Insights

This Stablecoin Card Lets DeFi Yield Pay for Your Lifestyle

Moto, a Solana-based startup, is building onchain private banking for the next generation of wealthholders who want yield, not debt.

January 28, 2026

Companies mentioned:

This Stablecoin Card Lets DeFi Yield Pay for Your Lifestyle

Most crypto "credit cards" are debit cards in disguise. Moto fronts transactions while your collateral earns yield.

~10% combined returns: DeFi yield can offset your spending entirely.

Targeting AmEx, not crypto natives. Launching with 50 exclusive users and luxury positioning

At Breakpoint 2025, Shimon Newman sat down for one of his first public interviews covering Moto to explain why he believes the crypto credit card market is fundamentally broken, and how his company Moto plans to fix it.

"All the crypto cards, at least onchain, that were calling themselves credit cards were functionally debit cards," Newman said. "And I thought that just made no sense."

The onchain options fall into two categories.

The first debits your wallet immediately at point of sale. Spend $100, and your balance drops by $100 instantly.

The second, popularized by projects like Etherfi, takes out a loan against your collateral every time you spend. Buy a $50 lunch, and you've just taken on $50 of debt with variable interest and liquidation risk if your collateral drops.

Neither model delivers what consumers actually want from a credit card.

A New Financial Primitive

Fresh off of a $1.8 Million pre-seed fundraise, Moto builds on top of Rain, the largest onchain card issuer, adding a crucial layer.

When users make a transaction, Moto fronts the payment.

A smart contract guarantees repayment at the end of every 30 days. During that period, the user's collateral continues earning yield rather than sitting idle or accruing debt.

The model mirrors charge cards popular in Europe and among the roughly 30 million Americans who use them to build credit. But Moto adds the onchain yield component: up to 5% cashback and up to 5% interest on deposits.

For users with sufficient balances, the yield can completely offset monthly spending.

Newman calls it a new financial primitive. The ability to fund your lifestyle entirely through DeFi yield.

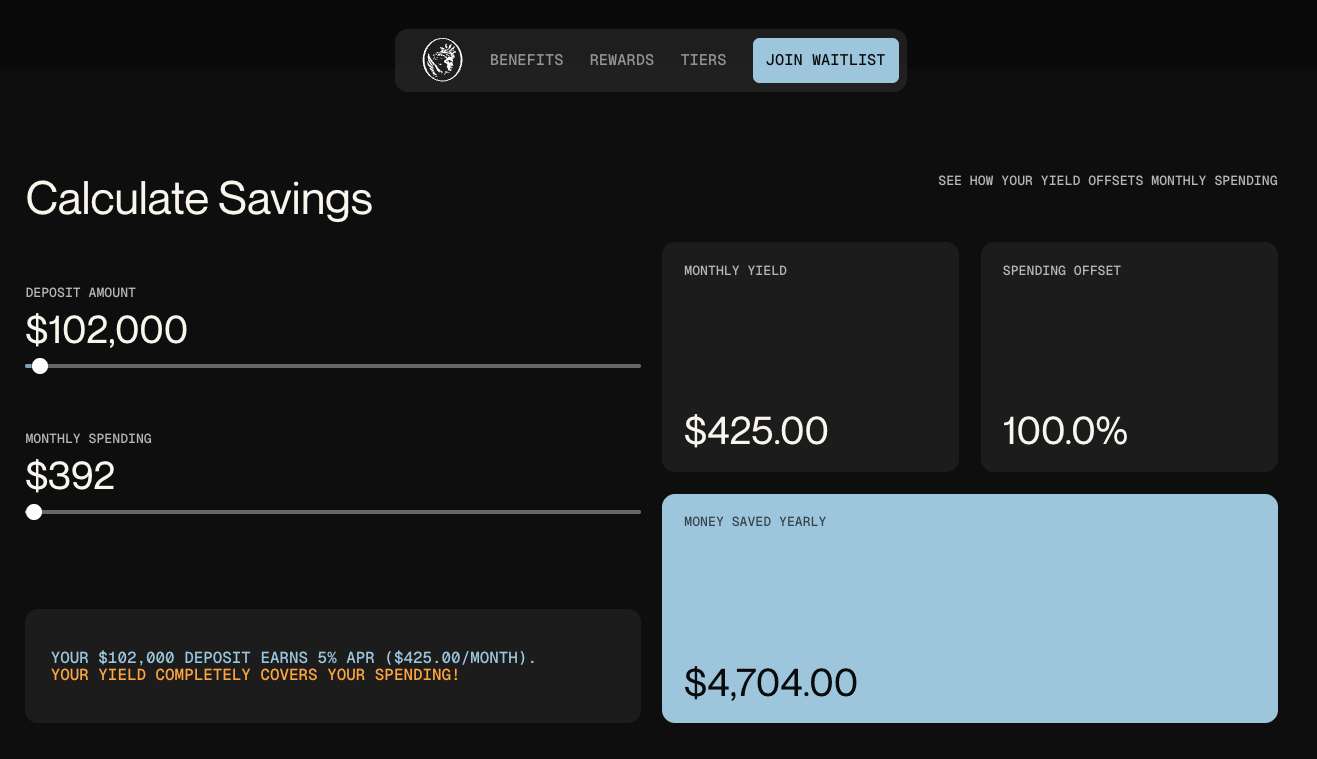

The math makes it real.

Deposit $102,000, and at current yields, you're earning roughly $392/month passively. If your monthly spending stays around that, your yield covers it entirely. You're not touching principal.

You're not going into debt. Your collateral is paying your bills.

Moto has a savings calculator on their website where you can plug in your own numbers and see how the math works for your situation.

Moto abstracts away the complexity. Users can onramp with Apple Pay and offramp to traditional bank accounts without ever needing to understand stablecoins.

They're going After Amex, Not Other Crypto Cards

Aligned Incentives

Moto generates revenue through AUM fees on deposits, which are automatically converted into delta-neutral yield-bearing stablecoins via Reflect, a Solana protocol with restaking-based insurance covering principal.

This structure means Moto only profits when users profit.

A deliberate contrast to competitors Newman describes as "quite predatory," padding thin interchange margins with FX fees and onramp charges.

The Soho Playbook

Moto is launching with radical exclusivity.

The initial rollout targets just 50 select users who can bring meaningful deposits. Newman believes the company can be highly successful with just a thousand users, provided they're the right ones.

The strategy borrows from Soho House: curation over vanity metrics, with plans to gradually broaden access over time.

"We can be a very successful business with just a thousand users," Newman said. "As long as they're the right users."

Join the Waitlist for Moto Cards: https://www.moto-card.com/

Don't Miss the Next Big Shift

The Stabledash newsletter keeps you off the timeline and dialed into modern money.

Join leaders at Circle, Ripple, and Visa who trust us for their stablecoin insights.