSD usable from day one for large traders who require tight spreads.

Second, it creates an instant network effect where Jupiter's existing 8.4 million active wallets will encounter jupUSD as the native medium of exchange across the platform's products.

The jupUSD stablecoin is being launched in partnership with Ethena Labs, a firm specializing in stablecoin infrastructure. This collaboration represents a strategic decision to leverage specialization, allowing each party to focus on its core strengths.

Under this model, Jupiter will manage ecosystem integration, distribution, and the value accrual framework that directs yield to its users. Ethena, as Jupiter's white-label infrastructure partner, will provide the underlying technical foundation for the stablecoin itself. This approach of using Ethena's "Stablecoin-as-a-Service" offering enables Jupiter to accelerate its go-to-market timeline and build upon a proven, audited technology stack.

jupUSD will initially launch backed by USDtb, which is Ethena's asset-backed stablecoin collateralized by tokenized U.S. Treasury bills with institutional backing from firms like BlackRock. This provides a conservative, low-risk foundation. Over time, Jupiter plans to incorporate USDe, Ethena's synthetic dollar backed by a delta-neutral hedging strategy on crypto assets, for additional yield optimization. This phased approach gives Jupiter the flexibility to balance risk appetite with yield generation as the product matures.

The partnership also addresses a critical technical hurdle. jupUSD is being built as a Solana-native asset with custom mint-and-redeem contracts specifically optimized for the network's high-throughput architecture. These contracts are currently undergoing comprehensive security audits, with the Q4 2025 launch timeline contingent on their successful completion.

The jupUSD economic engine is designed around a three-step process that captures, internalizes, and distributes value. This fundamentally alters the traditional stablecoin revenue flow.

The yield backing jupUSD will originate from the assets held in its reserve, managed through Ethena's infrastructure. With the initial USDtb backing model, this yield comes from low-risk assets like U.S. Treasury bills, which currently offer rates around 3.8%. For comparison, Circle reported an average realized yield of 4.93% on its USDC reserves in 2024. As Jupiter integrates USDe's synthetic model, additional yield from staking rewards and perpetual futures funding rates will further enhance returns.

In a traditional stablecoin model, this reserve yield is captured by the issuer and retained as profit. The jupUSD model fundamentally alters this flow. Through its partnership with Ethena, the yield generated by jupUSD's reserves will be programmatically funneled back to the Jupiter protocol's treasury instead of being retained by the infrastructure provider. This represents a structural change in how value flows through the stablecoin ecosystem.

Once captured, this new revenue stream will be distributed to Jupiter's key stakeholders. The primary beneficiaries will be holders of the JLP token (the liquidity provider token for Jupiter's perpetuals exchange) and stakers of the JUP governance token. This creates a direct link between jupUSD's growth and the rewards earned by the protocol's most committed users.

Kash outlined how this stacks on top of existing JLP yields: "75% of all perpetuals trading fees go to JLP holders. In addition, we actually have a JLP loans product... and we native stake a bunch of the SOL that's in the JLP pool... If we replace USDC with jupUSD inside of JLP, it'll only further increase the yield."

To illustrate the potential impact, consider realistic growth scenarios for jupUSD:

jupUSD Scenarios

| jupUSD Market Cap | Annual Yield (4%) | Context |

|---|---|---|

| $200 million | $8 million | Conservative launch scenario |

| $500 million | $20 million | 10% of Solana stablecoin market |

| $1 billion | $40 million | 20% market penetration |

These scenarios demonstrate how even moderate adoption creates substantial new revenue streams that directly benefit protocol participants, fundamentally altering the value proposition of staking JUP or providing liquidity to JLP.

One of the most significant technical and strategic hurdles for the jupUSD initiative is maintaining its value accrual mechanism as the token becomes widely adopted across the Solana ecosystem. The core challenge was succinctly identified in Kash's interview discussing the project's design:

"The stable coins could ultimately make their way out of Jupiter and into the the rest of the Solana world, right? like what what would that look like and how can you continue to bring value accrual back to Jupiter even as this juptoken ends up becoming composable with the rest of the Solana DeFi ecosystem."

The team has outlined a multi-layered approach to address this challenge:

The effectiveness of these solutions will determine whether jupUSD can function as a truly native, composable asset for all of Solana. It will show if jupUSD can become a foundational money primitive for the entire ecosystem, or if its yield-bearing properties will be confined primarily within Jupiter's own suite of products.

Kash acknowledged this is still evolving: the team is actively working through the technical and incentive design challenges to maximize composability without sacrificing the core value accrual mechanism.

Launching a new stablecoin carries inherent risks, a reality that demands transparent assessment. A balanced evaluation of jupUSD reveals three key risk vectors that warrant careful consideration:

A clear commitment to reserve transparency, ongoing third-party audits, and a well-defined emergency response plan will be crucial for building and maintaining user trust in jupUSD. Jupiter's track record of operating transparent, high-stakes DeFi products provides some confidence, but the stablecoin space demands even higher standards of operational excellence and risk communication.

Jupiter will embed jupUSD across its product suite from day one. The stablecoin will serve as a native asset in Jupiter Swap, as collateral in Perpetuals (within JLP pools), as a cornerstone asset in Jupiter Lend, and throughout Jupiter Mobile. This comprehensive integration ensures users encounter jupUSD at every touchpoint, from simple swaps to sophisticated leveraged trading.

Kash outlined the approach: systematic migration of existing stablecoin liquidity combined with deep integration across products creates multiple adoption vectors simultaneously. Rather than relying on a single use case, jupUSD benefits from Jupiter's multi-product flywheel where activity in one area drives adoption in others.

The success of the jupUSD initiative should be measured not by its market cap alone, but by its effectiveness in fulfilling its core mission: creating a self-sustaining economic engine that captures and redistributes value to Jupiter's community. Sophisticated analysts and ecosystem participants should track several key performance indicators (KPIs) to evaluate its performance against this thesis.

These metrics, tracked over time, will reveal whether jupUSD achieves its ambitious goal of creating sustainable value for Jupiter's community or whether it remains primarily a strategic moat-building exercise with limited economic impact.

If successful, Jupiter's jupUSD initiative will represent more than just another stablecoin competing for market share. It will pioneer a new DeFi primitive: a protocol-issued, value-accruing stable asset that transforms an application from a simple transaction layer into a self-sustaining economy. The model creates a powerful economic flywheel where growth in the stablecoin's adoption directly translates into tangible, sustainable yield for the protocol's community.

As Solana's stablecoin market continues its rapid expansion to over $5 billion, Jupiter's experiment arrives at a critical inflection point. The protocol's embedded distribution advantages position jupUSD to scale faster than typical stablecoin launches.

Yet the broader implications extend beyond Jupiter's individual success. The initiative tests whether major DeFi protocols should issue their own yield-internalizing stablecoins rather than paying rent to centralized issuers. If this model proves viable, it could fundamentally alter the architecture of decentralized finance, transforming leading platforms from transaction facilitators into independent monetary systems.

Whether jupUSD succeeds will depend on execution across technical robustness, security, composability, and most critically, whether yield internalization generates sufficient value to justify the added complexity. The answer will emerge over the coming quarters as jupUSD launches and scales within the Solana ecosystem.

The Stabledash newsletter keeps you off the timeline and dialed into modern money.

Join leaders at Circle, Ripple, and Visa who trust us for their stablecoin insights.