Insights

Tokenization turns savings from a bank-controlled liability into a personalized, programmable yield engine where interest flows to the depositor, not the institution.

January 6, 2026

The national average savings account pays 0.47%.

The 3-month Treasury bill yields around 3.6%. ( as of January 6th, 2026)

That is a $4.53 difference on every $100 deposited, flowing directly to the bank’s bottom line.

This gap represents structural extraction.

The real barrier to closing it involves access and personalization.

For decades, the financial system has relied on a one-size-fits-all model for savings, dictated by the limitations of legacy infrastructure. Banks capture the spread because they control the rails.

Tokenization changes the architecture of value transfer.

By moving assets onchain, we replace gatekeepers with programmable infrastructure, allowing yield to flow directly to the depositor.

Banks operate on a model that relies on the "nostro" account, literally "ours" in Latin.

When you deposit money, it ceases to be yours in a functional sense; it becomes a liability on the bank's balance sheet.

They take those deposits, maintained in their nostro accounts with clearing banks or the Federal Reserve, and lend them out or buy risk-free assets like T-bills at 3%+.

They pay the depositor 0.4%.

The difference, the Net Interest Margin (currently sitting around 3.31% industry-wide), funds their branches, legacy IT systems, and executive bonuses.

They pocket the yield that belongs to the depositor.

They lend out this money.

They capture the value.

Traditional fintechs like Wealthfront or Robinhood have improved the user interface, but they still operate on these same correspondent banking rails. They remain subject to the same structural costs and delays.

Consequently, the landscape remains fragmented.

A user currently requires ten different applications to access the yield sources that matter one for gold, one for T-bills, one for equities, and another for cash.

DeFi lending markets like Aave and Morpho have offered stablecoin yields of 3-8% throughout 2024.

These returns exist because the intermediary extraction layer the bank is removed from the equation.

"Savings" means something different to everyone.

The industry treats savings as a monolith, but in reality, it is a blended basket with weights that should vary based on the individual.

Consider the personalization gap between a 22-year-old crypto-native recent grad and a 55-year-old financial advisor. The former might look for aggressive growth through DeFi lending protocols.

The latter likely wants 90% allocation in T-bills and 10% in gold.

My own mother fits the latter profile. Her risk tolerance demands stability.

My personal allocation looks closer to 80% DeFi lending, 10% allocated to charitable causes, and 10% in alternative assets.

We even see this in emerging use cases, such as a teacher in Thailand using yield to fund school supplies. A mere $100 in interest per year makes a tangible difference in that context.

Current banking infrastructure forces a single definition of savings on all these users.

It fails to account for the fact that risk tolerance varies by age, geography, financial literacy, and personal values.

Larry Fink, CEO of BlackRock, argues that "tokenization democratizes yield."

This is not theoretical.

BlackRock’s BUIDL fund hit $500 million within months of its March 2024 launch the fastest-growing tokenized fund on Ethereum. The broader tokenized real-world asset (RWA) market has grown to nearly $9 billion, with U.S. Treasuries leading the category.

Tokenization serves as an infrastructure shift.

It allows distinct asset classes tokenized T-bills, gold, and index funds to coexist in a single interface alongside DeFi lending markets.

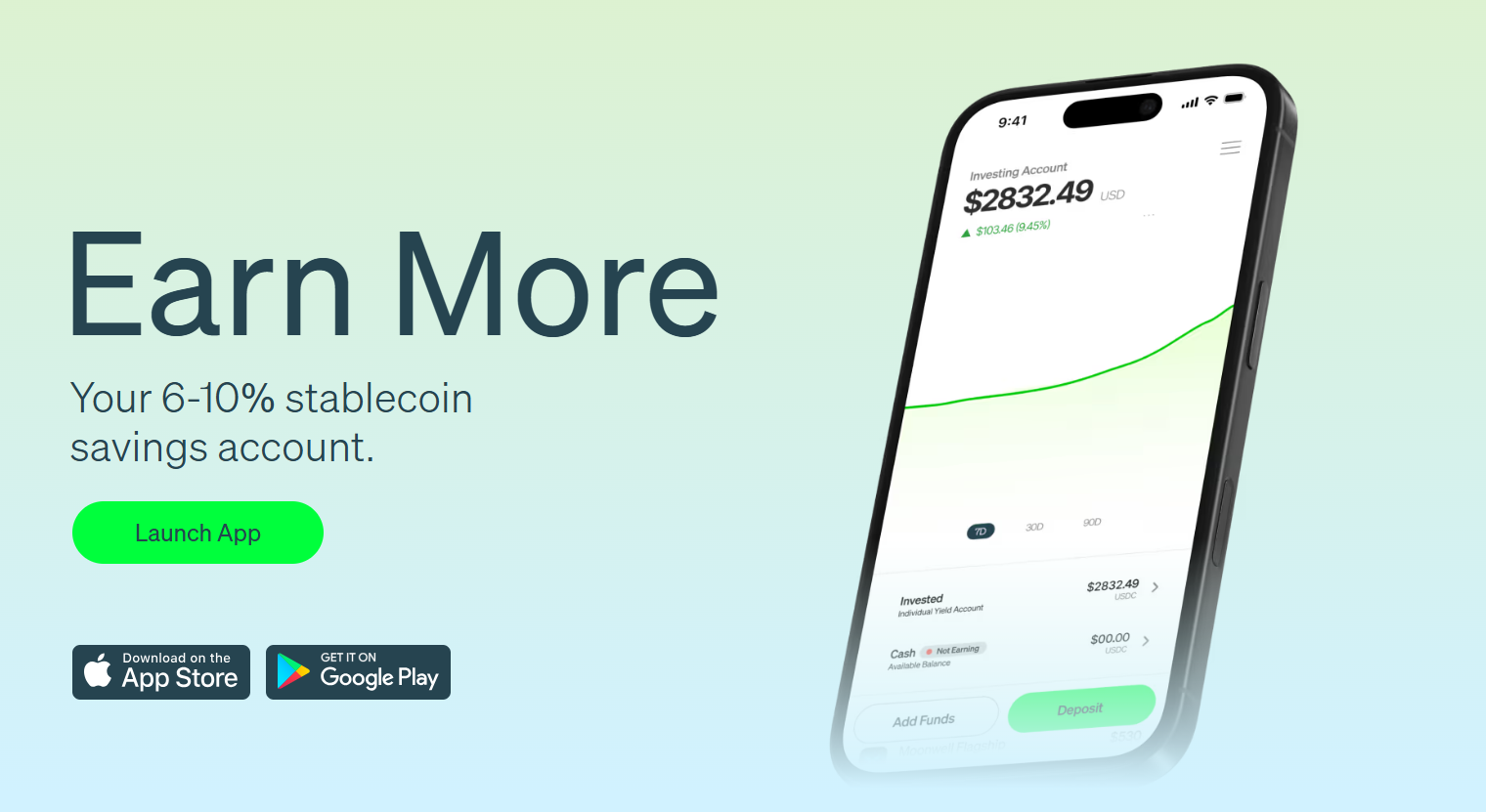

This enables a "choose your yield" model.

Imagine an onboarding experience similar to selecting communities on Reddit.

A user selects asset classes based on their specific risk tolerance. What was previously fragmented across a dozen apps becomes unified through onchain rails. Even the IMF acknowledges that tokenization could enhance access to high-quality liquid assets for small investors and those in emerging markets.

Messaging and trust constitute the primary barrier to adoption. The word "crypto," and often even "blockchain," causes a short circuit in conversations with otherwise intelligent people.

"Stablecoin," however, resonates differently.

Every kid has heard the word. While they may not understand the technical nuance of over-collateralized lending or smart contract auditing, they understand the concept of digital money.

The product must feel like digital money in fiat.

It should feel "not that different" from a Chase account, but with superior mechanics. Users need to understand where the yield comes from whether it is government debt, over-collateralized lending, or gold.

Transparency builds trust.

Talking to users directly reveals that they want insurance, they want to know the source of the yield, and they want a variety of asset classes.

Mainstream adoption requires removing complexity entirely.

Seamless bank transfers and insurance are table stakes. By diversifying across multiple liquidity pools, platforms can secure lower insurance rates than competitors relying on single points of failure.

The goal is "unbanking." This means routing a W-2 directly into a stablecoin yield account via a virtual account number. It means paying bills directly from that account.

This utility becomes critical in global markets.

In Nigeria, where the naira lost over 60% of its value in 2023-2024, dollar-linked stablecoins represent a savings necessity rather than a crypto experiment.

We recently saw a milestone that validates this shift.

A team member in New York met a stranger who had already downloaded Axal and deposited funds. This was not at a crypto conference. It was a random encounter in the wild.

That is the signal that the transition from niche to normal has begun.

The end state is a single interface where savings allocation reflects actual life risk tolerance, values, and time horizons. A 22-year-old in Austin and a 55-year-old in Lagos can both access yield that was previously gatekept by geography or institutional privilege.

We can save on everything. We can eliminate the clutter of fragmented fintech apps. This is a one-stop shop that optimizes, rebalances, and caters to individual preferences.

It is a robo-advisor in your pocket, built on rails that do not require permission.

Savings, personalized.

Finally.

The Stabledash newsletter keeps you off the timeline and dialed into modern money.

Join leaders at Circle, Ripple, and Visa who trust us for their stablecoin insights.