Research

This research was conducted as part of Plasma's Stablecoin Collective 4-week workshop program, designed to create educational content that advances global understanding of why stablecoins matter

September 3, 2025

This research was conducted as part of Plasma's Stablecoin Collective 4-week workshop program, designed to create educational content that advances global understanding of why stablecoins matter. As Plasma approaches mainnet beta, the Collective focuses on collaborative learning and demonstrating stablecoins' transformative potential through research reports, payment applications, and educational initiatives.

Disclosure: This research report was authored by third parties and is hosted on the Stabledash platform for informational and educational purposes only. Stabledash did not author the content. We have reviewed the report to the best of our ability before hosting. The views, opinions, and conclusions expressed are solely those of the original authors and do not necessarily reflect the views of Stabledash. References and sources are provided at the bottom of the report.

This material should not be interpreted as investment, legal, or tax advice. Readers are encouraged to conduct their own due diligence before making any decisions based on the information presented.

Stablecoins emerged in 2014 as cryptocurrency's answer to extreme price volatility. BitUSD pioneered the concept on July 21, 2014[1], but failed by backing stable value with unstable crypto assets. Early experiments taught the market a crucial lesson: stability requires stable backing. Tether's breakthrough came through simple fiat reserves, holding one dollar for each USDT issued[1]. This straightforward model proved resilient and became the industry standard, while MakerDAO later demonstrated in 2017 that sophisticated over-collateralization could enable decentralized alternatives (stablecoins not controlled by a single company)[2].

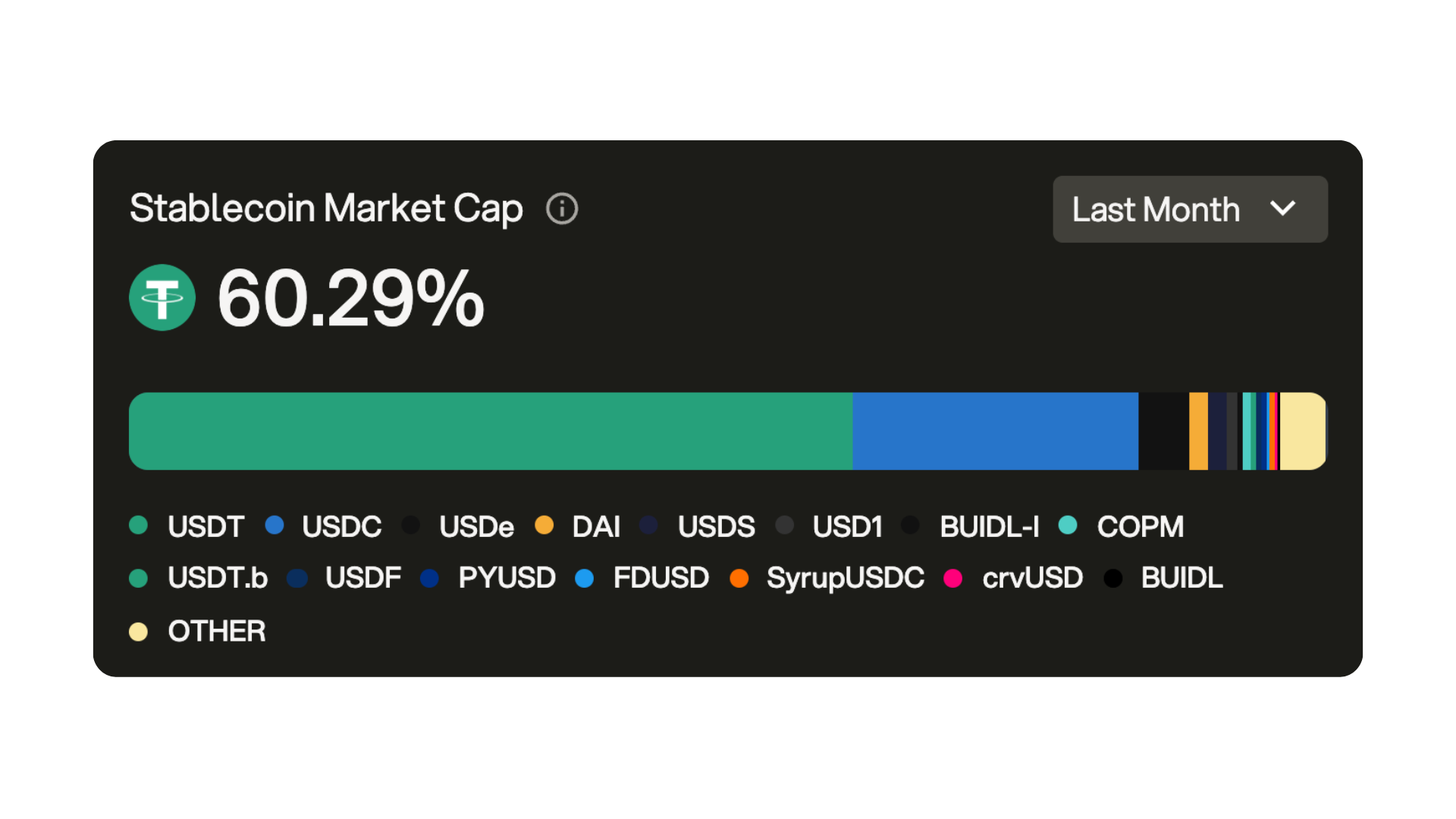

Today's market shows strong concentration among leading players. Tether is worth approximately $140 billion in market value, while Circle's USDC approaches $60 billion, together controlling 86% of the total market[3]. Tether's dominance stems from first-mover advantages and extraordinary profitability, generating $13 billion in 2024 by earning interest on reserves[4]. Circle differentiated through regulatory compliance and transparency, recently going public to solidify its institutional positioning[5]. New entrants like Ethena's USDe ($10B+) and PayPal's PYUSD show continued innovation despite incumbent dominance[6].

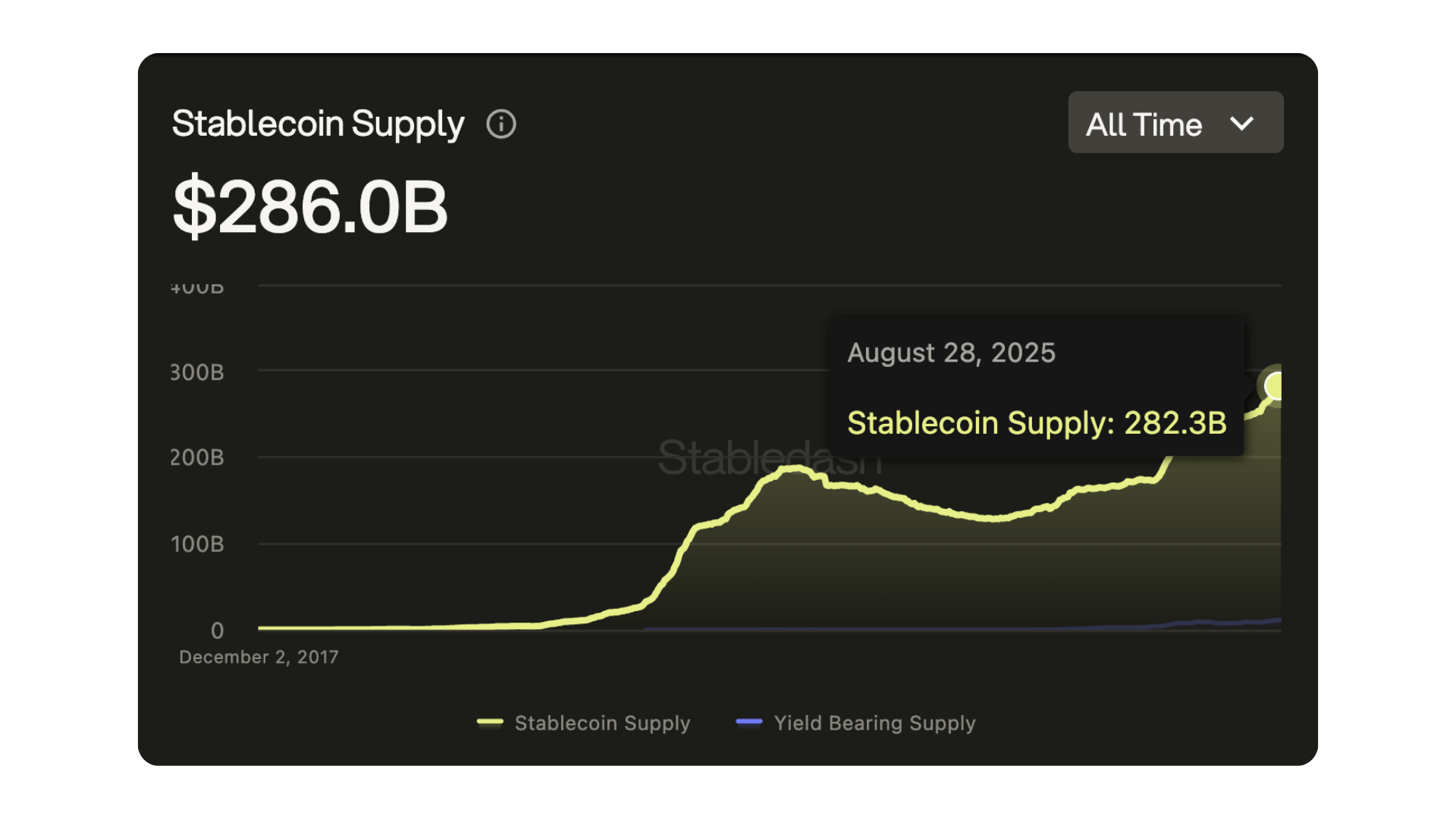

The growth trajectory validates stablecoins' utility beyond speculation, and in many ways solidifying itself as the strongest use case for crypto. From $5 billion in December 2019 to $232 billion by March 2025 represents a 45x increase[7], however, transaction volume provides the more meaningful metric. Stablecoins processed over $5 trillion last year, more than one-third of Visa and Mastercard's combined volume[8]. Unlike speculative assets, stablecoin usage continues growing during market downturns, demonstrating genuine product-market fit as a payment infrastructure rather than purely trading instruments.

General-purpose blockchains impose fundamental limitations on stablecoin operations. While Ethereum revolutionized programmable money, its design for complex computation means simple value transfers must pay for capabilities they don't utilize, creating performance constraints unsuitable for high-volume payments like what we see with Visa or Mastercard, for example.

This mismatch has catalyzed specialized infrastructure development, with platforms optimizing specifically for stablecoin requirements: predictable fees, compliance tools, optional privacy, and payment-optimized throughput.

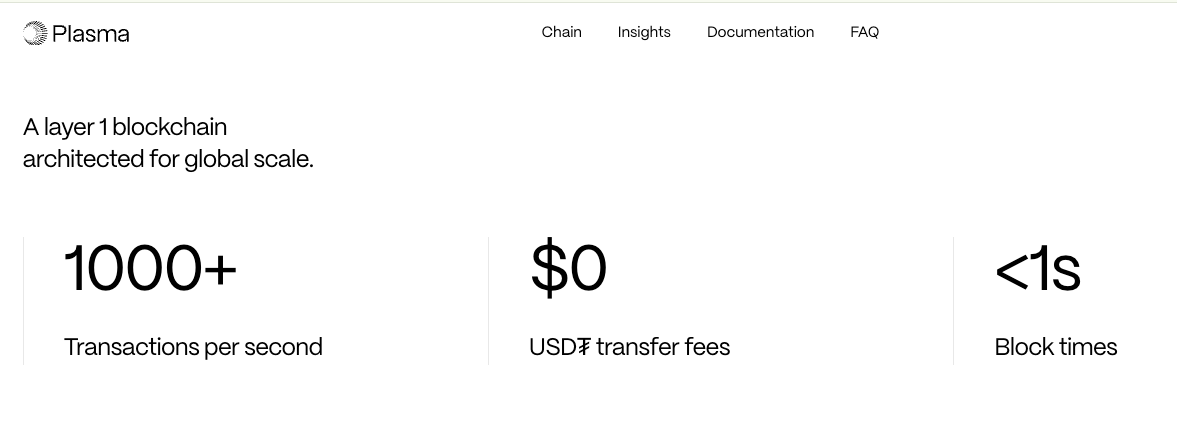

Plasma takes the most focused approach, building exclusively for Tether operations. Its zero-fee USDT transfers through protocol-level sponsorship remove adoption barriers while Bitcoin anchoring provides security[9]. The platform processes thousands of transactions per second without requiring users to hold native tokens for gas fees. As Zaheer Ebtikar from Split Capital notes, Plasma succeeds by "not trying to fit every use case under the sun"[10]. The platform's $1 billion deposit cap reached capacity in 30 minutes, demonstrating substantial institutional demand for dedicated infrastructure[11].

Arc represents Circle's vertical integration strategy, using USDC itself as a gas token and implementing institutional-grade foreign exchange ("FX") capabilities[12]. Early integration with Fireblocks, a digital asset custody platform, signals focus on banks and regulated entities that require enterprise features[13]. This approach reflects Circle's broader strategy of controlling the entire stack from issuance through settlement.

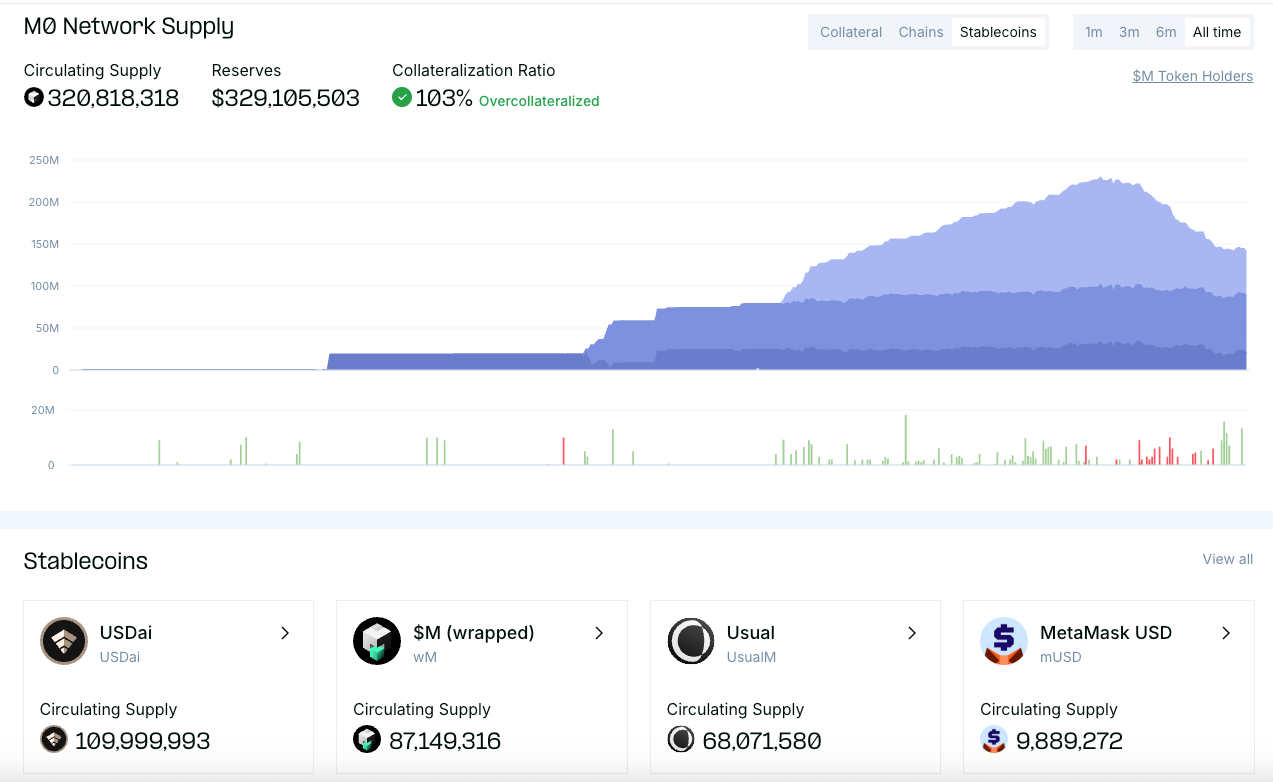

M0 introduces federated issuance, enabling multiple entities to mint interoperable stablecoins. CEO Luca Prosperi describes it as recreating central banking on blockchain, where

"many can come, access this centralized repo window and just mint the same coin"[14].

With $160 million circulating across Cosmos, Ethereum, and Solana implementations, M0 demonstrates the viability of decentralized issuance models[15].

The infrastructure proliferation addresses a critical gap identified by Rizon's Ignas Survila:

"Today's infra is good at transfers and custody, but not yet at scale for consumer fintech. Things like instant settlement at retail point-of-sale, programmable payroll, or mass remittance rails for millions require better on/off ramps, compliance tooling, and UX layers"[16].

Specialized platforms provide the foundation for scaling from thousands of DeFi users to millions of mainstream consumers.

Stablecoins follow Clayton Christensen's classic disruption framework, initially serving customers traditional finance ignored: DeFi traders, the unbanked, and cross-border freelancers[17]. These users accepted early limitations because alternatives didn't exist. However, unlike typical disruptions where established companies ignore threats, banks are actively embracing stablecoins through initiatives like PM Coin (JPMorgan's internal digital dollar for institutional clients) and Fiserv's FIUSD (a stablecoin for financial institutions), recognising both defensive necessity and offensive opportunity[18].

Historical parallels illuminate the adoption trajectory. PayPal evolved from eBay payment method to processing $1.5 trillion annually, demonstrating how niche financial tools achieve mainstream adoption[17]. M-Pesa's success in Kenya (a mobile phone-based money transfer service that became more popular than traditional banking) showed how emerging markets leapfrog traditional infrastructure entirely. Cloud computing's transformation from startup tool to enterprise standard mirrors stablecoins' current transition from crypto trading to critical infrastructure.

Three factors distinguish stablecoin disruption from historical precedents. First, global network effects mean innovation spreads instantly rather than gradually across geographies. Second, regulatory urgency has shifted from resistance to embrace, with Treasury Secretary Scott Bessent declaring "we will use stablecoins" to maintain dollar dominance[3]. Third, existing smartphone and internet infrastructure eliminate physical deployment barriers.

Survila identifies the convergence driving adoption:

"global demand for dollars in unstable economies, embedding stablecoins into everyday products where they become invisible in use, and regulatory clarity that gives businesses confidence to scale"[16].

When genuine need meets seamless experience and regulatory blessing, adoption accelerates beyond historical patterns.

The infrastructure developments in specialized platforms like Plasma, Arc, and M0 represent recognition that stablecoins aren't merely another token type but a distinct asset class requiring purpose-built architecture.

As stablecoins transition from alternative to primary payment rails, control over infrastructure becomes strategic rather than technical. A recent Citi report predicted that stablecoin AUM could hit $3.7 trillion by 2030, largely because of institutional adoption[17]. The question facing institutions isn't whether to adopt stablecoins but whether to build, buy, or partner for the infrastructure that will process trillions in future value transfer.

The first iterations of Fintech, while innovative, were largely constrained by traditional banking rails. Picture a fintech founder eager to transfer corporate funds but trapped by the slow-moving gears of conventional banking. A simple international transfer, expected to be swift in the digital age, languishes in bureaucratic limbo for days, each tick of the clock accumulating unnecessary fees.

Many early solutions were essentially attractive frontends masking the inefficiencies of an outdated system. While moving from physical banking halls to mobile apps (Banking-as-a-Service) was a step forward, these changes improved convenience but rarely revolutionized the underlying financial experience.

Today, the emergence of stablecoin-powered fintechs promises a true revolution in financial services. Unlike the restricted, permissioned nature of traditional banking rails, stablecoin infrastructure offers unprecedented openness, speed, and cost efficiency. This isn't just an incremental improvement. Businesses can settle payroll in seconds, significantly reducing operational lag. With reduced transaction costs, companies can substantially double their margins, enhancing profitability.

Moreover, such infrastructure broadens access, allowing financial services to reach underbanked merchants across the globe. These advancements unlock global trade, financial inclusion, and innovation at a scale never before possible.

However, even these have their own inefficiencies. Stablecoin infrastructure providers or "Stablecoin-as-a-Service" companies take a number of approaches to solving these problems. From M0 to Avenia to Plasma, these companies are not just out to fix marginal inefficiencies but to fundamentally change how we —retail, fintechs, institutions, import/export merchants— interact with money.

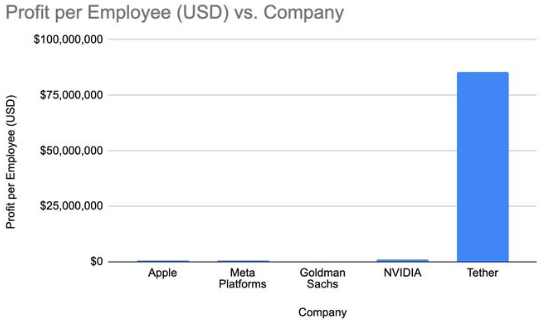

The Big Picture problem: Stablecoins are an extremely profitable business. Tether, the issuer of USDT, generated $13 billion in profits through 2024, matching the likes of Goldman Sachs in profitability with a significantly smaller workforce. Tether is currently one of the most profitable businesses in the world per employee.

However, traditional fintech companies coming into the space face a different reality. What seems to be an unimaginable amount of profitability is a combination of multiple factors for Tether:

For most businesses, the choice to build stablecoin infrastructure could potentially take years to reach full technical and regulatory maturity. And, with a global arms race underway to position for the wave of Fintech change, many are forced to use one of a few existing rails that solve this problem with different novel approaches.

This is where "Stablecoin-as-a-Service" providers emerge as game-changers. With stablecoin funding projected to rise to $12.3 billion in 2025, these infrastructure companies are building the financial highways of tomorrow and giving financial frontend businesses more than one option—unlike traditional banking infrastructure.

In this chapter, we examine three distinct approaches to solving this infrastructure problem: regional specialization, customizable middleware, and shared network models. Each represents a different path for companies wanting stablecoin economics without the years of development overhead. To facilitate comparison and aid decision-makers, a checklist of key criteria such as liquidity, compliance, customization, and revenue share can be used to evaluate each approach.

Avenia began as an asset management firm, with Leandro wanting to start a crypto business in a space that had limited regulation in place back in 2021. In the years that followed, the company pivoted to a stablecoin business, which further aligned with the institutional backgrounds of Leandro and the other co-founders of the company.

Avenia (formerly BRLA Digital) operates BRLA, a fully collateralized Brazilian Real stablecoin designed for instant, low-cost settlement in Brazil. Founded by entrepreneurs with backgrounds from Brazil's leading fintechs like Nubank and BTG Pactual, the company represents exactly what regional stablecoin infrastructure can achieve.

More than most countries, Brazil has built a crypto-friendly regulatory climate with the country's Central Bank at the helm of numerous financial innovations while doubling as the country's regulatory body[19].

Avenia's BRLA doesn't just provide other builders within the country's growing ecosystem with access to a compliant Brazilian Real stablecoin; it also enables offshore entities—who have no access to the country's well-gatekept financial landscape and CBDC—to participate and interact with the local economy seamlessly.

BRLA also exists as a vehicle for companies outside of the country to create some form of local structure for moving money in tandem with traditional banking rails. This local stablecoin service structure helps many businesses settle transactions in record time while abstracting the complexities of setting up an entity as a non-resident.

Avenia's "Stablecoin-as-a-Service" is also a pioneer in the realm of local non-dollar stablecoins. The company's stablecoin service allows companies outside of the country and non-residents to integrate seamlessly within the Brazilian local economy.

Avenia tells a story that is not only a reflection of the impact favorable regulations can have on adoption but also shows the potential for locally denominated stablecoins as a service, proving that regional infrastructure can be as powerful as global solutions when executed properly.

"M0 is an overlay on top of the distributed computing layer (Ethereum)"

M0 (pronounced "M ZERO") is a stablecoin-as-a-service company built by a team of co-founders with backgrounds in contributing to MakerDAO.

Led by Luca Prosperi, this project is built with many of crypto's core competencies in mind: composability, security, and decentralization—features essential for creating trustworthy financial infrastructure. M0's mission is to build a stablecoin protocol that serves to abstract most of the complexities of building on core blockchain architecture for their target clients.

"We are serving as a financial intermediation layer designed to allow institutions to interact and abstract all that complexity" — Luca Prosperi (Co-founder, M0)[20]

They describe the protocol as "middleware," alluding to their ability to interact with core blockchain technology as a proxy for the businesses that build consumer-facing services.

Luca resonates deeply with the idea of pushing back against "too big to fail" stablecoin issuance giants like Circle and Tether , instead leaning into the possibilities of endless use cases born from companies being able to issue their own stablecoins, tailored to the particular financial/banking primitives they bring to market, and building features that fit the needs of their specific user segment.

These companies also benefit from the shared liquidity provided by the M0 protocol as long as they meet regulatory requirements for their specific jurisdiction.

"A financial middleware allows the existence of several stablecoin issuers in their own way, with unique features built in depending on their specific use case."[21]

M0's "balance sheet-as-a-service" model not only manages fractional reserves across the board but serves as a fungible, composable backend for any regulated frontend financial intermediary across the globe.

The company hopes to serve mainly newer institutions, not just banks and larger financial players, hoping to create an ecosystem where the protocol grows alongside the companies they serve. The founder also believes that for DeFi to reach its full potential scale, the space around onchain financial primitives and stablecoins must be recognized as a B2B vertical that integrates large global institutions and players.

M0 goes beyond being an alternative to other approaches to building stablecoin infrastructure:

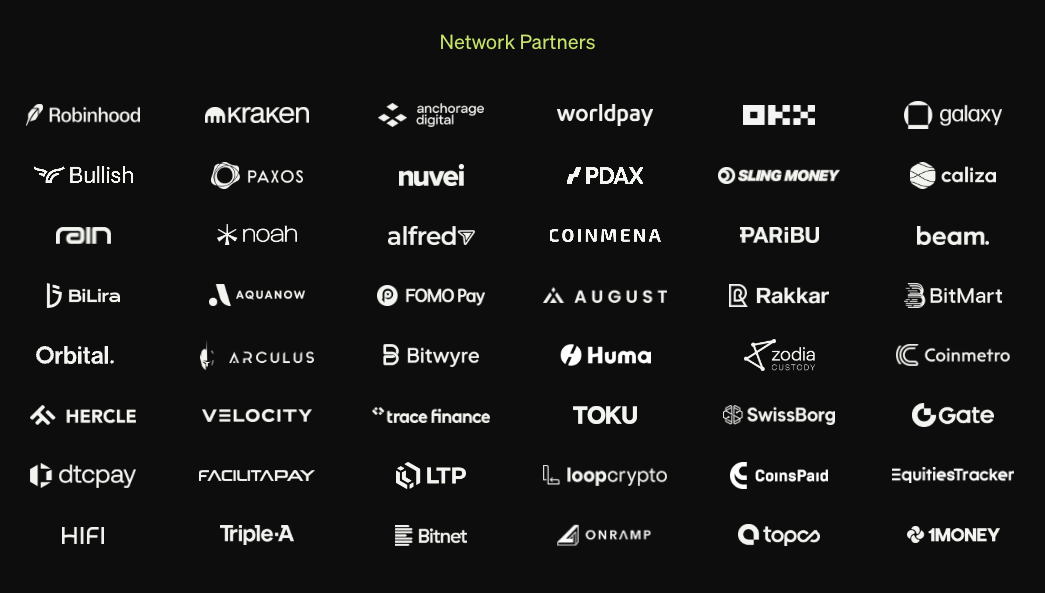

The Global Dollar Network takes what might be a hybrid approach between M0's "build your own stablecoin" and Tether's "use our stablecoins on our rails."

Developed by Paxos, a regulated blockchain infrastructure company that has been issuing compliant stablecoins since 2018, the Network rallies around Paxos's USDG but gives other entities some ownership of the stablecoin's potential upside[22].

GDN gives companies and institutions all the perks of issuing stablecoins and owning stablecoin infrastructure:

While these companies miss out on the branding benefits of other approaches or the extensible feature set of companies building their own stablecoins with M0, each member of the GDN benefits immensely from being able to lean on the network.

"This model has the benefits and flexibility of being able to lean on the network, grow the asset, get economics without worrying about regulation, net new issuance, managing underlying reserves, monitoring smart contracts, optimizing yield, dealing with DeFi ecosystems, and getting developers to build on it." — Ronak Daya (Head of Product at Paxos)[23].

With Global Dollar Network, the network is the product.

GDN participants include many household names in crypto custody and exchanges, including Kraken, whose new neobank leverages the network's infrastructure.

The team expects to allow a variety of assets to be used as money, including tokenized stocks, while paying back users for holding USDG.

The network goes beyond rewarding participants solely based on holding or minting USDG to include the right incentives to help contribute to overall network growth.

Traditional payment partners like Mastercard benefit here not by owning USDG but by contributing to overall network growth through sheer transaction volume and putting money into circulation.

With this model, Payment Service Providers can use incentives to create lower transaction fees.

GDN takes advantage of existing trust built via Paxos by allowing network participants of various sizes to abstract complexity and enjoy upside and network effects across their ecosystem.

If the future of Finance is one similar to the car industry, with multiple different apps providing frontend access to stablecoins, then stablecoin-as-a-service or stablecoin infrastructure providers are creating a multi-lane highway to financial inclusion. To capitalise on this emerging landscape, we encourage readers to experiment with piloting one of these models for a specific corridor or consumer segment. By framing this chapter as a springboard for innovation, businesses can convert insight into action, testing and refining their approaches to leverage stablecoin infrastructure effectively, and in alignment with their vision for a more financially inclusive world.

Stablecoins don't just facilitate fast transactions; they serve crypto's best use cases by providing access for anyone, from anywhere in the world, regardless of their financial situation, to send, receive, and store value instantly and at low cost. For example, a freelancer in Namibia who uses USDT on Tron to receive payments from abroad-based clients or a vendor in China that accepts stablecoins to avoid traditional banking delays and fees.

Both they and many new users will continue to use stablecoins to bypass 5-10% bank fees and week-long delays and never look back to traditional banking rails. This growing adoption, particularly in emerging markets supports projections that the stablecoin market could realistically reach $1 trillion by 2030[24].

Let's look at use cases that drive this adoption from an enterprise level.

KAST, a stablecoin-powered neobank, will use M0's Solana stablecoin infrastructure to make digital banking seamless without the need for a traditional bank account. They offer instant access to a globally accepted Visa card and seamless payments with USDC and USDT to both crypto savvy consumers and users in emerging markets seeking dollar access without traditional banking barriers[25].

KAST is not selling crypto - they're selling better banking that happens to use stablecoin infrastructure for improved economics and accessibility. Put another way, they're solving traditional banking's geographical and regulatory limitations through stablecoins. Any user with a KAST account gains instant global dollar access and spending capability without needing local bank accounts or needing to deal with slow, expensive cross-border payment systems.

KAST shows how through stablecoin infrastructure at the enterprise level (M0) can create consumer applications that solve real financial problems without requiring users to understand blockchain technology.

By offering features like USD-denominated, instant transfers and global Visa card spending, they're onboarding users through tangible value rather than speculation, proving that stablecoins have found genuine product-market fit especially in emerging markets where the most compelling use cases unfold.

Beyond cross-border payments, remittances, and dollar access for emerging markets, stablecoins have unlocked use cases that, when combined with these foundational applications, position stablecoins as the future of digital finance.

These untapped applications such as yield-bearing stablecoins, tokenized real-world assets, and automated smart contract systems have been hindered by regulatory uncertainty. Yet despite this uncertainty, categories like yield-bearing stablecoins have shown remarkable growth, expanding from $660 million in August 2023 to approximately $9 billion by May 2025 - a 13x increase in less than two years. This $9 billion represents less than 4% of the total $250 billion stablecoin market, indicating massive untapped potential[26].

The GENIUS Act, enacted as S.1582 on July 18, 2025, and signed by President Trump, changes this landscape. It establishes a framework for "payment stablecoins", defined as digital assets used for payment or settlement, redeemable for a fixed monetary value, and designed to maintain stability relative to that value. Crucially, the Act requires permitted issuers to maintain 1:1 reserves backed by US currency, Treasury bills, or their tokenized equivalents, while implementing comprehensive consumer protection measures including mandatory disclosures and redemption policies that build institutional confidence[27].

However, the Act's most significant provision prohibits permitted issuers from offering payments of interest or yield to holders of payment stablecoins solely in connection with their holding of such stablecoins. This restriction means major issuers like Circle and Tether cannot compete on yield directly - but the Act does not explicitly prohibit affiliate or third-party arrangements, creating a regulatory arbitrage opportunity for infrastructure providers. Additionally, the legislation establishes anti-money laundering compliance frameworks that reduce regulatory risk for institutional participants, while mandating public input on AI and blockchain tools for detecting illicit activities, positioning the US as a leader in compliant stablecoin innovation.

These instruments generate returns through three primary mechanisms: DeFi native yields (lending and liquidity provision), delta-neutral trading strategies, and real-world asset backing through US Treasuries and bank deposits. Current market leaders include MakerDAO's sDAI offering yields through the DAI Savings Rate, Ethena's USDe using delta-neutral strategies, and Figure Markets' YLDS, which became the first yield-bearing stablecoin approved by the SEC, offering an APR of 3.85%[28].

While permitted issuers are prohibited from offering payments of interest or yield to holders, the GENIUS Act fundamentally reshapes this landscape by creating a competitive moat for infrastructure players. The legislation does not explicitly prohibit affiliate or third-party arrangements, meaning infrastructure companies can, with this regulatory arbitrage, offer compliant yield mechanisms through ecosystem partnerships.

Assuming continued growth trends, this segment could capture 50% of the market in coming years, potentially reaching several hundred billion dollars in total value locked. Conservative projections suggest 20% adoption by 2026 would generate $46 billion TVL, while aggressive scenarios anticipating broader institutional adoption could reach $200+ billion as Bernstein projects the overall stablecoin market will hit $3 trillion by 2028[29].

Until recently, institutional participation in DeFi lending and liquidity mining protocols was minimal due to regulatory uncertainty around smart contract enforceability and compliance requirements. As of April 2025, these protocols collectively held approx. $42.7 billion in TVL, primarily driven by crypto-native capital.

By August 2025, this niche has grown significantly, with stablecoins driving DeFi TVL to $100 - $107 billion, reflecting a ~150% increase in just four months, fueled by institutional inflows and market recovery. Institutional-grade offerings, such as permissioned lending pools and curated vaults on platforms like Centrifuge ($1.215 billion TVL) and Maple Finance ($3.278 billion TVL), have expanded, with tokenized private credit reaching $15.1 billion, up 16-27% in 2025. Institutional lending via whitelisted DeFi pools hit $9.3 billion in originated loans by July 2025 (a 60% increase year-over-year).

Active loans have now exceeded $26.5 billion, signaling growing but still limited traditional institutional engagement. Most capital still comes from crypto-native sources, though infrastructure like whitelisted pools have started to attract traditional players[30].

The regulatory breakthrough with the GENIUS Act unlocks institutional participation in established DeFi protocols by enabling corporate cash to earn yields through Aave and Compound lending markets, automated liquidity provision via Uniswap and Curve pools, and participation in liquid staking derivatives like Lido's stETH, which managed $34.8 billion in staked assets in April 2025. With this, conservative projections suggest that 5% adoption of the $6-7 trillion corporate treasury market could funnel $300 billion into DeFi within three years.2025. Institutional lending via whitelisted DeFi pools hit $9.3 billion in originated loans by July 2025 (a 60% increase year-over-year). Active loans have now exceeded $26.5 billion, signalling growing but still limited traditional institutional engagement. Most capital still comes from crypto-native sources, though infrastructure like whitelisted pools has started to attract traditional players.

The regulatory breakthrough with the GENIUS Act unlocks institutional participation in established DeFi protocols by enabling corporate cash to earn yields through Aave and Compound lending markets, automated liquidity provision via Uniswap and Curve pools, and participation in liquid staking derivatives like Lido's stETH, which managed $34.8 billion in staked assets in April 2025. With this, conservative projections suggest that 5% adoption of the $6-7 trillion corporate treasury market could funnel $300 billion into DeFi within three years.

The RWAs market is over $23 billion as of August 2025. Tokenized private credit has seen a 16-27% growth so far in 2025. This has taken the market cap to ~$15 billion. Yet, this represents just a fraction of the multi-trillion dollar traditional asset markets that can be tokenized. Stablecoins serve as an important settlement layer for RWA transactions because of their instant settlement properties that let anyone purchase and redeem tokenized assets like US Treasury bills, real estate investments, and commodities without traditional banking delays. This setup birthed the idea around hybrid models where stablecoins themselves are backed by real-world assets[31].

An example can be seen in Ondo Finance's USDY, an interest-bearing stablecoin tied to yields from short-term U.S. Treasuries and bank deposits, and their OUSG Fund providing tokenized ownership of BlackRock's iShares Short Treasury Bond ETF where users deposit USDC to buy short-term U.S. Treasuries. Beyond RWA-backed stablecoins, projects now use stablecoins for real estate purchases, rental income distribution, and fractional ownership transfers. Currently, tokenized real estate and commodities (e.g., gold) have grown to $3.8 billion and $1.4 billion in market cap, respectively, while stablecoin-backed synthetic assets are estimated at under $1.5 billion.

The RWA market surged more than 260% during the first half of 2025 and with safe stablecoins now made available through the GENIUS Act, we could see a wave of pilot projects from major institutions tokenizing everything from U.S. Treasuries to municipal bonds. The RWA market could still see growth of 50-100% in the latter half of 2025, potentially reaching $35-50 billion by year-end, as institutional adoption and stablecoin settlement infrastructure expand. While the recently signed Act doesn't directly regulate RWAs, it provides the regulated stablecoin infrastructure that institutions need for RWA settlement.

Consumer adoption of programmable stablecoins is still largely untapped despite significant infrastructure development. With emerging markets driving growth by 30% year-over-year, global wallet address adoption surpasses 500 million and retail adoption surged as consumers used stablecoins for e-commerce, saving on fees as low as 0.1% compared to 3.5% via credit cards. Still, most consumer engagement remains basic payment functionality rather than leveraging stablecoins' programmable capabilities.

The programmable nature of stablecoins allows payments to be automated, conditional, or combined with other forms of logic like milestone-based funding, treasury operations, or smart contract-driven disbursements, yet mainstream consumer applications using these features remain minimal. Current barriers include complex user interfaces with founders noting that to bring stablecoins closer to consumers, the underlying blockchain complexity must be substituted with user-friendly interfaces like mobile apps or digital wallets[32].

The regulatory barrier that previously prevented mainstream consumer programmable money applications has been removed with the GENIUS Act. Mastercard now enables millions of people to spend their stablecoin balances at over 150 million Mastercard merchant locations worldwide and is introducing programmable payment capabilities through their Multi-Token Network for B2B applications like automated invoicing.

Similarly, Visa's partnership with Circle allows USDC payments across 80 million merchant locations and its Visa Direct platform allows programmable features like automated payouts for loyalty rewards or instant cross-border purchases with fees as low as 0.1%. Funding to stablecoin companies is projected to rise to $12.3B in 2025 - more than 10x 2024's $1B in funding, with significant investment flowing toward consumer-focused solutions that abstract blockchain complexity into familiar banking interfaces, positioning programmable stablecoins to capture a substantial portion of the global digital payments market projected to reach trillions in transaction volume.

GENIUS Act Breakdown

The evidence from enterprise adoption patterns, regulatory clarity through the GENIUS Act, and real founder experiences points to a fundamental shift in how we should think about stablecoin infrastructure. The mass onboarding opportunity isn't about convincing users to switch to cheaper rails, it's about building infrastructure that makes businesses "indifferent to all treasury management functions."

As Christian, founder of Fonbnk we interviewed explained:

"A network of the future makes me indifferent to all treasury management functions and codifies it in software where I have these assets here and can get something out on the other side at no cost." This insight reveals why current approaches focused solely on transaction fee reduction miss the bigger picture[33].

The real infrastructure opportunity lies in solving what the same founder identified as the core problem: "The biggest infrastructure impact is cost, but choosing low-cost networks creates liquidity fragmentation."

This fragmentation creates hidden costs that dwarf simple transaction fees:

The founder's vision of infrastructure that enables seamless interoperability, "where you could swap in every, any stable coin. And as long as you stay on a particular path, like off-ramp or swap out in USDT on a plasma-supported protocol or app, it's free" [33].

This perfectly illustrates what infrastructure players must build to capture the mass market.

Building Africa's Stablecoin Bridge | Chris Duffus, CEO of fonbnk | S2 E2

The GENIUS Act's prohibition on direct yield from stablecoin issuers creates a massive competitive advantage for infrastructure providers. While Circle and Tether cannot compete on yield, third-party infrastructure companies can build the comprehensive treasury management solutions that businesses actually need [34].

This regulatory arbitrage enables infrastructure players to:

As Christian noted, the winning approach requires being "protocol affiliated with well-known, respected, credible regulated actors" providing subsidized interoperability, like what infrastructure consortiums like the Global Dollar Network are building.

Free USDT transfers are not the killer feature that will drive mass adoption to the new stablecoin infrastructure. Talking to different founders made this clear: transaction fees are just one component of the total cost of ownership, and focusing on them alone misses the fundamental business need.

The real value proposition for mainstream-ready infrastructure like Plasma lies in becoming the treasury management layer that eliminates friction across the entire financial stack. For example, when the founder of Fonbank describes wanting to be "indifferent to all treasury management functions," they're describing infrastructure that:

The mass onboarding opportunity isn't about convincing users that zero fees are better than low fees. It's about building infrastructure so comprehensive and intelligent that businesses can focus on their core operations while the infrastructure handles all treasury complexity automatically [35].

The GENIUS Act has created the regulatory framework for this vision. Infrastructure players who can deliver on the dream of treasury-agnostic financial operations will capture the multi-trillion dollar opportunity as stablecoins evolve from simple payment tokens to the backbone of programmable money. The companies that succeed won't be those offering the cheapest transactions - they'll be those making businesses indifferent to the underlying complexity of managing money itself.

[1] Deltec Bank and Trust. (2022, September 1). The history of stablecoins. Retrieved from

[2] BitMEX. (2018, July). A brief history of stablecoins part 1. BitMEX Blog. Retrieved from

[4] Bankrate. (2025, July). World's largest stablecoins.

[5] Protos. (2025). 2025 great year stablecoin.

[6] Gate.io. (2025, August). Stablecoins ranking 2025: USDT, USDC and emerging tokens compared.

[9] Plasma Foundation. (2025). Plasma: Stablecoin infrastructure for a new global financial system.

[16] Written interview with Ignas Survila, Co-founder of Rizon, conducted for this report (2025).

[17] Blockworks. (2025, May). Stablecoins institutional adoption disruptors.

[18] Fiserv. (2025, June). Fiserv launches new FiUSD stablecoin for financial institutions.

[19] Medium. (2024-25). Brazil's stablecoin boom: Why Brazil leads in 2024–25.

[20] Stableminded. (2025). S4 - Why stablecoins are secretly killing banks [Video].

[21] Rebank Podcast. (2023, May). [Audio podcast].

[24] Industry analysis: Stablecoin market growth projections and emerging markets adoption (2025).

[27] Arnold & Porter. (2025, July). New stablecoin legislation: Analyzing the GENIUS Act.

[28] Transak. (2025, April). Yield-bearing stablecoins. Transak Blog.

[29] The Treasurer. (2025). Stablecoins attract treasury attention 2025.

[32] CB Insights. (Date not specified). Stablecoin market map.

[33] Interview with Christian Duffus, founder of Fonbnk, conducted for this report (2025).

We extend our gratitude to the industry leaders who contributed their insights to this report:

Additional appreciation goes to Zach Fowler and the Stabledash team for their continued support throughout this research and hosting the report.

Author

Author

Author

About the Plasma Cannon Research Team The Plasma Cannon Research Team was formed as part of Plasma’s Stablecoin Collective workshop, a four-week program designed to foster collaborative learning and original research. Led by Michael Adeolu, alongside Philip Z. and Idara Roland, and two pseudo-anonymous contributors, the team authored Stablecoins: Past, Present, and Future. This report explores the evolution of stablecoins, their role in reshaping global finance, and the challenges and opportunities faced by today’s builders.

The Stabledash newsletter keeps you off the timeline and dialed into modern money.

Join leaders at Circle, Ripple, and Visa who trust us for their stablecoin insights.